By Allan Heydorn and Kimberly Johnston

Manufacturers of asphalt pavers take the pulse of the market every time they talk with a paving contractor or are out on a paving job. But in addition to having a great feel for what's happening right at the moment, manufacturers can provide some perspective as well. Here are three market insights from our conversations for the 25th Anniversary print article, "How Asphalt Pavers Have Improved."

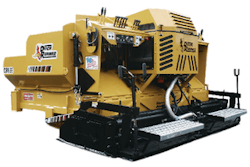

Market Shift to Track Pavers

An important change for contractors occurred in the 1990s when commercial contractors began to rely on track over rubber-tire pavers. John Hood, Bomag Americas' sales manager for paving and milling products, says that today roughly 90% of commercial work is done with track pavers, a significant shift from a roughly 50/50 split 20 years ago.

"The quality level of track systems improved and the speed of track systems increased because of the quality of components," Hood says. "That made track pavers more attractive for commercial contractors."

Brodie Hutchins, Vogele America general manager, says the key to the shift is the move from steel to continuous rubber tracks. "Rubber tracks can travel faster, rubber provides better flotation and have better traction effort, and rubber offers better maneuverability," Hutchins says. "The old steel components were not designed to go very fast."

Hood says contractors like track pavers because they are a stable machine. "The track spreads out the length of the undercarriage, 150 in. on two long tracks vs. 12 in. on four tires," Hood says. "Rubber tires were nice because they were fast but tracks now are fast and more stable and they produce a quality mat."

Shift in Purchasing Mindset

Hutchins says there has been a "shift in contractor purchasing mindset" as paving contractors are taking a new, longer-term view of their equipment purchases. "Contractors are looking at the overall ownership costs of a paver and not just the upfront costs," he says. Among the questions they are now asking is:

- How much will it cost over time?

- What are the prices of key replacement parts?

- What will the amount of downtime be?

- What will the residual value be in X years?

"It's becoming a more inclusive conversation," Hutchins says. "It's going from an acquisition transaction to a total ownership process."

Emission Regulations: Impact on Pavers

Hood says a change the industry has already seen and will continue to see is a result of new emission regulations, which he says are "daunting for most manufacturers."

"Tier 3 was a struggle, Tier 4 is an incredible undertaking," he says, adding that the tight emissions requirements have caused manufacturers to consider dropping their lower-volume pavers from their lines.

"All manufacturers want to keep all their products in their line, but when you're talking engineering money to bring all your models into compliance, it gets hard to justify that expense," Hood says. "As much as you try to keep all your products in your line, you have to consider dropping some of lower-selling units because it's difficult to see how you can recover the money you'll need to invest to bring the pavers into compliance with Tier 4."

Hood says the emission requirements are especially painful and difficult on the small paver. "Commercial contractors work in small areas so you can't structurally increase the size of small pavers to accommodate the emissions changes you need to make on the paver," he says.

Hood adds that even when pavers are brought into compliance with emission regulations they are a tough sell, especially in this economy. "Emissions costs slow the buying cycle, there's no question about it," he says. "Anything that drives up the cost of the machine without the benefit of quality or production is a tough sell."

Learn more about "How Asphalt Pavers Have Improved" in the August/September issue of Pavement.

![Lee Boy Facility 2025 17 Use[16]](https://img.forconstructionpros.com/mindful/acbm/workspaces/default/uploads/2025/09/leeboy-facility-2025-17-use16.AbONDzEzbV.jpg?ar=16%3A9&auto=format%2Ccompress&fit=crop&h=135&q=70&w=240)