It's not very often Uncle Sam provides us with a long-term tax program that benefits our industry. We did have the Bonus Depreciation program that provided a deferral for a couple of years. However, it is now generating tax problems because the deferral benefit is rolling over and the deferred taxes are coming due. (I'm sure many of you know what I mean.) There are some things a company can do to offset these excessive taxes, such as use tax-free exchange when selling equipment, but overall you have to pay the piper for benefits received previously.

That being said, the American Jobs Creation Act of 2004 introduced a Section 199 deduction for certain qualifying domestic production activities, which covers the activities of construction contractors, engineers and architects. The final regulations have been issued for this complex section of the code so contractors can now finalize their planning to obtain this deduction.

Free money?

What is the benefit of this deduction? Quite honestly, this is almost free money if you qualify, then do what is necessary to capture the information required to support your qualified efforts and the related deduction. The benefit is phased in from 2005 to 2010, with the deduction increasing from 3% to 9% of the lesser of Qualified Production Activity Income (QPAI) or Taxable Income. See below for your potential benefit assuming a QPAI of $1 million dollars:

Potential Deduction Savings

- 2005-'06 3% or $30,000 $10,500

- 2007-'09 6% or $60,000 $21,000

- 2010- 9% or $90,000 $31,500

Not bad for just taking the time to set up and understand the deduction. To make sure you understand how we arrived at these figures, the potential deduction was calculated using the $1 million qualified production activity income, which is basically the taxable profit from the activity calculated using the new regs.

Of course, there are deduction limitations in place. The deduction is calculated on the lesser of your QPAI or taxable income, and is also limited to 50% of W-2 wages. So, in short, you need to make the money and you need enough payroll to make it work.

We can spend a lot of time reviewing this opportunity, but the real questions are:

- Does your business qualify for the deduction?

- Do you generate enough QPAI and have enough wages to make it worthwhile?

- Do you have your accounting records set up to support your calculations of the deduction?

This is NOT a simple code section to navigate. And there is a cost involved to learn it and set it up so it works and is in a format to support tax return preparation. So if having an annual tax reduction available is meaningful based on your current activities, you have to invest the time and effort to get this set up right the first time.

Does your business qualify?

There are Industry Specific Guidelines that apply to the construction industry. Basically, if you are involved in the construction of residential or commercial buildings on real property, or perform major renovations, the new act probably applies to you. Infrastructure work applies, as well.

What is really interesting is that more than one contractor can claim the deduction on the same receipts. A general contractor, as well as subs who perform the work, can claim the deduction on the same receipts. Keep in mind, however, the limitations still apply to all the companies involved.

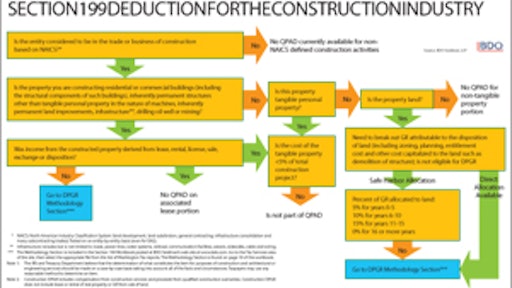

Here is a chart or decision tree (produced by BDO's tax department) that you can use to determine if your activities qualify for the deduction. This chart was updated as of January 2006 and there have been some changes to the regs. It should be good to get started, but it would be best to review the latest changes before embarking on a project to implement a program to track the Section 199 deduction.

The tax savings (or "free money", as I call it) is there for the taking if your activities qualify and you can get past the limitations. The rules are complex and a number of issues require consideration before you can make an informed decision. The affiliated group rules do apply for those of you thinking about moving some business activities around to obtain the credit.

Just so you know, there is a Small Business Simplified Method you can use if your sales are less than $5 million or you use the cash method of accounting.

To wrap up, the Domestic Production Deduction is well worth investigating and — if found to be beneficial — well worth setting up properly the first time. If you need help with this issue, you can contact me and I will refer you to one of our specialists.