The following is a guest column by Ron Hodgeman, a tax attorney and the leader of the like-kind exchange practice at WTP Exchange, an affiliate company of WTP Advisors. WTP Exchange is the Preferred Provider of LKE services to the Associated Equipment Distributors (AED). Ron has dedicated his entire 15-year career to helping individuals and companies to minimize their tax liability when selling business or investment property.

The elections are over and the future of our country is still unclear. As we saw during the last four years, meaningful change with a partisan, divided Congress is, at best, painfully slow. In fact, the 112th Congress was often referred to as the worst Congress ever. It’s uncertain whether the newly elected Congress will be able to tackle the fiscal cliff and move our country forward.

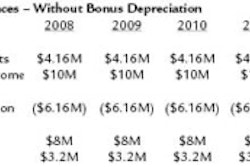

Yet, during this murky economic period, two things remain very clear. The first is that bonus depreciation will expire on December 31st of this year, and Congress has indicated on multiple occasions that it will not be extended. Bonus depreciation is the economic stimulus provision that has provided substantial tax and cash flow benefits to contractors since 2008. For the last five years, contractors have been able to immediately deduct on their tax returns either 50% or 100% of the cost of new equipment acquired.

Secondly, you have a tool in their belt right now that can provide your businesses with the same benefits of bonus depreciation — a like-kind exchange (LKE). An LKE is a common tax strategy that can lower the amount of tax gain recognized when selling equipment down to zero.

This tax strategy has never been more important, since most contractors’ equipment has low-to-no tax basis after five years of bonus depreciation. And one of the best things about an LKE is that there is no need to wait and see whether our government will unite to avert economic disaster. An LKE has been a part of our tax law for over 90 years.

The following is a summary of the different types of LKE transactions that can provide substantial benefit.

Simultaneous Exchange

A contractor that trades in a piece of equipment with a dealer in exchange for other equipment can potentially qualify the transaction as a simultaneous exchange. The key word to keep in mind with this type of exchange is “simultaneous.” The transfer of equipment to a dealer in exchange for a trade-in credit will likely fail to satisfy the LKE rules and requirements.

The primary advantage to structuring a transaction as a simultaneous exchange is that the timing requirements discussed below do not come into play. A disadvantage to the simultaneous exchange is that it is often difficult to find another party to swap equipment.

Forward-Delayed Exchange

The most common type of LKE is the “forward-delayed exchange.” This type of exchange allows a contractor to sell equipment today, but delay the purchase of more equipment for up to 180 days. In order to take advantage of this type of an exchange, you must contact a qualified intermediary (QI) prior to selling old equipment. If the QI does not set up the LKE prior to the sale, it is too late to benefit from an LKE.

The advantage of a forward-delayed exchange is that you do not have to find another party to swap equipment. You can sell to one party in the normal course of its business, and purchase another asset from a different party. A disadvantage is you must identify within 45 days the equipment you hope to purchase within 180 days to complete the exchange.

Reverse Exchange

The question often arises as to whether an LKE can be structured whereby the new equipment is purchased prior to the sale of the old equipment. The answer is yes, as long as the exchange is set up as a “reverse exchange.” However, it is important to contact a QI prior to purchasing the new equipment. The QI can discuss the pros and cons of the transaction and make sure that a key party, called an “exchange accommodation titleholder,” is involved in order to satisfy the tax rules.

One of the primary advantages to a reverse exchange is that you can acquire and use the new equipment before the old equipment is sold. The disadvantage is that it is more costly to participate in this type of an exchange. Whereas most LKEs cost around $1,000 to set up, the fee charged to set up a reverse exchange is normally several thousand dollars.

LKE Programs

Larger contractors that buy and sell multiple pieces of equipment during the year can take advantage of an ongoing program of LKEs.

There are a couple advantages to an LKE program vs. separately structuring each sale and purchase as an exchange. First, a single exchange agreement (referred to as a Master Exchange Agreement) can be executed up front and apply to all future exchange transactions. Second, the Internal Revenue Service provides certain safe harbors to companies that take advantage of an LKE program. When set up properly, there is no disadvantage to an LKE program.

Although the economy has shown signs of improvement, we still face the threat of another recession. The large drop in the stock market the day after President Obama was re-elected is proof that investors are on edge and uncertain of what happens next. Contractors do not need to let this uncertainty hold them back if they take advantage of strategies such as LKEs that are available right now.

More information:

Bonus Depreciation: Double Trouble Ahead

Ensure Safe Like Kind Exchanges