Last month, one of my colleagues, Allan Heydorn, editor of Pavement Maintenance & Reconstruction, attended the annual Associated Equipment Distributors/Infor Executive Forum in Rosemont, IL, to gain insights on the condition of the construction market. Specifically, he wanted to hear what Eli Lustgarten, a senior research analyst for Longbow Research, had to say about the prospects for construction in 2014 and beyond. Historically, Lustgarten has been a pretty accurate prognosticator when it comes to his analysis of where the construction industry is heading.

In Lustgarten’s opinion, on a macro scale, if the U.S. economy makes it through the next 12 to 18 months, it is positioned to have one of the “most favorable outlooks of the world economies.” On a more micro level, he sees decidedly positive opportunities for future construction activity. “The next three to five years, construction is going to be the place to be as long as the government doesn’t get in the way,” he stated. “If we can let the free market operate, the opportunities in construction are huge.”

Lustgarten is forecasting construction spending to grow 6% to 10% or more from 2013 through 2018 — attributed largely to continued growth in natural gas and shale-based oil exploration, the widening of the Panama Canal and the increase in the U.S. population of elderly adults and children.

While “there’s just no money on the public side to allow that market to grow,” Lustgarten said private investment in nonresidential construction will continue to improve. And while housing starts are unlikely to return to the 2 million mark, he predicts residential construction will be up 10% to 15% through the end of 2014, with multi-family taking the lead.

Before you cast a skeptical eye on his forecast, consider that he’s not alone in his outlook. According to the Q3-2013 Construction Outlook Report issued by FMI last month, residential construction is expected to be up 12% in 2014, on top of the double-digit growth being experienced this year; commercial construction (retail) will be up 5%; healthcare will growth 6%; and educational and manufacturing will be up 4%. All told, the outlook shows combined growth of 7% to $977 billion in total construction-put-in-place.

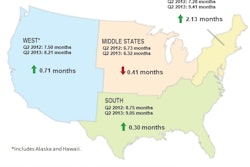

Trends in construction backlogs also appear to support these forecasts. The Associated Builders and Contractors (ABC) Construction Backlog Indicator (CBI) — which reflects the amount of commercial and industrial construction work under contract, but not yet completed — rose 3.9% in the second quarter of 2013 to 8.2 months, up 6.6% compared to the same time last year.

According to Anirban Basu, ABC chief economist, “For several quarters, various surveys on nonresidential construction firms operating across the U.S. have indicated a growing sense of confidence regarding the near-term outlook. Through the first half of this year, U.S. nonresidential construction spending was roughly flat. Performance should improve during the latter half of the year, but the CBI seems to be indicating that revenue opportunities are set to expand more forcefully in 2014.”

Admittedly, we’ve heard such positive talk from economists before. But this time, economic indicators seem to be backing up the forecasts.

So what do you think — will construction become “the place to be” in 2014 and beyond? Consider sharing your own outlook in the comments window below. We’d love to get your perspective on where you think the industry may be heading.