A scarceness of natural resources, growth of the population and ever tightening emissions regulations are driving manufacturers to search for unique solutions in the powertrain sector. Many solutions currently being explored to create more efficient powertrains include hybridization, electrification of various components, engine downsizing and downspeeding.

“Engine downsizing is primarily enabled through design advancements and being able to increase peak cylinder pressure,” says Joe McManus, chief engineer, engine products group, Ricardo.

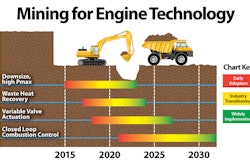

Automotive technologies are migrating into the commercial arena. “On the air handling side variable valve actuation has been common in the automotive sectors and it is making more progress into the heavy-duty sector to provide a more through and comprehensive way of air handling into the engine cylinder.” Precise fuel injection equipment is also a major enabler to reduce emissions and increase engine efficiency. “There is a trend to much higher injection pressure levels to get better combustion performance. That is enabled through more advanced control systems, such as closed-loop control of the combustion system itself.”

The questions regarding diesel engine aftertreatment have largely been settled. “On the aftertreatment side the general trend to apply SCR has been adopted globally,” says McManus.

Don’t Overlook Natural Gas

Natural gas has been gaining momentum in the heavy-duty engine sector. “It has been demonstrated that natural gas is here to stay,” says McManus. “All different sectors from the rail industry to the heavy-trucking fleets and light-duty vehicles are all looking for ways to adopt and exploit the use of natural gas.”

Despite recent natural gas discoveries, the number of overall natural gas vehicles is falling behind the rest of the world’s appetite for natural gas vehicles. “We are becoming a natural gas exporter rather than importer. The energy production companies have recognized this as well as engine manufacturers across the whole supply chain, and mechanisms are being put in place to improve this,” says McManus. “The price differential between natural gas and diesel is making it such that it is a fuel that needs to be considered and efforts put into the development of the engines so it can become a primary transportation fuel.”

Natural gas could become a game changer. “Similar to what happened in the 1940s and 1950s when diesel fuel won out the race between gasoline and diesel fuel for heavy-duty transportation, there are some industry experts who say that natural gas is a similar interruptive fuel,” says McManus. “The diesel engine is not going to be completely replaced, but proper application and proper engineering to the natural gas engines will enable them to be very competitive options to an end user.”

Economic drivers behind natural gas for the transportation sector are well established. “Class 8 trucks consume a tremendous amount of fuel,” says McManus. “There is a price differential between natural gas and diesel that is going to maintain itself for quite some time. Even if you are not able to displace 100 percent of the diesel fuel going into the engine, there is still a very advantageous economic payback for the end user.”

He adds, “The other reason for adopting natural gas in this sector is the advantages that it has for reducing some of the greenhouse gas output, primarily CO2. “Methane has a very advantageous carbon to hydrogen ratio, which equates to having less CO2. So as Europe and the United States develop CO2 legislation, enabling fleets to have a more advantageous carbon signature and finding solutions that enable that are going to be sought after.”

But natural gas is still a fossil fuel. “It does need to be pointed out that the natural gas emissions signature also does have a methane slip component and methane is a greenhouse gas that has a higher weighting factor than CO2,” says McManus. “Likewise, N2O is also a greenhouse gas and is a product of natural gas combustion. However, proper design and implementation will mitigate that either through catalysts or through proper combustion management.”

Aftertreatment is going to be a key component to enabling any system, whether it be diesel or natural gas. “The three-way catalyst technology is well established,” says McManus. There is also a methane oxidation catalyst (MOC). “Methane is not very reactive so we have to change the formulation and create a system to clean up those hydrocarbons.

Total Cost of Ownership in Truck Market

Ricardo has developed an intensive tool to compare all aspects of what alternative technologies cost in the truck markets. “We analyzed the total cost of ownership for segment. The model looked at both the vehicle operating expenses and vehicle capital expense,” says Ruth Latham, associate in strategic consulting. Technologies included diesel, natural gas, electric, hybrid electric and hybrid electric with natural gas.

Most of the technologies were fairly close in total cost of ownership with the exception of electric vehicles. “When you graph it out is there is not a huge range in the total cost of ownership with the exception of the cost for electric vehicles because the capital expenditure is so high,” says Latham. “Electric vehicles have the lowest operating expenses, but they have significantly high capital expenses.”

The payback period for introducing new technologies ranges from one to 23 years. The technology provides the best payback is heavily influenced by the duty cycle.

For Class 3 to Class 6 delivery vehicles the lowest cost of ownership was natural gas even though the capital expense of the vehicle is higher. “This would likely be followed by a hybrid natural gas vehicle if one was available right now,” says Latham.

The results change with a work truck application. In this case the plug in hybrid offers the lowest cost of ownership. “For work truck the PTO operation strongly drives the value of plug-in hybrids,” says Latham. “We size the battery so that the PTO operation for one shift was covered by the battery. The operating costs of the PTO can be reduced significantly from $5,000 on a diesel down to $357 on electricity. PTO capacity is based on the battery pack. Because the long life people tend to own these vehicles for, even though the capital expenditure is fairly high, it in no way overwhelms the savings toward the operating expenses.”

For Class 8 on-highway trucks the lowest cost of ownership is still the traditional diesel engine. But it should be noted that duty cycle is incredibly important in this calculation.

Other factors that went into the calculations were fueling infrastructure and maintenance. “There are some maintenance features that are very different with new technology vehicles,” says Latham. “For instance, hybrid electric vehicles and electric vehicles with regenerative braking systems have significantly reduced brake replacements. That has a big impact on maintenance costs for high mileage duty cycles.”

Natural gas trucks have shorter oil change intervals recommended by the manufacturers. “You have to change you oil more often with a natural gas vehicle than a diesel vehicle,” says Latham. “On a hybrid electric vehicle battery size is important. Depending upon how long the vehicle is owned and how many cycles go through it, there is the risk on an electric vehicle that the battery pack itself will have to be replaced. For a large battery, that can have a significant impact on the maintenance costs.”

The model developed by Ricardo uses complex algorithms and considers many variables. It looks at six powertrain technology configurations as a baseline and 22 powertrain configurations. “The model is fairly extensive in which you can exchange anything from duty cycle to the cost of infrastructure to the oil change interval of the vehicle to the cost for maintenance,” says Latham.

You must understand the impact of technology on ownership costs. “The total cost of ownership can be reduced by 14 percent or increased by as much as 80 percent depending upon which technology, infrastructure and fuel you looking at,” says Latham. “A Class 3 truck with natural gas and a work truck with plug in hybrid natural gas have about a one year payback period. A Class 3 electric vehicle has about a 23 year payback period driven significantly by capital expenditure. That is not including the incentives they have in New York and Chicago for electric vehicles.”

For more information check out the calculator on the American Gas Association’s website at http://www.aga.org/our-issues/natural-gas-vehicles/Pages/default.aspx.