As premiums rise, employers look for ways to improve their risk profiles and control their costs. Insurance companies report that their clients have seen mid-year Workers' Comp rate hikes ranging from 2.5% to 5% for large accounts and 5% to 10% for mid-market employers. Pricing pressures come from many angles - medical inflation, claim severity, Medicare set asides, state regulatory changes and lagging investment income from low interest rates. In addition to fairly aggressive price increases, insurance companies are increasingly selective about which accounts and risks they will underwrite.

This is not good news for employers who are not actively engaged in claims and risk management practices and can even be challenging for those who are. Employers looking to better position themselves focus on the fundamentals of reducing Workers' Compensation costs:

- Loss prevention and control

- Managing claims

- Return to work programs

- Improving the outcomes for medical care

- Measuring and tracking results

- Training, education and communication

- Wellness initiatives

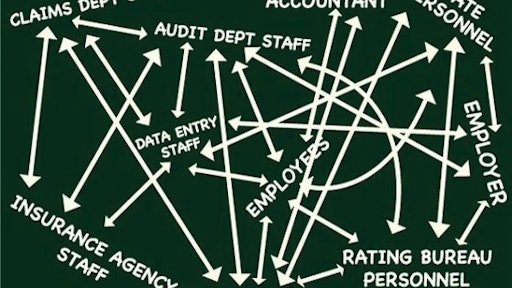

Yet, even employers with a strong commitment can struggle to achieve long-term, consistent progress in cost containment. The complexity of Workers' Compensation, the interrelated nature of the components of Workers' Compensation that can result in delays and superfluous services, and the number of stakeholders who sometimes have different and conflicting objectives, can lead to frustration and sub-par results.

To be successful requires rigorous oversight, coordination and constant vigilance. While employers need to lead by setting the vision and strategy, at other times they need to be the traffic cop, assuring that all aspects are moving properly and smoothly. Employers who carefully select partners, establish a coordinated framework, set expectations for each stakeholder and monitor results are in the best position for success.

Here are some expectations and red flags that can help guide the process:

Claims adjuster/Insurance carrier

- Ensure proper administration of all Workers' Compensation claims, setting a strategy for the proper management of a claim in collaboration with the employer, health care provider and employee

- Ensures that reserves are correct

- Maintain communication with the injured employee, health care provider and employer

- Encourage and actively assist injured workers in successfully returning to work

- Be proactive; actively manages through the life of the claim

- Provide analytics on injury trends, medical outcomes and recommends individualized, cost-effective programs to reduce injuries

Red flags: failing to investigate thoroughly; sloppy documentation; billing errors; failure to read medical reports; failure to monitor and control medical treatment; failure to close claims in a timely fashion; not using medical case management when appropriate; failure to understand employers' return to work program; not pursuing subrogation; inadequate communication with employee, employer and health care provider; frequent changes of adjusters; many litigated cases; inadequate support for defense attorney

Health care provider

- Provides appropriate, effective medical treatment that facilities recovery and expedites return to productive work

- Sets reasonable return to work and recovery goals from the beginning of treatment

- Work with the employer to encourage appropriate recovery at work opportunities

- For complex cases, integrates care for the entire case including specialty providers and ancillary services such as equipment and transportation

Red flags: Treatment inconsistent with evidence-based guidelines; dispenses drugs, including opiates, from office; allows employee to direct care; co-morbidity conditions such as obesity, diabetes ignored; broadens scope of treatment beyond the injury; excessive testing; billing errors; does not understand or ignores return to work options; does not provide timely reports or appointments; injured employees do not reach MMI within forecasted time

Injured employee

- Know and follow safety procedures

- Report injuries immediately

- Inform treating physician of return to work opportunities

- Keep appointments and follow doctor's orders and restrictions

- When released to return to work, report on the next regular shift

- Notify supervisor immediately if work status changes

Red flags: provides conflicting versions of injury; injuries are inconsistent with nature of accident; refuses medical tests or exams; difficult to reach; injury is not reported in timely fashion; refuses contact with supervisor and colleagues; depression; poor performer, disgruntled, and/or serious financial issues

Employer/Supervisor

- Provide a safe work environment

- Educate all employees about Workers' Compensation, proper reporting of incidents and near misses, and incident investigation

- Follow internal injury reporting procedures before the end of the shift in which the injury occurred so that the Workers' Compensation carrier is notified promptly

- Report claims within 24 hours

- Regularly communicate with injured employee during time away from work and monitors progress upon the injured worker's return

- Develop and provide meaningful return to work opportunities

- Communicate with the treating physician and insurance carrier to facilities return to work

- Develop functional job descriptions and identify physical requirements that clearly identify the physical activities to do the work

- Monitor and strategize how to resolve claims

Red flags: slow reporting of claims; many litigated cases (over 20%); a high percentage (over 20%) of lost-time claims; a high number of injuries among new employees; rash of injuries in particular areas; spikes in average costs of claims; retaliation/bullying relating to claims reporting

This article is provided by the Institute of WorkComp Professionals, which trains insurance agents to help employers reduce Workers' Compensation expenses. Contact the Institute of WorkComp Professionals, Box 5437, Ashville, NC 28813; Phone: 828-274-0959 are visit www.iwcpro.com where you can sign up for their newsletter.