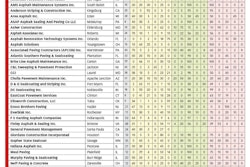

In last year’s 2013 Top Contractor results the Paving 50 List lead all five industry segment with total segment-only sales for 50 companies of $292,641,327. This year’s 2014 list, which boasts an additional 25 qualifying contractors making it the Paving 75, also leads the way among the five lists with $621,250,562 paving-only sales – more than doubling last year’s paving-only sales total.

Obviously the additional 25 contractors account for a substantial part of that dollar-volume increase, but the number of companies alone can’t support that sizeable jump. The more than two-fold increase means that some of the industry’s larger paving contractors have gotten on board – and their sizeable sales are reflected in the paving-only dollars for this biggest dollar of industry service.

And the vast majority of these 75 companies are laydown specialists – that is they’re not asphalt producers. Only five of the 75 companies indicate they generate any dollars from hot mix asphalt production and only one company (Richards Paving Co.) generates a meaningful percentage of sales (23%) from HMA sales. So the companies in this list are paving specialists, they aren’t HMA-production specialists. By and large they buy their hot mix from producers as opposed to making it themselves.

But just because they’re specialists doesn’t mean they don’t provide other services to their customers. Only two of the companies indicate they generate 100% of their sales from asphalt paving while the vast majority of contractors in the Paving 75 offer their customers a variety of paving- or pavement maintenance-related services (including “Other”):

- 5 companies generate revenue from 6 services

- 25 companies generate revenue from 5 services

- 27 companies generate revenue from 4 services

- 11 companies generate revenue from 3 services

- 5 companies generate revenue from 2 services

Sweeping is the service least-likely to be offered by companies on this list (and when it is offered it’s most likely as an adjunct to paving-related construction work) while 68 companies offer sealcoating and 63 companies offer pavement repair services. (Note: Given that contractors often keep their books differently than one another it’s possible that almost all of the Paving 75 provide pavement repair services, if only in preparation for construction of an overlay, and that sales dollars from that service is lumped in with the paving dollars.)

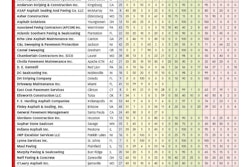

Where Pavers Work

The survey results indicate that while the Paving 75 are predominantly off-road contractors, they do perform work across the spectrum of pavements. While only two companies pave highways as a significant part of their business, 14 other contractors do paving work on highways. The number paving roads jumps to 62 contractors though, again, only a few companies are involved in road paving to a significant degree.

That leaves parking lot paving where only two contractors don’t pave parking lots at all and the remaining 73 firms generate significant dollars from their parking lot work. As far as driveway work goes, 56 contractors generate dollars paving driveways but their degree of involvement varies widely.

As expected, the customer mix tracks closely the types of work being paved.

- 73 companies generate sales from commercial/industrial customers and to a large extent are heavily invested in this market segment

- 56 companies generate sales from state or local agencies, the percentage of work varying widely

- 64 companies perform work on multi-family properties

- 47 companies pave driveways

Contractors who participated in the 2014 Top Contractor Survey can look forward to receiving their annual analysis and report in August. Contractors who miss out on the report can participate in the 2015 Top Contractor Survey which will be open online from Jan. 1 through April 30, 2015.