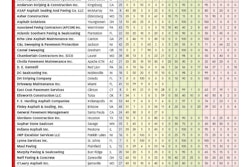

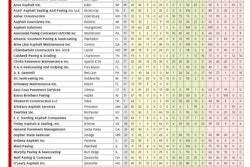

While the sweeping industry’s response to Pavement’s 2014 Top Contractor Survey still lags other segments of the industry, contract sweeper listings grew 150% from 10 to 25 companies. Assuming a jump like that next year Pavement should be able to list at least the top 75 sweepers as we did this year for other industry segments (but we’re still aiming for 100 contractors).

Because last year only 10 contractors were included in the 2013 Sweeping List we didn’t report total sweeping-only sales. This year, however, we think it’s fair to release that figure: Sweeping-only sales for the 25 contractors in the 2014 list totaled $41,719,267 – which we can report is a significant jump from the 2013 totals.

Clearly with only 25 contractors topping more than $41 million in sweeping-only sales there’s no question the economic value and impact of this segment of the pavement maintenance industry. It’s not only a significant revenue generator for contractors and a significant service (and expense) for property managers and public agencies, it’s an important opportunity and market for manufacturers of sweeping equipment, parts and support services. Of course that gross sales total doesn’t say anything about profit margins, which have been narrowing for years (we’ll address that in the August report we’ll send out to survey participants).

In all but five of the 25 listings, companies generated 10% or more of their revenue from sweeping; 13 of the companies generated more than 50% of sales from sweeping, and only four companies generating 100% of sales from sweeping (with another four generating 90% or more of sales from sweeping). While it’s difficult to use these limited results to draw firm conclusions (and because it’s only the second year we’ve been collecting data), it’s likely that these numbers hint at a diversification among sweeping contractors that might not have existed only a handful of years ago.

So other than aggregate sales for the sweeping industry segment, what do the survey results tell us?

- Most of the contractors do their sweeping on parking lots with 22 of the 25 companies generating at least some of their revenue from parking lot sweeping (and only four companies generating 15% or less from parking lot sweeping

- Highway sweeping is a small part of this group’s business with 13 contractors generating at least some revenue from highway sweeping but only one contractor reporting 50% or more of sales from highway work

- Sweeping of streets and roads, however, represents a significant revenue generator with 20 companies reporting work sweeping roads and only six of those reporting 15% or less work done on roads

Not surprisingly, then, the numbers for types of customers serviced are weighted heavily toward off-road sweeping.

- 100% of contractors in the list report work for commercial/industrial customers

- 10 companies reporting work for multi-family residential customers (most in single-digit percentages)

- 17 contractors sweep for public agencies

Hopefully next year more contract sweepers will participate in the survey and we can generate a 100-company Sweeping List and report the industry information that would accompany it. Mark your calendar to participate in next year’s survey which will be available online from January 1 through April 30.

Note: Some of the contractors who qualified for the 2014 Sweeping List are members of the North American Power Sweeping Association (NAPSA) or the World Sweeping Association (WSA). We have indicated those companies with an N for NAPSA or a W for WSA.

![Pavement Awards 2025[main]](https://img.forconstructionpros.com/files/base/acbm/fcp/image/2024/05/PavementAwards_2025_main_.665883e4276e8.png?auto=format%2Ccompress&bg=fff&fill-color=fff&fit=fill&h=100&q=70&w=100)

![Pavement Awards 2025[main]](https://img.forconstructionpros.com/files/base/acbm/fcp/image/2024/05/PavementAwards_2025_main_.665883e4276e8.png?ar=16%3A9&auto=format%2Ccompress&bg=fff&fill-color=fff&fit=fill&h=135&q=70&w=240)