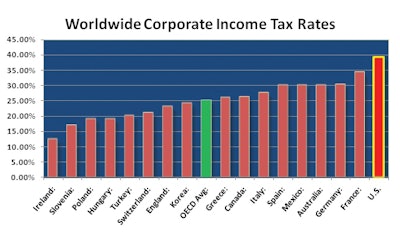

At 39.1 percent, the U.S. corporate income tax rate (average combined federal and state) is the highest in the industrialized world. Most of us want to find ways to (legally) limit our taxes. For equipment lessors, one of the best and most commonly overlooked ways to limit/defer taxes is to “exchange” (rather than sell outright) old or obsolete equipment.

Many people have been led to believe 1031 exchanges are available only on real estate, but this is not true. “Personal property” (rental equipment) 1031 exchanges have been available since at least 1935.

What is a 1031 exchange?

A 1031 exchange is an “exchange” (for tax purposes) of “qualifying” property, including rental equipment, for other “like-kind” property that enables an equipment lessor to avoid paying tax immediately upon the sale of rental assets. This allows the lessor to use the money that would otherwise be used to pay taxes to, instead, buy more and/or better replacement equipment.

Section 1031(a)(i) of the Internal Revenue Code states:

“No gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment, if such property is exchanged solely for property of like-kind which is to be held either for productive use in a trade or business or for investment.”

Following is an example of an ordinary sale:

? Sale: An equipment lessor sells a piece of equipment for $200,000 after fully depreciating it, and immediately incurs roughly $70,000 in ordinary income tax liability, assuming a 35-percent tax rate (depreciation recapture). Only $130,000 remains to be reinvested in replacement equipment.

? 1031 exchange: The same equipment lessor elects to, instead, “exchange” the asset (known as “Relinquished Property”) under Section 1031. Doing so yields no immediate tax, and enables the equipment lessor to reinvest the entire $200,000 in new equipment (“Replacement Property”).

The role of the qualified intermediary

If any payment(s) is/are involved (i.e., the exchange is not an even swap of equipment), the Internal Revenue Code and the applicable guidelines make it clear that the parties will be required to engage a Qualified Intermediary (QI) to hold the funds and transfer the assets. The taxpayer must not receive or take “constructive” receipt of the proceeds. Doing so will disqualify the exchange. Consequently, the QI, working under a written “Exchange Agreement,” must:

Transfer the Relinquished Property to the buyer;

Receive and hold the purchase price paid by the buyer; and

Transfer the Replacement Property to the equipment lessor.

Doing this properly (including the accounting) requires expertise, so we generally recommend using an experienced QI with a strong reputation.

What happened to the tax on the sale?

Because the lessor spent the proceeds on qualifying Replacement Property, the tax is effectively deferred for as long as the lessor continues to replace its fleet using 1031 exchanges. This means an equipment lessor can reinvest the funds that would otherwise have gone to pay the current year’s taxes, and continue doing that well into the future. Obviously, spread across an entire fleet, this can have an enormous impact on fleet composition (e.g., age, hours and obsolescence), and therefore, profitability.

In the simplest example, a lessor who replaces $10,000,000 (at current fair market value) worth of fully depreciated equipment in a given year could defer the gains, and therefore make available for fleet reinvestment, approximately $3,500,000 in cash (at an assumed 35-percent ordinary income tax rate on the depreciation recaptured). Those funds, which would otherwise have gone to pay income taxes, are not only preserved for the lessor’s use, they are reinvested into assets which not only produce income in the current year, but also in future years.

In terms of revenue generation, total five-year revenues (acknowledging that such assets might have useful lives that run several years longer) generated by replacement equipment purchased with such 1031 exchange tax savings (using a rough annual revenue or “dollar utilization” estimate of .65 x cost; recognizing that utilization tends to vary substantially with equipment types, ages, etc.) could exceed $18,000,000.

The tax savings can be significant

In the current economic (and tax) environment, using every tool at your disposal for limiting taxes and their effect on your bottom line is more than good business practice; it’s a necessity. A properly administered 1031 exchange program can save thousands or even millions of dollars in taxes, and in doing so, enable equipment lessors to generate multiples of that in additional revenues by reinvesting in newer, more efficient, and more competitive equipment.

Fortunately, 1031 exchange programs have been around for quite a long time. Consequently, a significant body of expertise has developed around the practice, making the process far easier than it at first appears; provided you engage an experienced 1031 exchange advisor/QI. If you’re an equipment lessor and not currently engaging in a 1031 exchange program, you might be paying far more in taxes than you have to (and missing out on substantial revenues in the process).