We started the Contractor Help Station two months back when we received a request for help from an excavating contractor that wanted to review his bidding process, considering that he owned a good portion of his equipment fleet. I thought it would be a good idea to ask Ken Hedlund of Somerset CPAs (www.somersetcpas.com) to join the party. Ken and his team spend 100% of their time working with all types of contractors, big and small.

What I do for construction equipment dealers and rental companies is supply a list of service providers that I know are industry experts and charge reasonable rates. My website, Dealer Success LLC (scheduled to be live in mid-August), offers a list of the services covered with one or two names to call regarding your problem or need at the time. I then monitor the contact to the point of reviewing the expert’s work and checking with the user to see that they are happy with the results. Since Ken is one of the most highly regarded contractor specialists I know, he is on the list. The bottom line here is: “If you need something, I can get it for you at a reasonable price.”

Back to Our Contractor Problem

We posted our reader’s questions and responded to them in the last two columns. (ForConstructionPros.com/11525486 and ForConstructionPros.com/11573808). Both Ken and I offered up suggestions on how to deal with the question, and last month, Ken submitted an article geared to equipment-intensive contractors and how to determine how to bid out the use of this equipment.

Subsequently I have received phone calls and emails from readers offering suggestions on how they handle bidding when the equipment is owned. The suggestions ran from “bid it as if the equipment was not owned free and clear and use your reputation to get the job,” to “bid with a discounted equipment charge, and your reputation, to give yourself an edge in the bidding process.” I did not get any suggestion to not include a significant machine charge.

In the end, the contractor in question has to get his accounting and historical results in order so he can estimate his “cost” of owning and operating the equipment and thus have numbers to use for bidding purposes.

I got another question about overhead and how to allocate that for bidding purposes. You are in the business of construction and accordingly all costs associated with your business, which includes overhead, must be considered when estimating a project. This kind of falls right into line with our previous topic of determining rates for equipment.

Overhead rate determination is a more complex topic. When you own equipment and use it on the job, you know your direct costs and hours used to calculate the rate and allocate the cost to the project. In effect, what we try to do with overhead is apply all the costs we incur that were not direct costs for equipment and manpower. It’s fairly easy to understand but not so easy to allocate over a year to ensure profitability.

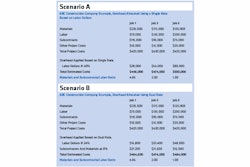

To determine overhead rates, you need to gather up your historical results for the last couple of years and adjust them to a “normal” result. Once that’s done, a budget for the current year is required, and probably more than one version so you can come up with rates depending on how much work you get. Best practices would also suggest you adjust these budgets quarterly so you can catch any adjustments that need to be made. Let’s face it, if a contractor does not recover all of his costs — including overhead — he cannot generate a profit nor generate positive cash flow.

How to Cover Your Costs

Now that you have your budget for the year prepared, you have to determine how you will charge your jobs for this real cost of business. Most contractors use a single rate method allocated by either labor hours or labor dollars. Easy enough.

However, my friend Ken thinks this method is flawed unless basically all of your work is self-performed, and it does not contain jobs where costs are skewed because of different levels of material costs or subcontract costs. If this were the case, the self-performed jobs would get a higher percentage of overhead than the larger jobs, where the costs come in the form of higher material costs or the work performed by subs. After all, these other jobs probably require as much overhead as your normal work and should have overhead allocated accordingly.

Contractors have to be careful not to fall into a false sense of profitability. After all, Revenues - Expenses = Profit. Make sure your Revenue number is properly covering the Expense or a loss will be the result.

One last word of caution and that is that volume will impact how you charge overhead. If you determine a rate based on some expected level of volume and that volume moves on you either way, you should adjust your overhead rate to accommodate this shift. That will allow you to lower your charge and be more competitive or increase the charge if revenue is short.

Next month, Ken will discuss the Dual Overhead Rate Method. This may sound complicated but per Ken really is not. It is the industry best practice approach for understanding and applying overhead and enhancing profitability. As always, we are happy to address any questions we get in the meantime.

Join the party and feel free to send in comments or questions we can post either in this column or on ForConstructionPros.com.