The economy continues to grow, although the pace might not be as robust as most would like. Still, the uptick continues and it will have a direct impact on your customers’ purchasing and rental habits for the coming year. Just how much of an impact was addressed by the following economists as they weighed in on highway and building construction, raw materials costs, employment, and the overall economic outlook for 2015.

Highway construction

Rental: In 2014, there seemed to be more highway and bridge construction than in several previous years, at the federal, state, and local levels. Certainly, there is plenty of work to be done in repairing and adding to the infrastructure. Do you foresee a healthy highway construction market in 2015 and how would it compare to 2014?

Anirban Basu, chief economist for the Associated Builders and Contractors (ABC): The outlook remains very unclear because the volume of highway construction is less an economic outcome and more a political one. The federal Highway Trust Fund sends about $35 billion a year to states as their primary source of funding for road construction and repair. As stakeholders know, the Fund is not collecting enough revenue from gasoline taxes. No state receives less than a third of its transportation money from the federal government and only six states are below 40 percent – Florida, Georgia, Massachusetts, New Jersey, Utah and Washington state.

The federal gas tax, which accounts for 72 percent of Fund revenues, has not been raised since 1993. Congress recently transferred $12 billion into the Fund for the most recently completed fiscal year, but that money is largely spent. The outlook therefore depends upon the next Congress. For now, expect flat levels of construction.

Ken Simonson, chief economist, Associated General Contractors of America (AGC): I’m very pessimistic about the highway outlook. It appears extremely unlikely that federal funds will increase, and they may drop sharply if Congress can’t find a way to extend the federal-aid program past May 2015. Most states funds are also dwindling, although a few states have embraced public-private partnerships. These are a very limited solution, however.

Jeannine Cataldi, IHS Inc.: 2015 spending on highway and bridge construction will increase from 2014 levels and will be stronger than 2014. Factors that will lead growth are continued improvement in economic conditions, which lead to increased revenues at the state and local level. Also, the continued improvement in residential markets will lead to more upgrades of existing roads and construction of new roads for new housing developments.

Issues facing the industry in 2015 are the expiration of the short-term extension of the Moving Ahead for Progress in the 21st Century (MAP-21) transportation bill – which is funded through May 31, 2015. Since highway infrastructure projects require longer-term planning, until a new longer-term agreement is in place, activity will remain dependent on the length of any new agreements regarding this funding. There is resistance to raising the gas tax – as well as to other means of raising funds that have been discussed (vehicle miles traveled or VMT, tolls, increased fees).

Ed Sullivan, group vice president and chief economist, Portland Cement Association (PCA): We anticipate a small increase in highway construction next year. The increase will largely be the result of increased funding at the state and not the federal level where the highway bill has been frozen for some time. An improving economy and more jobs have allowed many states to shift funds back to the infrastructure where there is pent up demand for repair and new construction.

While legislators wrangle with how to find money for the Highway Trust Fund, state and local governments have been forced to be more creative to maintain their infrastructure. Several states have raised their gas tax and public and private partnerships have generated much-needed capital to upgrade roads and bridges.

Dr. Alison Premo Black, senior vice president & chief economist, deputy director Contractors Division, American Road & Transportation Builders Association: We are expecting a slight uptick in the highway and pavement construction market activity in 2015, an increase of about two percent after accounting for expected changes in project costs, but the uncertainty over the reauthorization of the federal highway program will continue to put a damper on the market.

The real value of pavement work is expected to reach $47 billion in 2014, up nearly three percent from $45.8 billion in 2013. (ARTBA tracks the value of construction put in place, available monthly from the U.S. Census Bureau. The nominal value is adjusted with the ARTBA Price Index, which measures changes in material prices, inflation, and industry wages. The value for pavement work in this analysis does not include the “other” highway related category reported by Census.)

By comparison, the real value of highway work was $56.9 billion in 2008, before the Great Recession. Even looking back further, the real value of work was $54.9 billion in 1999, accounting for changes in material costs, wages and inflation. So the increase in activity is a positive sign, but the industry is climbing out of a deep hole.

The bridge market continues to show growth, and is expected to reach a record level of $31 billion in 2014, up from $30.8 billion in 2013. A number of large projects and increased activity in about half the states will sustain that level of investment – we expect the value of bridge work to be about $31.2 billion in 2015.

The main wild card in the outlook for 2015 is the federal highway program. Over the last 11 years, federal aid has accounted for an average of 52 percent of all state highway and bridge capital outlays, including construction, right of way and engineering work. Given the improvement in state and local finances and the overall U.S. economy, I would expect more robust growth in the highway and bridge construction market in 2015. But the uncertainty over the federal highway program is acting as a damper on the entire market. Although the highway and bridge construction market was up in 2014, the data on contract awards, a leading indicator of future market activity, is cause for concern. The real value of state and local government contract awards for highway and bridge projects are down 15 percent between January and September 2014 compared to the same time period in 2013. This pullback is widespread, with 28 states and Washington, D.C. pulling back on their programs. If states continue to delay projects, this would impact the outlook for 2015 and beyond.

Building construction

Rental: Building construction in both the commercial market and in single- and multi-family homes continued to gain momentum in 2014. What were the biggest drivers in both markets in 2014 and do you see the trend continuing in 2015? What is your estimate of starts for 2015?

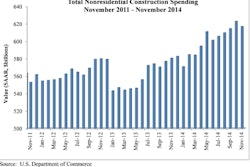

Basu: Commercial construction has been driven largely by a combination of expanding consumer outlays (e.g., more construction in retail and lodging) and growth in professional services employment (e.g., office). That is likely to continue into 2015 since economic growth might actually accelerate a bit next year, which will likely allow more office positions to be created and for consumer outlays to continue to expand. Residentially, the energy of the marketplace continues to be concentrated in rental stock construction due to a combination of millennials, significant job growth in lower-paying sectors, more rigid mortgage lending standards, higher down-payment requirements, student debt, and cultural factors.

Simonson: Multifamily construction has been going gangbusters for three years and should continue to be a hot segment in 2015. Hotel construction has been torrid; for now, it still looks hot but it has a history of cooling off suddenly. There may be a small upturn in new-office construction in cities but the suburban office market remains very weak. The strongest segments should be ones that supply the oil and gas drilling industry or downstream - pipelines, railroads, petrochemical plants and export terminals.

David Crowe, chief economist, economics and housing policy, National Association of Home Builders (NAHB): The multi-family apartment sector was the power behind growth in 2014. Apartment building grew about 14 percent over 2013 because of the strong demand from young adults just moving out of school or their parents’ home. In addition, the prime household formation ages of 25 to 34 are filling up with the millennial generation, adding even more demand for rental apartments.

Single-family construction did advance in 2014 but most of the gain was in the latter part of the year. The unusually harsh winter in most of the country kept construction from taking place and home buyers from getting to the sites. Low mortgage rates and affordable home prices will help regain those losses.

The Great Recession caused many home owners to delay their next move until the future is more certain. As economic growth returns to more normal levels and incomes grow, this pent up demand will feed new home construction for several years. NAHB expects total starts in 2015 to exceed one million with 820,000 single-family homes and 365,000 multifamily units.

Cataldi: In 2014, the residential market has largely been driven by spending on construction of multi-family units. Growth in the single-family market, while positive, was slower than it was in 2013. Drivers of growth in the multi-family market are pent-up demand from the recession, as well as a new generation of households that is wary of actual home buying. Growing levels of student debt prevents many households from meeting stricter lending criteria, especially in terms of debt to income ratios while others want to maintain a degree of mobility. Both factors are increasing the demand for multi-family rental units. Looking ahead, construction spending in 2015 will remain strong in the multi-family segment, although it will begin to moderate as supply aligns with demand. Single-family construction is expected to be stronger in 2015 as economic conditions improve, allowing for more households to look into the possibility of buying homes. Housing starts are expected to grow at a stronger pace in 2015 than in 2014.

In the commercial segment, growth in 2015 is expected to continue at a strong pace, with spending coming from the same sectors that drove growth in 2014 – office, lodging, and warehouse construction. Growth in the office and lodging segments is being driven by increasing gains in employment, and consumer confidence gains as economic conditions improve. Warehouse construction is being driven by the increasing share of e-commerce retail sales, which means a greater need for distribution centers.

Sullivan: Both the commercial and residential housing markets should continue to gain ground over the next few years, and job creation is the main driver for both. Already, we are seeing 250,000 jobs created each month, which means there will be 3 million jobs created annually by the end of next year. More jobs mean more household formations. Combine this with a pent up demand of 3.5 million housing units and residential construction looks strong for 2015 and beyond.

We see more growth, however, in the multi-family market that is especially attractive to college graduates who, saddled with student loans, cannot afford single-family homes. Baby boomers will likely be transitioning to multi-family homes, as well, which will delay significant improvement in many single-family markets.

Commercial construction is driven by return on investment, which is measured by net operating income and appreciation. More jobs translate into more office workers and higher occupancy, brightening the ROI picture. Seeing less risk, banks are allowing better access to capital, which will help sustain growth in this market for several years. We anticipated 7-percent growth in commercial construction this year and look to 10-percent growth for next year.

Employment

Rental: With unemployment rates trending downward and an increase in construction starts, has finding construction workers been an issue for builders? If so, how have builders met the challenge, e.g., increasing wages, slowing expansion, or looking at other markets to attract new workers.

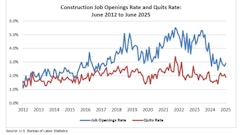

Basu: Shortages in skilled construction labor have become more apparent over the past two years, particularly in states in which the economy is growing rapidly, including Texas, Louisiana and North Dakota. These shortages will worsen over time. The response to shortages will take many forms, including in terms of rising purchases of labor-saving technologies, more modular construction, and rising wages and per diems.

Crowe: Finding construction workers and subcontractors has been a challenge for home builders. The long recession and slow recovery has caused many former construction workers to leave the industry and a resupply of younger workers has not grown to replace those workers. Builders have met the challenge in many ways. Some local home builder association are sponsoring training programs and helping with referrals. Builders are delaying construction and carefully scheduling subcontractors to balance the demand from other companies. And, builders are paying subs more although there is a limit to what builders can pay and remain profitable in a very competitive environment.

Simonson: AGC of America surveyed members about worker availability in late summer and received close to 1,100 responses from contractors. Eighty-three percent said they were having trouble filling at least some craft positions, and 61% said the same about other professional positions. Nearly two-thirds of firms that employ carpenters or roofers reported hiring difficulties, with half or more having problems finding most other crafts. Project managers/supervisors were the hardest professional position to fill. For now, wages are still rising very modestly, but I expect wages, bonuses and per-diems to accelerate in 2015.

Sullivan: During the recession, people left construction to find work elsewhere. Now, with unemployment rates declining and the labor market broadening with different types of jobs becoming available, some construction companies are experiencing shortages, especially among skilled workers and truck drivers. Company training programs and community colleges are attempting to help supplement the workforce.

But it’s not just a shortage of workers that’s creating a few challenges for employers. The demand for trucks and heavy equipment is outstripping supply and a booming oil industry in North Dakota is putting pressure on railroads and logistics overall. Among headaches, however, these are not bad ones to have. More work, more workers, and more orders for trucks and equipment will ultimately put more juice into the economy.

IHS: Unemployment in the construction industry is declining rapidly, and the construction labor force has shrunk over the past six years as a result of workers exiting the workforce during this prolonged weak activity. This means a smaller pool of construction workers will be in high demand as residential and nonresidential markets improve; tighter labor markets will shift negotiating power toward employees over the near term. Seasonally adjusted unemployment came in at 9.1% in August, above the average pre-recession unemployment rate of 7.7% but well below peak unemployment of 21.6%.

Although unemployment is coming down, the unemployment rate for the construction industry remains one of the highest in the country, and while some regions are improving faster than others, from a national perspective there is still enough slack in labor markets to limit wage growth over the near term. However, a significant characteristic of the construction recovery is that it varies by region and profession. While the overall market in the United States shows lackluster growth, some regions (Gulf Coast, Bakken) and professions (skilled workers) are already showing wage growth well above 2.0%. (Pricing and Purchasing, Construction Wages, October 2014.)

Raw materials costs

Rental: How has an uptick in construction this year impacted the cost of raw materials (such as asphalt for roads, steel for the commercial market, and lumber and wood in the housing market). Do you see this trend continuing in 2015?

Basu: Input costs have not expanded rapidly over the past two years. Contributing factors have included a sluggish global economy and a strengthening U.S. dollar. Correspondingly, despite the uptick in U.S. construction, materials prices have remained extraordinarily stable in the aggregate. Some volatility is apparent within certain categories, however, though often increased prices in one segment have been largely offset by falling prices in others. As an example, the impact of rising natural gas prices has at least been partially offset by falling oil prices.

Crowe: Building material prices ramped up rapidly as the industry started building again as those supply chains also attempted to reopen capacity and rehire workers. Lumber, gypsum, OSB panels and concrete have been particularly volatile. As production capacity returns to material producers, more stable price trends are likely to return. Cheaper energy costs will also help keep prices from rising faster than general inflation trends.

Simonson: Materials costs have remained very mild throughout 2014, with the exception of big jump in gypsum prices at the beginning of the year and continuing increases in lumber prices. The best news has been about diesel fuel, which is close to a four-year low as of early November. I expect more good news on materials costs in 2015, thanks to the abundance of domestic oil and gas, along with subdued demand from most of the world for globally traded materials such as steel and copper.

Charlie McCarran, IHS Inc.: The uptick in construction activity this year has certainly had an impact on building material prices. However, not all regions and not all material markets are experiencing the same degree of pressure. Ready-mix prices in Missouri are rising at more than twice the rate they are in New York. Cement prices in Texas are nearly 20% higher than they are in Pittsburgh. Generally, cement, ready-mix and aggregate prices are outpacing the national average in the US South and Midwest and are lagging the national average in the Northeast. In terms of material markets, those most exposed to developments in housing, such as lumber, are generally seeing less pressure than those that have both residential and nonresidential applications. Unfortunately for buyers, continued gains in housing and nonresidential construction next year will drive pricing leverage increasingly in favor of suppliers. From lumber and wallboard to cement and rebar, prices in the third quarter of next year are expected to be higher than they were during the third quarter of this year.

Overall Economic Outlook for 2015

Rental: What level of economic growth do you see for 2015? What are some of the key drivers that will impact this growth either positively or negatively?

Basu: The U.S. economy should expand in the neighborhood of 2.5 to 2.8 percent next year, led by growing consumer spending, surging energy production and strong industrial segments.

Sullivan: We are looking for a 3 to 3 ½ percent annual growth in GDP over the next two years. It could be higher, but it will likely stay within this range thanks in large part to consumers who are yet spending with confidence. Consumers make up approximately 70 percent of all economic activity. Their debt has been reduced, interest rates are more favorable, and they are gaining better access to credit. Still, their confidence hasn’t kept pace with their ability to buy. As the saying goes, the deeper the wound, the longer the recovery. On the optimistic side, consumer confidence is currently at an eight year high.

Crowe: The modest and uneven economic recovery up to this point suffered from the severe depth of the recession. Residual fears, lost wealth and hesitant consumers led to an uneven recovery. External factors like weather and world economic health also caused uneven pluses and minuses to the US economy. But, most of the uncertainty and repair from the Great Recession are over. Head winds have diminished and the future is looking much better. NAHB expects at least a 3.5 percent GDP growth rate in 2015 as consumers regain their footing, as job growth continues at more than 200,000 per month and as foreign economies also come back to normal. The primary risk is the consumer and their willingness to return to markets thereby boost spending, causing the need for more production and leading to more employment. That is the virtuous cycle that leads economies through a recovery.

Simonson: I think real (inflation-adjusted) gross domestic product will grow 2.5 to 3 percent in 2015. Of course, that’s the same range most economists have predicted for four years, and something always seems to go wrong! But I believe the “shale” gale is delivering a tremendous boost to U.S. competitiveness, providing consumers with more buying power and generating orders for many types of business. Weak foreign demand and a return to confrontation in Congress may drag down growth, however.

IHS: Job creation in the United States has been solid over the past several months, with a monthly average of 227,000 jobs created since the start of the year. We see a 200,000-ish trend continuing through 2015, and the unemployment rate hitting 5.6% by the end of 2015. But this presumes that improvements in the supply of labor take place.

The demographic trends affecting the labor force also affect household formation. Recent data on household formation show that a huge, recession-like shortfall began over the past year. As household formation slows, it restrains housing starts and sales. The causes are familiar: a population aging into more stable and less mobile situations, poor wage growth, slower immigration, limited access to credit, and onerous student loan burdens.

Overall, the forecast is for stronger growth in 2015, with real GDP increasing at 2.7%. Potential risks to growth are continued weakness in household formation that could have wide ranging impacts on the US economy. (US Economics commentary, IHS October 2014)