If I had to guess what the most important need in the construction world will be for 2015, I would say it will require productivity gains to keep your company competitive. I would further bet these trends will impact every aspect of the construction process — manpower, equipment and job management — all in the name of meeting or beating the bids accepted by customers.

The decrease in oil prices (if they stick), the increase in rental utilization and the implementation of technology such as telematics will all impact the cost of doing business, because the oil patch will be asking for price cuts, rental reduces equipment costs and telematics help contractors fine tune their bids using actual data to determine “costs.” Take it to the bank.

Part of the productivity question always comes around to compensation plans and how to structure them to incentivize your employees.

So to give you some background on the topic, my partner in crime, Ken Hedlund of Somerset CPAs (www.somersetcpas.com), is contributing a two-part series on the topic. It’s pretty straightforward, but as they say, the devil is in the details — which he will discuss next month. Enjoy! - Garry Bartecki

One of the most effective financial power tools and certainly best practice concepts is the use of a performance-based incentive plan. Many owners are looking for that key ingredient to maximize their company’s success. We always hear owners say that their employees are the company’s most important asset. Attracting and retaining employees whose skills and commitment contribute significantly to the growth and profitability of the business should be a priority.

While high-performing employees are typically driven by their own high standards, a performance-based incentive compensation package can often motivate them to continue performing at optimum levels. Often, we see companies have profitable years and allocate bonus and other incentive payments on an arbitrary and subjective determination. However, wouldn’t it make sense to put an objective reward system in place to identify high performers and provide them with the highest level of incentives and truly reward them for their contributions? We will introduce the basic principles of this concept in a two-part article, with this part focusing on the corporate level funding formula.

Funding and Allocation

There are two key components in the design of a performance-based compensation plan: a corporate-level funding formula, and the determination of incentive allocations based predominately on employee performance.

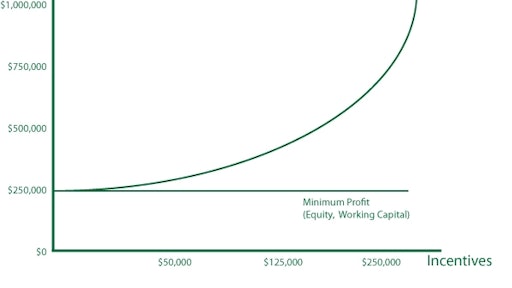

Corporate-level funding formula — For contractors, there is a minimum level of profitability that should be achieved before any incentives are considered. This minimum profitability level considers many variables, including equity and working capital needs for bonding, banking, investment in capital assets, debt service, owners’ return on equity, etc.

Upon achieving this minimum level of profitability, employee incentive pools are then funded. For each incremental higher tier of profitability, incentives are funded at an increased percentage. This structure motivates employees to continue to reach for that next higher level of profitability. (See chart below.)

Determination of incentive allocations — An incentive compensation plan is designed to tie pay to performance and achieve gains in worker productivity. Such plans incorporate various incentives including but not limited to cash bonuses, commissions, profit sharing, deferred compensation, phantom stock and corporate stock ownership. The incentives can be paid current or deferred to sometime in the future.

An incentive compensation plan can be purely discretionary and may be targeted to individual employees, work crews, branches or profit centers, the organization as a whole or a combination of these groups. A performance-based incentive compensation plan takes it a step further — it is more predominately objective and designed to specifically identify and incrementally reward the top performers.

We strongly recommend putting in place a system of performance measurement to provide a model of accountability and identify high performers. Employees should understand what’s expected of them to qualify for the incentive compensation. You should clearly spell out minimum performance standards that link corporate goals to managers’ and supervisors’ performance objectives in order to earn incentive compensation.

Incentive compensation plans are customized to a company’s specific needs and goals. A performance-based plan employs objective criteria to determine incentive pay. These plans establish clearly identified objectives that the manager must accomplish in order to receive the compensation.

Next month, we will explain the details of these identifiable objectives and what steps to take to integrate them into your culture.