It has been a busy time, between the Associated Equipment Distributors (AED) convention, American Rental Association (ARA) convention and other year-end and beginning of the year planning programs. The top four takeaways from these events of most importance to you are:

- Construction work is on an upswing.

- Equipment rental is expected to expand approximately 30% over the next three years.

- More dealers are getting into the equipment rental business (not rent-to-sell).

- Contractor surveys show that 47% plan to rent as much as they did last year, with 37% saying they will rent more in 2015.

I don’t know about you, but customers of the rental company I work for were very busy in 2014, and our internal survey indicates more of the same or better for 2015.

Adopt a Rental System to Track Time and Use

No matter what survey you look at, construction work and construction hiring are on the rise, and I think we can all conclude that if contractors are hiring, the backlog is telling them to do so.

Nonresidential seems to be where the action will be, especially in the commercial and industrial sectors. Residential construction is still scraping by but with not much to write home about. And I think we can forget about any increase in institutional work because every survey I see reflects a flat line in terms of this type of activity.

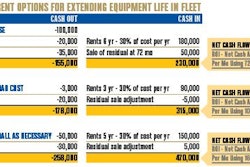

The big question will be “Can you make a buck with this new work?” Along these lines, I feel that contractors have figured it out and are taking steps to increase their efficiency by renting more equipment, especially specialty equipment that will help them leverage their investment in personnel. Why rent more? Because it is more cost effective and allows you to take on more work with smaller investments in equipment.

When you stop and think about it, you are running your own internal rental company when you own, transport, maintain and pay for units in your equipment fleet. And if that’s the case, you need to abide by the rental metrics just like rental companies do. Is it possible to do? Yes, it is if you have a “rental system” that tracks the equipment time and dollar utilization, and a service department that is managed similar to that of an equipment dealer that tracks time and dollar utilization of technicians. If you don’t have these systems in place, I highly doubt you can meet the rental metrics to ensure “profitability” in terms of time utilization and an acceptable ROI on your original equipment cost.

To get a handle on these metrics, you should review a copy of the ARA’s “Cost of Doing Business Survey” (http://bit.ly/1CVlKBC) to see if you come close to a time utilization and ROI that allows you to not only cover costs but also cover the debt service on equipment purchased. There are rental systems out there geared to contractor fleets, as well, that can supply the information you need to determine how much equipment you can own and how much you should rent.

I also understand that every contractor is going to own some equipment to cover what they need on a daily basis, and that specialty equipment may not be readily available in the rental market. But with 2009 still on our minds, none of you want to over invest and run into another credit crunch.

Technology and Other Trends

Telematics is also driving more contractors to rent because the data dump from this technology clearly shows that the time utilization they think they’re getting is not due to actual work but more idle time than they thought.

Let’s face it, contractors need to keep costs to a minimum (and know they are doing so) to properly bid jobs and gather data for future bids for similar work. It is quite possible that many are finding out it would be cheaper to rent more equipment, use it effectively and send it back when they are finished with it. As a matter of fact, contractors are now asking rental companies to supply them with the telematics stats from the rental equipment to further help them understand their true need for equipment hours.

On the plus side, the increase in rental activity is pushing more equipment dealers into the rent-to-rent (RTR) market. I expect you will find many of your equipment dealers contacting you about their ability to supply more RTR services from this point forward.

When I attend the AED convention, which was held this year in February in Orlando, I always make it a point to stop by as many bank hospitality suites as I can to discuss how they see the current market and to ask what is keeping them up nights. What is making the banks nervous these days is how many dealers approached them for financing of RTR fleets, because operating a RTR business is much different than operating a dealership that is primarily in the rent-to-sell (RTS) business. In short, a word of caution may be to make sure dealers new to the RTR game can deliver in terms of both availability and service.

You may also have been hearing about excess rental units in the field because of the slowdown in oil. It may be true to some extent and, if so, you may have an opportunity to purchase some late-model units at a discount if you need to buy some basic units. I suspect this will be a short-term event due to the exposure of the public rental companies, since oil is a very small percentage of their business, and because they can move the equipment to other locations and adjust their CapEx expenditures to remove the “excess” from their fleets.

Most of you should be in for a better year. Just avoid increases to overhead or fixed costs by renting instead of owning. Let the rental companies take the risk.