- Economic indicators for industries like construction show "all-time high."

- Construction was the fifth-highest growing sector in the report.

- “Residential new home construction demand continues to outpace supply."

- Construction companies reported the highest price increases for materials and services in March of all 18 services industries.

“All-time high” was the buzz phrase in a monthly economic report meeting for industries like construction, rental, warehousing and others. Anthony Nieves, chair of the Institute of Supply Management (ISM) Services Business Survey Committee, delivered the March services sector report on April 5. The PMI, or the Purchasing Managers’ Index, is a set of economic indicators based off surveys of private-sector companies.

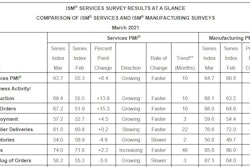

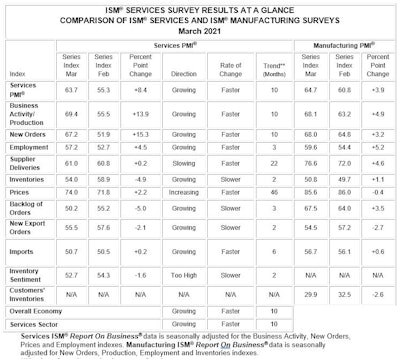

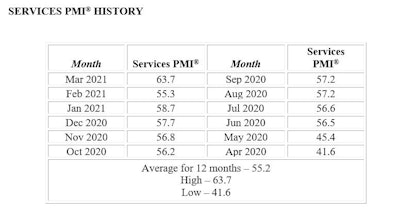

“The Services PMI registered an all-time high of 63.7 percent, 8.4 percentage points higher than the February reading of 55.3 percent,” Nieves says. “The previous high was in October 2018, when the Services PMI registered 60.9 percent. The March reading indicates the 10th straight month of growth for the services sector, which has expanded for all but two of the last 134 months.”

According to the report for March, the Services PMI registered 63.7 percent, an 8.4 percentage-point increase compared to the February figure of 55.3%. This reading indicates the services sector grew for the 10th consecutive month after two months of contraction and 122 months of growth before that. A reading above 50% indicates the services sector economy is generally expanding; below 50% indicates the services sector is generally contracting.

Construction was the fifth-highest growing sector in the report. All of the 18 services industries reporting growth in March: arts, entertainment and recreation; wholesale trade; mining; management of companies and support services; construction; agriculture, forestry, fishing and hunting; accommodation and food services; real estate, rental and leasing; transportation and warehousing; public administration; finance and insurance; utilities; health care and social assistance; professional, scientific and technical services; information; retail trade; educational services; and other services.

ISM

ISM

A Services PMI above 49%, over time, generally indicates an expansion of the overall economy. The March Services PMI indicates expansion for a 10th straight month following two months of contraction and a preceding period of 127 months of growth. March’s PMI of 63.7% corresponds to a 5.1% increase in real gross domestic product (GDP) on an annualized basis, Nieves says.

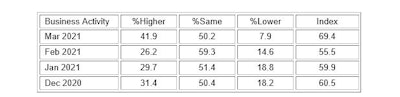

Business Activity Reports Highest Rating

ISM’s Business Activity Index had its highest reading since it began in 1997. The index came in at an all-time high of 69.4% in March, an increase of 13.9 percentage points from the February reading of 55.5 percent. This represents growth for the 10th consecutive month.

ISM

ISM

“We believe there is some pent-up demand starting to come back as back-orders and production ramp up after COVID-19 delays; we also think there is purchase optimism due to the recent stimulus package,” one survey respondent said.

The top performing industries for business activity in March, in order of performance, include: arts, entertainment and recreation; mining; management of companies and support services; accommodation and food services; wholesale trade; agriculture, forestry, fishing and hunting; real estate, rental and leasing; utilities; finance and insurance; public administration; transportation and warehousing; health care and social assistance; construction; information; retail trade; educational services; and professional, scientific and technical services.

Logistics/shipping delays

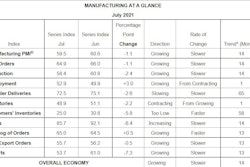

Nieves says many of the services industries are reporting slow deliveries and resulting price increases on raw materials and other goods.

The Supplier Deliveries Index registered 61%, up 0.2 percentage point from February’s reading of 60.8%; a reading above 50% indicates slower deliveries, which is typical as the economy improves and customer demand increases, he says.

“Residential new home construction demand continues to outpace supply,” one survey respondent said in the report. “Building material delays, discontinuations and shortages are beginning to develop. Shipping delays at the L.A. and Long Beach ports have contributed to longer lead times. Cold weather in Texas has hurt several component manufacturers for building materials. We have encountered the ‘perfect storm’ for building material shortages and price increases.”

Other respondents reported, “Logistics challenges, port delays, shipping delays, [and lower] part availability” and “It is still difficult to find trucks for loads and to secure shipping containers.”

One survey respondent from the mining industry reported, “Lack of chemicals and the recent freeze in Texas has delayed some orders and is creating a micro [price] increases for certain products. Suppliers are using the short-term shortage to their advantage to raise rates.”

Price Increases Widespread

Nieves also pointed out today that many survey respondents said they are experiencing price increases because of shipping and logistics delays.

“The Prices Index figure of 74% is 2.2 percentage points higher than the February reading of 71.8%, indicating that prices increased in March, and at a faster rate,” he says.

Construction companies reported the highest price increases for materials and services in March of all 18 services industries. Other industries reporting price increases, in order of increase include: construction; wholesale trade; utilities; mining; real estate, rental and leasing; management of companies and support services; public administration; retail trade; transportation and warehousing; finance and insurance; other services; accommodation and food services; agriculture, forestry, fishing and hunting; health care and social assistance; arts, entertainment and recreation; professional, scientific and technical services; educational services; and information.

Nieves says the issue of delivery slow downs and price increases, while important to those industries, isn’t grave.

“These companies are resilient,” he says. “We still have access to essential items.”

Construction materials and services are at the top of the list when it comes to price increases. Commodities that have increased in price include: chemicals; construction materials; construction services; copper products; diesel; electrical components; exam gloves; food and beverage; freight; fuel; gasoline; gasoline-related products; labor; labor - construction; labor - temporary; lumber; oriented strand board; packaging materials; paint-related products; personal protective equipment; PPE - gloves; poly products; polyvinyl chloride (PVC) products; resin products; steel; steel conduit; steel products; steel - rolled; trucking services and wood products.

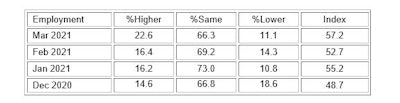

Employment Numbers Up

All sectors but three – utilities, information and health care – reported increases in employment in March. Hiring grew in March for the third consecutive month after contracting in December. After 72 straight pre-pandemic months of expansion, the index contracted from March through September. ISM®’s Services Employment Index registered 57.2% in March, up 4.5 percentage points from the February reading of 52.%.

ISM

ISM

The 10 industries reporting an increase in employment in March, listed in order, are: arts, entertainment and recreation; management of companies and support services; wholesale trade; construction; finance and insurance; other services; accommodation and food services; public administration; educational services; and professional, scientific and technical services.