Our team talked with four experts from Link-Belt Excavators for the State of the Industry Report:

- Adam Woods, general manager of innovation and product portfolio strategies

- Monica Crawford, supply chain supervisor

- Chris Wise, general manager of market & development

- Kevin Roberts, general sales manager, North America sales

Each expert weighed in on certain areas of expertise including the workforce shortage, the post-pandemic supply chain and rising interest rates moving into 2024.

What was the construction industry’s biggest challenge in 2023?

Wise. I don’t believe there was just one big challenge our company and dealers faced this year because the construction industry isn’t that simple. In the first half of 2023, we were still feeling the effects of a supply chain that was trying to keep up with the incredible demand of our customers and deliver equipment promptly.

In the back half of this year, as that smooths out and we begin to build up available inventory, we’re seeing interest rates and the cost of goods increase dramatically, which causes concerns that customers will start slowing down their demand. So, we’re just shifting from one challenge to another as we continue to do our very best to provide the best product at the best price to our dealer network and back it with the best support we can provide. Regardless of the challenge, we will continue to do our best to support our dealers and their customers.

Are changes in the workforce, including retirements, affecting your company?

Woods. From an innovation and product portfolio strategies (product and in-field) perspective, the short answer is yes. The long answer is, of course. With the baby boomer generation beginning to retire, they leave a vast labor gap that must be backfilled. The problem is [that] there are not enough younger generation newcomers to fill that gap.

This is where we will see technology and innovative solutions utilized to help with either the learning curves of newcomers into the industry or to fill duties once done by personnel. Because these labor gaps are expected to worsen, Link-Belt Excavators dealers will also have to work to help solve these new issues with end users and customers within our … industry.

In what technological areas do you see the potential for the most innovation in 2024?

Woods. Production technologies such as grading solutions, weighing technologies and any other technology that aids in improving productivity or tracking will carry some of the best potential into 2024. Through these technologies, contractors can learn more about the efficiencies of their business and, thus, improve margin opportunities and gain sustainability targets through more efficient work.

What innovations or improvements do you anticipate in construction equipment in 2024?

Woods. Construction equipment, in general, is getting smarter while being more sustainably conscious. Utilizing more efficient ways of functioning while providing more data to the end user/owner to track and improve productivity are some ways this is happening.

Innovations surrounding this point will continue to be used and integrated into products. The world is no longer of the mindset of just getting it done, but rather, getting it done quicker and more efficiently while being sustainability conscious.

Which construction sectors face the most hurdles in the move toward electrification? Alternative fuels? Automation?

Woods. I feel the industrial construction sector will face the most significant hurdle for electrification. This is due to the need for power grid evolution. The infrastructure making up the power grid today cannot sustain the demand from the push and force of electrified machines. If it isn’t difficult enough to design an electric product, powering it once in the field is even more difficult.

As for alternative fuel, I would again lean on the industrial sector as facing the greatest hurdles. This is due to a lack of economy of scale for distribution. Because of this gap, the cost for these alternative fuels will likely be high [because of] low volume (supply) while demand remains low, reducing demand for production and the evolution of distribution.

Construction sectors will see their own hurdles regarding automation. However, education, use and cost will reduce these hurdles over time. Through this, society will begin to trust automation and what it can do for society.

Is your company still experiencing fallout from the pandemic, including supply chain issues or other problems?

Crawford. The pandemic has forever changed the supply chain globally. Many companies are now reshoring their production closer to home or diversifying their supply means. Once U.S. manufacturers’ goods were much higher than Asian markets, the continued logistic challenges of getting goods to North America are starting to balance the tables. The pandemic taught us to rethink who our logistics partners are and their loyalty to us during a crisis—having a competitive rate with a true partner is vital. Container rates have dropped significantly from 2022, but the cost of goods has increased due to the increase in the price of raw materials, especially steel.

The weakness of the YEN is a benefit currently to North America, but the cost of goods and logistics quickly balances out that savings. The Japanese concept of just-in-time goods significantly impacted many sectors during the pandemic, and we continue to experience the fallout of this no-waste philosophy as there was little to no safety stock. It significantly impacted manufacturers all over the world and crippled supply chains. We continue to see delays in many commodities, from electrical components to RED DOT items. These continued delays have made us rethink what we are stocking and how to set our safety stocks based on continued disruptions in the supply chain.

How is the Industrial Internet of Things, software, and connectivity affecting your company specifically and the industry as a whole?

Wise. We feel it’s been a positive change because it forces you to be fully connected and engaged with your customers. One must learn to adapt to new technologies and business methods, which is the best lesson from working through the pandemic. For LBX, we leaned very hard on new software platforms to keep our employees engaged and productive to support our dealers and each other.

We brought on new software to help provide our dealers with the level of customer support they’ve grown to appreciate and expect [from] LBX, and it’s been a game-changer on the technical support side for them. There was a learning curve, but we adapted very quickly, and we have seen that same behavior demonstrated by our dealers, who didn’t skip a beat when meeting the ever-changing needs of their customers.

It’s also changed how we hire new talent by being flexible in our work locations, and in many instances, it’s improved productivity. We’re seeing a bunch of new and exciting technologies on our equipment that keep our operators fully connected and engaged with how the machine is performing and offer them a level of customization and automation that was unheard of just a few years ago. It’s an exciting time to be in this industry!

Do you expect the infrastructure bill to affect your business or your customers’ businesses? How, if you can explain further?

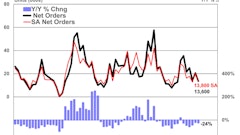

Roberts. The infrastructure bill of November 2021 touted $550 billion in new spending over the next five years. Of that, approximately 20% was to be dedicated to road and bridge work around the country. Another 20% was set aside to cover airport, port, and rail infrastructure improvements. In conversations with several dealers, most cannot pinpoint specific projects funded due to the bill. Still, that work has been steady through 2023 and appears strong regionally into 2024.

Anyone who travels via car or airplane has undoubtedly witnessed many projects upgrading existing roads, bridges, and airport facilities. In addition, pipe replacement inside major cities for water and gas seems to have benefitted from some level of appropriated funds. It isn't easy, however, to pinpoint those funds to federal spending increases. Overall, there appears to be a slight softening in the economy, but customers and dealers remain optimistic about the work environment throughout 2024.

What will be the biggest challenge in 2024 for the industry?

Wise. The challenge today with growing inventories and rising interest rates will carry into 2024. This is a significant concern as customers are doing their best to shop around for the best rate to afford new equipment to keep up with their backlog and new demand. There doesn’t seem to be much relief coming in the short term with interest rates. You combine that with an election year that always raises concerns and uncertainty in our industry, plus sitting inventory in dealer yards. You have the perfect recipe for another challenging year.

As an original equipment manufacturer, we are looking for ways to be creative and support our dealers as best we can to help them succeed even when new challenges come our way. That’s where the strength of our relationships and partnerships come into play because this isn’t the first time we’ve faced these conditions.

Are there any other insights looking toward 2024 that you’d like to share?

Wise. There is never a year without a challenge; that’s just the nature of our industry, and that continued adversity has shaped us into the brand and the company we are today.

We will be celebrating 150 years of the Link-Belt brand name in 2024. Brands don’t have that legacy and longevity without overcoming challenges and growing through the tougher times; we have done that repeatedly. Maintaining and developing our relationships with our dealers, providing a premium product, and strengthening our culture and who we are as a company will keep us relevant and growing throughout 2024 and beyond.