It appears that more contractors are looking to buy used equipment this year compared to the last five years or so. And more are also asking for late-model equipment with low hours. I wonder why? Could it be that business has recovered to the point where equipment utilization is so high that it pays to own the units? Or that rental units no longer fit their needs, are not available or are unreliable? Could it be that “deals” offered up by dealers are just too good to pass up?

Whatever the reasons, I want to remind all of you that if you plan to buy either new or used equipment, please keep your tax position in mind because Uncle Sam can provide financing in the form of tax savings that translate into improved cash flow.

What do you need to know to make intelligent decisions?

- You need to know your current tax position going into the year-end.

- You need an understanding of your current year results for tax purposes.

- You need to analyze potential equipment purchases keeping tax benefits (if any) in mind.

All of this came up when a customer wanted a late-model used unit with low hours. After comparing the selling price of the unit in question to a new unit, there was not a big difference. When bonus depreciation is brought into this particular choice, the new unit with the tax benefits “cost” a little bit more than the used unit. Take into account the warranty on the new unit, and I would have to say it is a wash when comparing new vs. used. However, it is not the cost but what it costs you that is important!

My point here is that you have a choice if your business is doing well and you find yourself in a “taxable income” situation. You can pay tax to Uncle Sam or use a portion of that tax to fund your equipment purchase. In short, you wind up with more money in your bank account generated by either a purchase of a new or used unit.

Sounds too easy, doesn’t it? But it isn’t. You just have to do your homework and keep abreast of your tax situation and cash flow.

Make sure the equipment purchase is right for you at this time. Do you have the cash flow to fund the purchase, which is most likely a 60-month commitment? Keep in mind that taxable income and cash flow mean two different things.

Know Your Tax Position Before You Buy

Making use of tax benefits is an art because the benefit can be “nice” or it can be “great.” Said another way, the higher your tax bracket, the more benefit available.

A business owner must have knowledge of what carryovers (if any) are available from prior tax years and the taxable position for the current year. After reviewing the IRS tax schedules for both corporations and individuals, it is easy to see how many business owners can find themselves in a 35% to 40% marginal rate situation.

We currently have two specific tax benefits available regarding fixed asset purchases: Sec 179 deduction and bonus depreciation. The Sec 179 deduction can be used for both new and used equipment purchases. Bonus depreciation is used for new equipment only.

The Sec 179 deduction for 2016 is limited to $500,000 as long as your total equipment purchases do not exceed $2 million. After hitting the $2 million threshold, you lose $1 of your deduction for every $1 of equipment purchased. In other words, if you have $2.5 million in equipment purchases, the Sec 179 deduction is not available for 2016.

Bonus depreciation is 50% of the cost of new equipment purchased in 2016. It does not apply to used equipment purchases.

Now you see why it is important to have a handle on your tax situation, especially if you wish to purchase a late-model unit as opposed to a new unit. Make an error in your tax assumptions and you may wind up without any special benefit as a result of the purchase. You will still get a depreciation deduction, but one over five years as opposed to an immediate benefit tied to the purchase.

Examples of How Tax Benefits Apply

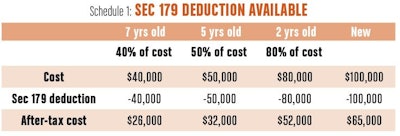

Schedule 1 compares various used equipment purchases against a new unit purchase, taking into account a 35% marginal tax bracket. I used three examples of used purchases ranging from 40% of original cost (more than seven years old) to newer units, with one at 80% of original cost (about two years old). The Sec 179 deduction can be applied to every category listed, including the new unit. Note the spread between that two-year-old unit and the new unit — about $13,000.

Schedule 2 reflects when Sec 179 is not available. The after-tax cost for the used units increases dramatically. Even the new unit has a higher after-tax cost, but the spread between the two-year-old unit and the new unit is only $9,000. Take into account the new unit warranty and the probability to finance the new unit on better terms and you really have a wash between the two-year-old unit at 80% of cost and a new unit.

Schedule 3 demonstrates how a company purchasing $800,000 of equipment could use both Sec 179 and bonus depreciation to save a considerable about of tax dollars if they find themselves in the 35% bracket.

To sum up, make sure you have the cash flow to fund an equipment purchase irrespective of potential tax benefits available. If you’re counting on getting Sec 179 or bonus depreciation benefits for 2016, make sure you are in a high enough bracket to maximize your benefits.

Don’t let the tax tail wag the dog. Make sound financial decisions.