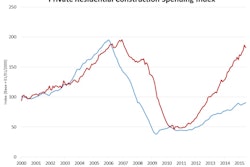

The Bureau of Economic Analysis (BEA) has just revised America’s Q2 2015 GDP growth rate significantly upwards from +2.3% to +3.7%. Consumer confidence is on the rise; durable goods orders are climbing; the price of gasoline is a bargain; and the labor market has improved to the point where analysts are wondering when tightness will lead to escalating wages.

So get a grip.

Before China became the locomotive pulling the world’s economic train, there was a juggernaut that was in many ways every bit as dominant − the U.S. economy. America is making an impressive comeback.

In today’s more interconnected world, it has been shown that the U.S. can be affected by what is going on in other countries. For example, when worldwide demand for commodities becomes too intense, the U.S. will also be caught in the vice of higher prices.

Or American banking entities that conduct business internationally can be placed in a degree of jeopardy by particular financial flare-ups in exotic locales – although higher capitalization and lower leverage have reduced that risk.

At the same time, the vast size of the U.S. domestic economy, serving nearly 320 million people, means it is not necessarily dependent for its output increase on what is occurring elsewhere.

Exports as a share of total U.S. GDP are only between 10% and 15%. In Canada, the proportion is close to 30%; in Germany, higher than 40%.

The ability of the U.S. to go it (mostly) alone has been further strengthened by a reduced dependence on foreign sources of energy.

Saudi Arabia’s gung-ho production of oil, to retain its market share, has also forced America’s new hydraulic fracturing oil and gas sector to improvise and innovate as a means to realize cost savings and lower break-even price points.

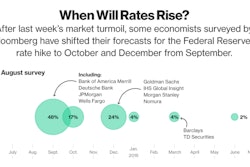

The rest of the world has rewarded the U.S. economy with a supercharged currency. Through the mechanism of lower import prices, this will keep inflation restrained and allow the Federal Reserve to maintain a fairly relaxed monetary policy, if it so wishes. (We’ll find out the Fed’s intentions after its next Open Market Committee meeting in September.)