FMI’s forecast for 2017 predicts an increase of 6% for the total value of construction put in place in the U.S. With GDP most recently reporting 2.1% growth in the fourth quarter of 2016, construction growth of 6% looks solid. Although this is a drop from the hot pace of growth from 2013 through 2015, it seems to indicate that the recovery bounce is over and more normal growth is in store for the next few years.

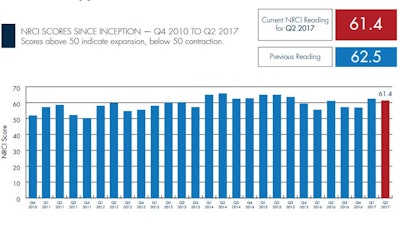

The Nonresidential Construction Index (NRCI) score for the second quarter slipped 1.1 points but remains at an optimistic 61.4. The backlog index indicates a median of 12 months, unchanged for the last three quarters, and the cost of labor index is still indicating higher costs. When labor and materials costs rise, the overall NRCI index decreases somewhat. Nonetheless, FMI points out that rising costs of labor and materials indicate that the economy is supporting these increases.

Other economic components gained or lost within a point of last quarter’s results. The areas to watch, however, are the market indices. As in the Outlook forecast, panelists expect manufacturing construction to grow solidly for the next three months to three years. Other markets are still registering positive numbers, but lodging, office and commercial construction indicate that NRCI panelists expect a sharp downturn in those markets next year, particularly for commercial and lodging construction.

Forecasts for key sectors:

- Manufacturing – Manufacturing construction growth has been subject to some sharp ups and downs in the last decade, but FMI expects growth to improve to 4% in 2017 to reach near $78.2 billion and increase to 7% in 2018. Currently, at just 75.4 for February 2017, manufacturing capacity utilization slipped 0.6% over the previous month and was just 0.2% lower than the same time last year. Increasing energy prices may spur some capacity additions in the oil and gas sector, but price increases haven’t been that stable at this point. The completion of the Panama Canal expansion project is expected to decrease costs and increase shipments from Gulf Coast ports between the U.S. and Asia.

- Lodging – At just 10% for 2017, lodging construction is expected to have its slowest year of growth since 2012 when it made a roaring comeback from negative 22% to a 19% improvement. New supply of rooms is beginning to surpass absorption rates, putting downward pressure on revenue per room and occupancy rates. The industry is also facing some new competition in the market with the rise of startups like Airbnb. Nonetheless, the hotel industry is showing solid performance as revenue per available room (RevPAR) continues a long streak of improvement. Renovation of key properties will continue to be active so that established properties can continue to attract quests looking for new services and amenities.

- Highway and Street – Highway and street construction increased just 1% in 2016 to $91.0 billion. FMI forecasts 3% growth for 2017 and another 4% in 2018. The Fixing America’s Surface Transportation (FAST) Act for highway and transportation funding removed some uncertainty for highway funding; however, we do not expect a significant jump in spending over current levels. Although much political discussion is being generated around infrastructure with highways, streets and bridges being high on the list, no real plans are in place at the federal budget level.

- Commercial – Commercial construction, especially retail, is forecast to drop to 6% in 2017 and slip lower throughout FMI’s forecast horizon of 2020. Sears and other big-box chains closing stores at an alarming rate suggest retail shopping has been disrupted, and it remains to be seen how many current retailers will survive into the next generation. Those who make a living building storefronts will need to adapt to whatever is next, and there is always something that is next.

- Office – Office construction has followed a similar recovery pattern as lodging, and FMI expects it to slow to 8% growth in 2017.

Download the full report on FMI’s Q2 2017 Nonresidential Construction Index