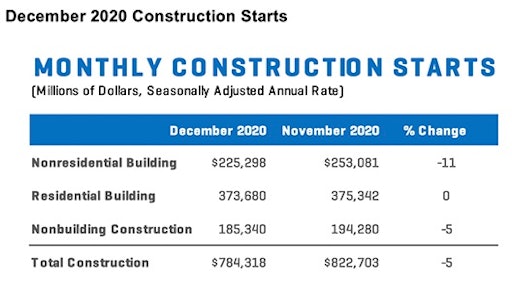

Following a 2% decline in the previous month, total construction starts again fell in December, dipping 5% to a seasonally adjusted annual rate of $784.3 billion, according to Dodge Data & Analytics. Construction starts were lower in three of the four regions in December, with the South Central region the only one to post an increase.

“We saw declines in nonresidential buildings – they were down 11% through the course of the month – as well as in nonbuilding or infrastructure construction, which was down 5%,” reports Richard Branch, chief economist for Dodge Data & Analytics. “Residential construction starts in December were essentially flat; they were down by less than one full percentage point. Multifamily construction actually posted a fairly significant increase, but single-family construction starts fell back.”

Nonresidential construction fell 5% in December to a seasonally adjusted annual rate of $185.3 billion. Highways and bridges, environmental public works and miscellaneous nonbuilding starts all saw declines. However, the utility/gas plant category jumped 70% with the start of two large power generation facilities.

The largest nonbuilding project to break ground in the month included:

- the $1.2 billion Traverse Wind Energy Center, a 999-MW wind facility spread across Blaine, Custer and Kingfisher Counties in Oklahoma

- the $1.0 billion Three Rivers Natural Gas Power Generating Energy Center in Morris, IL

- the $555 million West Lake Corridor Project, which is an 8-mile extension of the Northern Indiana Commuter District’s South Shore rail line in Dyer, IL

- a $600 million Gulf Coast Ammonia Plant in Texas City, TX

- the $341 million Orlando Health Jewett Orthopedic Hospital in Orlando, FL

- the $325 million University of Massachusetts Education and Research Building in Worcester, MA

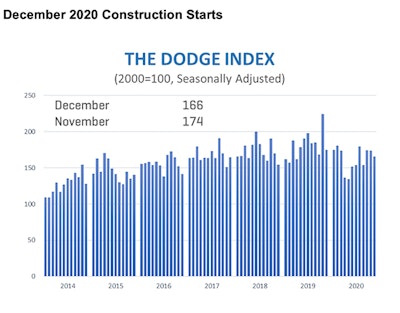

Following on the overall weakness for the month, the Dodge Index fell 5% to 166 (2000=100) from its 174 reading in November. For the full year, the Index averaged 163, a 10% decline from 2019.

Rough 2020 with Slow Recovery to Come

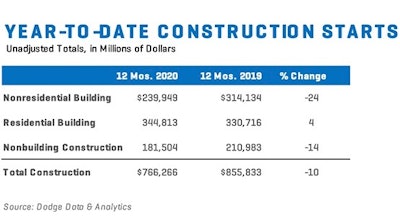

On a year-over-year basis, total construction starts fell 10% to $766.3 billion. “Not surprisingly, construction starts fell sharply over the course of the year. Total construction starts in 2020 were down 10% from 2019,” notes Branch. “The largest damage was in nonresidential buildings, which were down 24% from 2019. [We also saw] declines in the nonbuilding or infrastructure side of the market; they were down 14%. The one upside was, of course, in residential building construction, which rose 4% through the course of the calendar year [with] all of that on the single-family side of the market.”

As noted, nonresidential building starts tumbled 24% to $239.9 billion — the lowest level since 2015. Commercial starts plummeted 26% year-over-year, with warehouse construction eking out a meager 1% gain in 2020. Institutional starts fell 13% last year, while manufacturing start dropped 59%.

“The scars from the pandemic and recession will be long lasting and resulted in significant declines across most construction sectors,” Branch comments, adding, “Single-family housing, warehouse and highway and bridge starts were bright spots that cannot be understated for their gains.”

There will continue to be difficult months ahead for the economy and for construction starts as COVID-19 cases mount. However, Branch remains optimistic.

“As we move into 2021, we do expect that the economy will recover. It will move in lock step with the vaccine roll-out,” he states. “That will pull construction starts with it through the course of the calendar year. So, we are confident that we will start to see this market recover, although again it will be a long and slow road back to full recovery through the course of 2021 and beyond.”