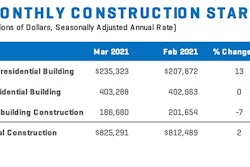

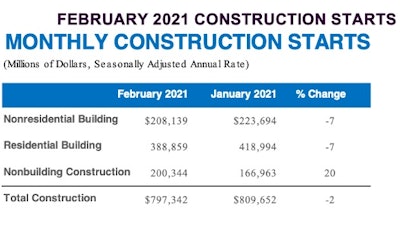

Although nonbuilding construction starts rose substantially in February, total construction starts fell 2% for the month to a seasonally adjusted annual rate of $797.3 billion, following on the heels of a 4% decline the prior month. According to Dodge Data & Analytics, while nonbuilding construction starts posted a solid 20% rebound after dipping 10% in January, residential and nonresidential building starts declined, prompting a pullback in overall activity. The Dodge Index also fell 2% in February to 169 (2000=100) from January’s 171.

In a forward-looking podcast discussion, Richard Branch, chief economist for Dodge Data & Analytics, acknowledged that the construction sector is struggling to gain traction. “On the nonresidential side, whether that be… commercial properties or schools or even infrastructure, that activity is lagging due to either an overhang in supply and growing budget gaps at the state and local level, or rising material costs,” he noted. Material costs have been accelerating rapidly over the past few months.

Yet, single-family construction and warehouse construction have continued to post solid growth over the past month, showing there are bright spots in certain market sectors. Regionally, starts fell lower in the South Central and West regions but moved higher in the Midwest, Northeast and South Atlantic Regions.

“With spring just around the corner, hope is building for a strong economic recovery fueled by the growing number of vaccinated Americans,“ said Branch in response to February’s data. “But the construction sector will be hard-pressed to take advantage of this resurgence as rapidly escalating materials prices and a supply overhang across many building sectors weigh on starts through the first half of the year."

Nonbuilding Starts

Nonbuilding construction starts rose to a seasonally adjusted annual rate of $200.3 billion for the month, with specific segments seeing substantial growth. The miscellaneous nonbuilding sector (largely pipelines and sitework) leapt 76%; environmental public works increased 26%; and highway and bridge starts moved 11% higher. Conversely, utility/gas plant starts fell 17%.

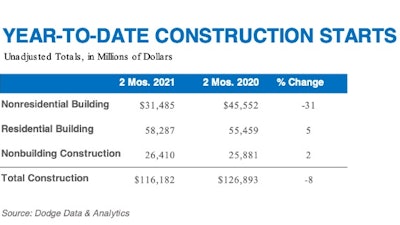

For the 12 months ending February 2021, total nonbuilding starts were 13% lower than the 12 months ending February 2020, Dodge Data reports. Highway and bridge starts rose 4%, while environmental public works were up 1%. Miscellaneous nonbuilding fell 26% and utility/gas plant starts were down 37% for the 12 months ending February 2021.

The largest nonbuilding projects to break ground in February were the:

- $2.1 billion Line 3 Replacement Program (a 337-mile pipeline in Minnesota),

- $1.2 billion Red River Water Supply Project in North Dakota

- and $950 million New England Clean Energy Connect Power Line in Maine.

Nonresidential Building Starts

Nonresidential building starts fell 7% in February to a seasonally adjusted annual rate of $208.1 billion. Institutional starts declined 8% despite a strong growth in healthcare. Warehouse starts fell back following a robust January, offsetting gains in office and hotel starts and dragging down the overall commercial sector by 8%.

For the 12 months ending February 2021, nonresidential building starts dropped 28% compared to the 12 months ending in February 2020. Commercial starts declined 30%, institutional starts were down 19% and manufacturing starts slid 58%.

The largest nonresidential building projects to break ground in February were:

- Ohio State University’s $1.2 billion Wexner Inpatient Hospital Tower in Columbus, OH,

- ApiJect Systems’ $785 million Gigafactory in Durham, NC,

- and Sterling EdgeCore’s $450 million data center in Sterling, VA.

Residential Building Starts

Both single-family and multifamily starts fell 7% in February, resulting in total residential building starts slipping 7% to a seasonally adjusted annual rate of $388.9 billion.

However, total residential starts were 4% higher for the 12 months ending February 2021 vs. the 12 months ending February 2020. Single-family starts gained 12%, while multifamily starts were down 15% on a 12-month sum basis.

The largest multifamily structures to break ground in February were:

- Bronx Point’s $349 million mixed-use development in The Bronx, NY,

- the $215 million Broadway Block mixed-use building in Long Beach, CA,

- and the $200 million GoBroome mixed-use building in New York, NY.

Information provided by Dodge Data & Analytics and edited/enhanced by Becky Schultz.