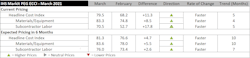

Engineering and construction costs continue their upward climb, increasing for the fifth consecutive month in March, according to IHS Markit and the Procurement Executives Group (PEG).The headline IHS Markit PEG Engineering and Construction Cost Index (ECCI) totaled 79.5 for the month, up from a reading of 68.2 in February, indicating widespread engineering and construction costs increases.

Based on data independently obtained and compiled by IHS Markit from procurement executives representing leading engineering, procurement and construction firms, the ECCI tracks industry specific trends and variations, identifying market turning points for key projects, and is intended to act as a leading indicator for wage and material inflation specific to this construction and engineering industry.

According to the March report, the materials and equipment portion reached 83.3, marking the fourth straight month of price increases and an 8.5 point increase from the prior month. The subcontractor labor index came in at 70.5, indicating labor price increases were even more widely felt than in February.

For the third consecutive month, survey participants saw increases for all categories under the materials and equipment sub-index:

- Costs of ocean freight from both Europe and Asia to the U.S. increased for the seventh consecutive month.

- The carbon steel pipe price index rose to 83.3 in March, an increase of 4.7 points from February.

- Fabricated structural steel prices rose 11.9 points from a score of 71.4 to 83.3.

- Transformer prices recorded a fourth straight month of price increases, up to 77.3 in March from 66.7 the prior month.

- Copper prices continued to increase, notching their eighth consecutive monthly gain.

“We continue to see the copper market as a richly priced one that has seen prices swing by over $800 per metric ton in the past month,” said John Mothersole, director of pricing & purchasing research, IHS Markit. Copper fundamentals are currently tight as strong Chinese consumption growth and heavy investor buying provide significant support for copper demand.

"Pandemic-related disruptions to mine production and port operations in South America have roiled the market on the supply side," he continued. "The net result has been a drawdown in visible inventory on all the major exchanges and a takeoff in prices.”

The current subcontractor labor costs sub-index was reported at 70.5 in March, a substantial climb over February’s 52.7. According to survey responses, labor costs rose in all regions of the U.S. and Canada for the month, despite significant job losses reported in the industry in February. According to U.S. Bureau of Labor Statistics, during the last 10 months, construction has added 805,000 jobs, recovering 72.3% of the jobs lost during the earlier stages of the pandemic.

Engineering and construction costs will continue their upward climb for the foreseeable future, according to ECCI survey respondents. The six-month headline expectations for future construction costs registered 81.3 in March, displaying expectations of continued price increases through the first half of 2021. Both sub-indexes reflected this sentiment, with the materials and equipment sub-index totaling 83.6 this month. The six-month expectations index for subcontractor labor rose to 76.0 in March, with costs expected to continue rising in all regions of the U.S. and Canada.

Most survey responders did not report any shortages for materials and equipment, other than shipping constraints.

To learn more about the IHS Markit PEG Engineering and Construction Cost Index or to obtain the latest published insight, please click here.

Information provided by IHS Markit and edited by Becky Schultz.