Nonresidential contractors are confident as some economic underpinnings supporting construction (construction spending, infrastructure funding) are improving, and others (inflation, materials cost) show promise heading into the end of a turbulent year.

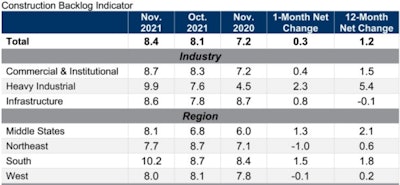

The Associated Builders and Contractors’ Construction Backlog Indicator rose 0.3 months from October to 8.4 months in November. Not surprising after October construction spending was up in 13 of the 16 nonresidential subcategories, with the commercial subcategory virtually unchanged. The reading is up 1.2 months from November 2020, after a tough 12 months for nonresidential construction spending. Associated Builders and Contractors

Associated Builders and Contractors

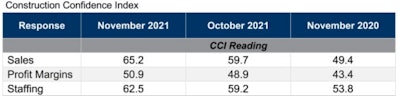

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels increased in November. All three indices – based on monthly surveys of the association’s nonresidential-contractor members – stand above the threshold of 50, indicating expectations of growth over the next six months.

“It’s getting better out there,” said ABC Chief Economist Anirban Basu. “While the outlook for construction remains imperfect, extraordinarily low interest rates have created enough appetite for deal-making to push backlog higher and persuade the average contractor that sales, employment and profit margins will climb over the next six months.

“Optimistic expectations are a testament to how strong deal flow remains in stimulus-driven America. The infrastructure package passed in November is another reason for optimism, particularly for contractors who work in segments like roads and bridges, water and sewer and mass transit.”

The Federal Highway Administration has already apportioned a historic $52.5 billion to the states for fiscal 2022 (ending September 30) as a result of the Infrastructure Investment & Jobs Act. It’s a 20% increase in resources. Surging home prices continue to fill state coffers with matching-fund potential.

“It is likely that industry circumstances will improve further in 2022,” said Basu, “Especially if supply chain disruptions and input shortages become less severe, which many economists anticipate by the second half of next year.”

Basu shared in his industry economic forecast, during a Dec. 8 webinar for ABC’s Construction Executive reported by ENR.com, that the annual inflation rate in the U.S. reached a three-decade high of 6.2% in October. While he expects inflation will likely remain high in 2022, he thinks a more hawkish Federal Reserve (see Fed signals three rate hikes for 2022 as inflation fight begins) may help limit the inflation rate to 3% to 4% next year. Associated Builders and Contractors

Associated Builders and Contractors