Associated Builders and Contractors (ABC) has published its Construction Backlog and Construction Confidence reports for June and both have taken a dip.

The ABC construction Backlog Indicator fell to 0.1 months in June to 8.9 months, according to surveys conducted from June 21 to July 5. ABC says that reading is up from a year ago, by 0.4 months.

“Several months ago, there was conjecture that contractors were generally too upbeat regarding their collective future,” said ABC Chief Economist Anirban Basu. “Increasingly, the data suggest that they were. At the time, many contractors reported surging backlog and an ability to pass along hefty cost increases to project owners. For months, contractors expected sales, employment and margins to expand. The most recent ABC survey indicates that, to secure work and to induce project starts, a growing fraction of contractors is having to trim margins.

Associated Builders and Contractors

Associated Builders and Contractors

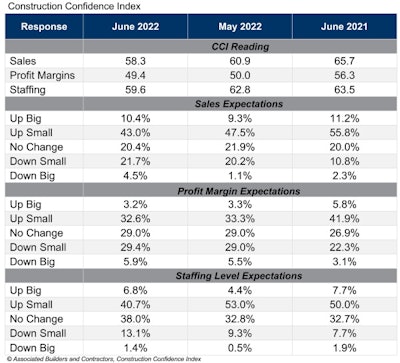

The ABC Construction Confidence Index readings for sales, profit margins and staffing levels declined in June. The indices for sales and staffing remain above the threshold of 50, indicating expectations of growth over the next six months, while the reading for profit margins fell below the threshold of 50 for the first time since October 2021.

“While circumstances are hardly catastrophic, the nonresidential construction marketplace is not as strong as it was expected to be,” said Basu. “Many factors are involved, including materials prices that have remained stubbornly elevated and construction skills shortages that have refused to dissipate."

Associated Builders and Contractors

Associated Builders and Contractors

“In the context of rising fears of recession and rising borrowing costs, the stage has been set for softer nonresidential construction activity going forward," said Basu. "That said, public contractors can expect to remain busy in the context of a significant infrastructure spending package. Still, the market may not prove as robust as anticipated given delayed project start dates as public agencies determine the right moment to purchase construction services. Despite all of these considerations, contractors continue to expect industry sales and employment to expand over the next six months.”