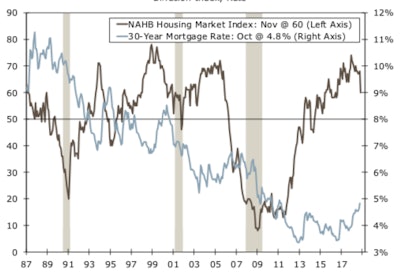

Growing affordability concerns resulted in builder confidence in the market for newly-built single-family homes falling eight points to a level of 60 in November on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). In fact, according to Wells Fargo Securities, builder confidnece took its biggest tumble in nearly five years as virtually every metric of builder confidence measured dropped for the month of November.

Wells Fargo Securities

Wells Fargo Securities

For the past several years, shortages of labor and lots along with rising regulatory costs have led to a slow recovery in single-family construction. While home price growth accommodated increasing construction costs during this period, rising mortgage interest rates in recent months coupled with the cumulative run-up in pricing has caused housing demand to stall. As a consequence, builders have adopted a more cautious approach to market conditions.

The decline of builder confidence should be noted by policymakers. Recent statements on economic conditions have lacked commentary on housing, even as housing affordability has hit a 10-year low. Given that housing leads the economy, policymakers need to focus more on residential market conditions.

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

Wells Fargo Securities

Wells Fargo Securities

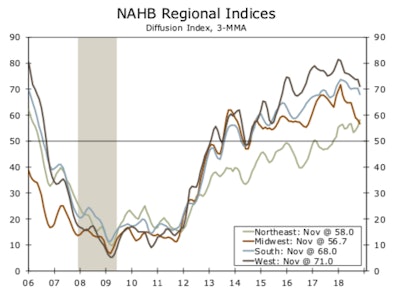

Looking at the three-month moving averages for regional HMI scores, the Northeast rose two points to 58. The Midwest edged one point lower to 57, the South declined two points to 68 and the West dropped three points to 71.

The HMI tables can be found at nahb.org/hmi