The Equipment Leasing and Finance Association (ELFA), which represents the nearly $1 trillion equipment finance sector, has revealed its Top 10 Equipment Acquisition Trends for 2020. Given U.S. businesses, nonprofits and government agencies are expected to spend $1.91 trillion in capital goods or fixed business investment (including software) this year, financing a majority of those assets, these trends impact a significant portion of the U.S. economy.

“Equipment acquisition drives supply chains across all U.S. manufacturing and service sectors. Nearly 80% of U.S. businesses use equipment leasing and financing to acquire the productive assets they need to operate and grow," said Ralph Petta, ELFA president and CEO. "We are pleased to again provide the Top 10 Equipment Acquisition Trends to help businesses understand the market environment and make their strategic equipment acquisition plans.”

ELFA distilled recent research data, including the Equipment Leasing & Finance Foundation’s 2020 Equipment Leasing & Finance U.S. Economic Outlook, industry participants’ expertise and member input from ELFA meetings and conferences, in compiling the trends.

The forecast includes the following:

1. Steady tailwinds will support modest economic growth

The strongest labor market in a generation and healthy consumer spending kept the U.S. economy growing in 2019. These factors appear to be well positioned to continue the trend this year and should insulate the broader economy.

In addition, a recession doesn’t appear to be likely for at least the first half of 2020. This is also good news for businesses seeking financing to acquire equipment since a healthy economy promotes a favorable environment for the equipment leasing and finance industry. Equipment Leasing and Finance Association (ELFA)

Equipment Leasing and Finance Association (ELFA)

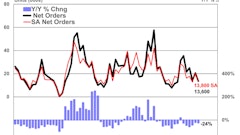

2. Capital spending will slow but remain in positive territory

Equipment and software investment growth has dragged since Q2 2019, largely due to a slowdown in the industrial sector and trade tensions that dampened business confidence. Although credit markets remain healthy and financial stress is muted, the forecast for equipment and software investment is 1.1 percent growth this year.

3. Low interest rates will be beneficial for business borrowing

A low interest rate environment will continue with the possibility of additional rate cuts by the Fed in the face of economic weakness this year. Equipment financing will remain an attractive acquisition strategy as businesses take advantage of low fixed rates combined with flexibility and other financing benefits.

4. A vast majority of U.S. businesses will acquire equipment through financing

The latest industry data show nearly eight out of 10 U.S businesses—79 percent—use at least one form of financing for their equipment acquisitions, with leasing being the most used method.

5. Trade issues will weigh on business investment decisions

Businesses will keep abreast of trade issues with their potential to help or hinder the U.S. and global economic outlook. The ongoing U.S.-China trade war, the passage of the United States-Mexico-Canada Agreement (USMCA), and a growth slowdown among key trading partners will be closely watched.

6. Many key equipment verticals should show improvement in investment growth

Despite the U.S. manufacturing sector creating a weak jumping off point for the U.S. economy and the equipment industry, a number of equipment verticals will improve or grow modestly in 2020. Software should remain strong while agriculture, construction, medical, materials handling and other industrial equipment should strengthen.

7. Technological innovations will make acquiring equipment more attractive to businesses

This year end-users who invest in capital assets for their businesses will benefit not only from the most up-to-date equipment, but will also find new, enhanced technologies and processes that make financing transactions easier and faster. Tools for credit analysis and decision making within seconds, more efficient asset tracking and e-documents are among the customer-centric innovations businesses can expect from their financing partners.

8. Smaller businesses and nonprofits will work to complete their accounting processes for leased equipment

A one-year delay in the effective date of the new lease accounting standard, ASC 842, for certain private companies, nonprofits and tax-exempt organizations will give them additional time to meet requirements for compliance as they continue to benefit from leasing. They’ll review lease contracts, implement software, consult with auditors and look to public companies as examples for implementing the new lease accounting rules.

Read more: Small Businesses Must Make the Most of the Delay in Lease Accounting Changes

9. Uncertainty around U.S. elections will impact equipment investment decisions

The results of the November elections have the potential for major implications on U.S. policymaking. As a result, some businesses will take a wait-and-see approach before “pulling the trigger” on new equipment acquisitions.

10. “Wild cards” will factor in business investment decisions

In addition to the trends above, there are additional areas businesses will keep an eye on for the potential to impact their equipment acquisition strategies. Business confidence is increasingly being tempered by slowing domestic and international manufacturing sectors. The U.S. political climate continues to be mired down by a largely partisan Congress. Geopolitical instability may also factor into equipment investment decisions by businesses.

On the plus side, the economy could get a boost from the housing sector, which appears to be rebounding after a two-year downturn. Credit market conditions remain broadly healthy and financial stress remains subdued by historical standards.