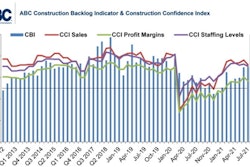

July’s drop in U.S. housing starts outstripped forecast declines as consumer sentiment toward financed purchases faded to the lowest level since 2011. Of course, connection between those two economic measures is not direct, but the coincidence is interesting.

Click on this graph to enlarge it.data: US Department of Commerce; graph: ForConstructionPros.com

Click on this graph to enlarge it.data: US Department of Commerce; graph: ForConstructionPros.com

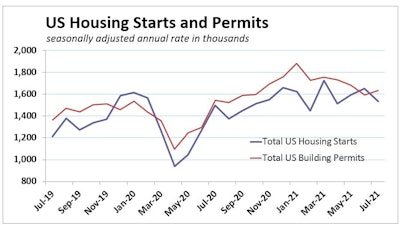

July’s 7.0% starts plunge stings less when you recognize that the numbers for previous months were revised higher, that July building permits rose 2.6% after three months of declines, and that U.S. home builders have maintained a monthly average pace of starts that would reach nearly 1.6 million homes in 2021. Should that pace continue, this will be the best year for housing starts since 2006.

How low might home demand go?

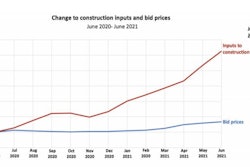

Builder confidence fell five points to 75 in August, a 13-month low after peaking at 90 in November, according to the NAHB/Wells Fargo Housing Market Index. Builders report growing concerns over increasing lumber and other construction costs, as well as delays in obtaining building materials.

Dramatic materials-supply and labor shortages and are forcing home builders to manage their project workflows much more carefully than ever before, though, and that has slowed prospective home-buyer traffic in a couple of ways.

First, builders have fewer homes to show prospective buyers. And second, skyrocketing home prices fueled by supply issues are beginning to run into falling consumer purchase sentiment.

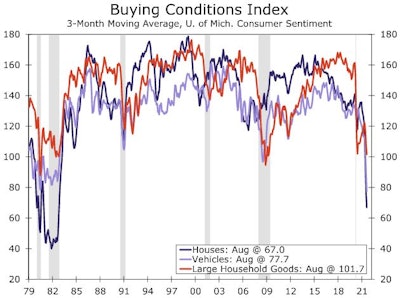

With inflation rising, and with resurging COVID-19 infections threatening the economic recovery, the University of Michigan's consumer sentiment index is at its lowest point since 2011. That could explain some of the decline in prospective-home-buyer traffic.

Buying attitudes toward financed big-ticket purchases such as homes, cars, furniture and appliances asked about in the Michigan sentiment research have been trending down since the start of the year. Scarcity has hit the housing market, too, and home buying attitudes revealed in the detail of the Michigan sentiment index have dropped to an almost 40-year low.

Wells Fargo Economics’ analysis of recent July consumer confidence data states: “Price is unequivocally the culprit for declining interest in new purchases. The proportion of consumers citing ‘high prices’ as the reason it is a bad time to buy a home or an automobile has jumped to the highest level since 1978.”

“While housing starts fell more than expected, most forecasters, including ourselves, were looking for a decline in July,” says Mark Vitner, senior economist with Wells Fargo Securities. “There is no question that home building has hit some sort of near-term ceiling, with surging home prices reducing affordability and leading to a record drop in the proportion of consumers that feel now is a good time to buy a home.”

There is a multifamily rebound

Click on this graph to enlarge it.data: US Department of Commerce; graph: ForConstructionPros.com

Click on this graph to enlarge it.data: US Department of Commerce; graph: ForConstructionPros.com

“We recently reduced our forecast slightly for single-family starts in 2021 and 2022, but we still expect single-family starts to easily surpass one million units in both years,” says Vitner.

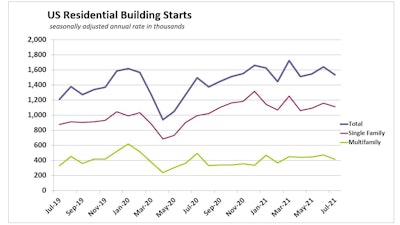

Surging home prices and single-family starts growth in the first half of the year has kept attention turned toward single-family homes, but the apartment market has regained considerable momentum too. Leasing picked up sharply during the first half of this year and rents have taken off.

“The bounce-back in apartment demand was swifter than expected and has cleared up some of the questions about whether young people would return to urban centers again – they have,” says Vitner. “The real surprise has been the bounce-back in some of the hardest hit urban areas, including New York City and San Francisco.”

While rents have moderated in some higher-priced markets, they are rising rapidly in many of the Sunbelt markets, like Phoenix, Dallas and Atlanta, which are attracting lots of migrants from higher costs cities.

“There is a tremendous growth opportunity for more affordable apartment developments today, although delivering that product is more challenging amidst higher building material prices and higher labor costs,” Vitner points out. “We recently boosted our forecast for multifamily starts for this year and next, based on the recent strong absorption numbers and rise in apartment rents.”

University of Michigan and Wells Fargo Securities

University of Michigan and Wells Fargo Securities