Customer value is the profit they generate for your business in the current year. If you can track materials used, labor hours and equipment costs for particular sites over the course of the season, you should be able to calculate the expenses attributable to the client.

This article was originally published by the Snow and Ice Management Association (SIMA)

I have often wondered why some businesses treat prospective clients better than their current clients. If you calculate the true cost of acquiring a new client, you may potentially spend hundreds or even thousands of dollars to bring a new client into your business. Is your prospective client worth the investment?

How do you decide how much to invest in both retaining existing clients and selling to prospects, and how do you decide which clients provide you with the best return on your investment? There are precise models and methods that more sophisticated businesses with more resources may use to determine the value of their clients. For smaller businesses, it’s important that we keep it simple and at a low cost. Create a methodology that works for you and track it consistently so you can see trends.

How do you decide how much to invest in both retaining existing clients and selling to prospects, and how do you decide which clients provide you with the best return on your investment? There are precise models and methods that more sophisticated businesses with more resources may use to determine the value of their clients. For smaller businesses, it’s important that we keep it simple and at a low cost. Create a methodology that works for you and track it consistently so you can see trends.

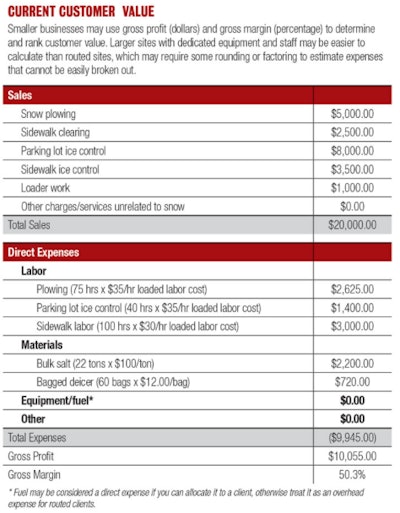

Current customer value

Customer value is the profit they generate for your business in the current year. Most small businesses don’t have the systems or administrative capacity to calculate net profit by customer. Instead, you may choose to roughly calculate gross margin per client, which equals revenue less direct expenses. If you can track materials used, labor hours and equipment costs for particular sites over the course of the season, you should be able to calculate the expenses attributable to the client.

Rate your clients by both gross margin (percentage) and gross profit (actual dollars). You may also factor in special costs that may be required to service the customer, which might be categorized as overhead but can be directly attributed to a particular client. As well, you may require specialty equipment that adds a cost to carrying a particular client.

Rate your clients by both gross margin (percentage) and gross profit (actual dollars). You may also factor in special costs that may be required to service the customer, which might be categorized as overhead but can be directly attributed to a particular client. As well, you may require specialty equipment that adds a cost to carrying a particular client.

Frequency of service

Clients that have low tolerance for snow and ice accumulation will require more service, and thus their contract values will be higher than clients requiring more basic services. The lower the tolerance the more you will work. Assuming you have the capacity and means to service these types of clients, meeting their demands may be worth the investment.

Just because a client only needs basic plowing service and may not be a high gross profit customer, it doesn’t mean they may not have higher margins, which can justify keeping them on the books if it doesn’t distract from your higher margin clients. Filling in the route with higher margin service work is better than no work at all.

Just because a client only needs basic plowing service and may not be a high gross profit customer, it doesn’t mean they may not have higher margins, which can justify keeping them on the books if it doesn’t distract from your higher margin clients. Filling in the route with higher margin service work is better than no work at all.

Repeat sales

A returning client adds value each year. Depending on the sales process, you may have more or less expense to re-sign them. Multi-year agreements — if you can sign them — allow you to plan your operations further in advance and become more efficient. You can become more competitive on pricing and still potentially increase the margin for the multi-year client.

Multiple lines of business

If you offer more than snow services and your clients buy other service lines, your revenue has the potential to expand. The gross margin will likely vary between the lines of business; but if they are profitable overall, even with lower margin work they are still contributing more to your overall gross profit.

Selling multiple lines is a two-edged sword. Increased sales are attractive, but if your lower-margin service strains the relationship and puts your higher-margin work at risk, you will need to invest more in your lower-margin service to protect your relationship, which cuts into your profit. Decide what services you should offer and whether it will strengthen the relationships with your clients.

Selling multiple lines is a two-edged sword. Increased sales are attractive, but if your lower-margin service strains the relationship and puts your higher-margin work at risk, you will need to invest more in your lower-margin service to protect your relationship, which cuts into your profit. Decide what services you should offer and whether it will strengthen the relationships with your clients.

Increased sales due to expansion

A client is more attractive if they are growing and expanding, either increasing the scope or size of the work at the current site or adding sites that you can add to your portfolio. Assuming the additional sites fit into your service mix and routing, it can be a real win. If your clients’ needs extend beyond your geographic comfort zone, consider partnering with other qualified service providers that may provide you with geographic reach so you can still service the client without stretching yourself too thin.

Cash flow and payment timing

Evaluate how long it takes your customer to pay their invoices. Many accounting software packages provide this data so you can easily see the average number of days it takes for you to get paid. A client increases their value when they pay quickly, helping to finance your operations. Having large and profitable clients on the books can be great for business, but if your cash flow suffers because they take 60 to 90 days to pay, you will have to float the direct expenses plus overhead until you get paid.

Referrals

You may have clients that are influencers either in their industry or community and can introduce you to prospective clients. Referrals reduce your selling cost and improve your overall margins. Often, referral clients are looking to make a change from a current provider because they’re not satisfied and price may be less of an issue, allowing you to bill closer to a retail rate.

Similarly, working for property managers that leave their current employer and begin at a new company works as a direct referral into the new business. Just because the relationship with a property manager at their current company isn’t as productive as you would like, the relationship may have value if they take you into a new place of business.

Similarly, working for property managers that leave their current employer and begin at a new company works as a direct referral into the new business. Just because the relationship with a property manager at their current company isn’t as productive as you would like, the relationship may have value if they take you into a new place of business.

Cost to acquire a customer

Selling new business can be expensive. Marketing and advertising expenses help get your name in front of prospects and clients to reinforce your brand and make soliciting new business potentially easier. The investment of time in communication, follow-up, site and bid meetings, and developing or improving a relationship all adds up. You may also have out-of-pocket costs to travel to see a client or court them through events or associations that you need to belong to in order to be in the same space. Some clients require a longer sales cycle. If you anticipate signing a three- or five-year contract, plan to have a three- to five-year sales cycle to win the business.

When you factor in all of your selling costs, including labor, and divide the total cost by the number of new clients you add each year, you can determine the average cost per client acquisition.

When you factor in all of your selling costs, including labor, and divide the total cost by the number of new clients you add each year, you can determine the average cost per client acquisition.

Lifetime value

After ranking your clients based on gross profit and gross margin, score the other aspects of your relationship:

- Are they currently and likely to continue to be multi-year clients?

- Do they provide you with referrals?

- How quickly do they pay?

- Are they expanding and are you likely to add new work as a result?

- How needy are they?

- Do they require special services that consume additional resources?

The only true dollar value you may have is the gross profit that you generate each year. It’s more difficult to assign a value to the other considerations. Estimate how long your client is likely to be with you and apply the gross profit factor for the period.

The results of your research and calculations will help you make better decisions about where to invest your time and resources in customer acquisition and retention. Keep your process simple and easy to replicate. Having access to objective data about your client’s value will prevent you from making a rash decision. Instincts are good, but they can get you in trouble if you decide to begin firing clients that may actually be more beneficial to your business than you realize. Likewise, you may not realize the opportunities you’re missing to pursue more valuable clients.

The results of your research and calculations will help you make better decisions about where to invest your time and resources in customer acquisition and retention. Keep your process simple and easy to replicate. Having access to objective data about your client’s value will prevent you from making a rash decision. Instincts are good, but they can get you in trouble if you decide to begin firing clients that may actually be more beneficial to your business than you realize. Likewise, you may not realize the opportunities you’re missing to pursue more valuable clients.

Douglas Freer, CSP, owns Blue Moose Snow Co. in Cleveland. Contact him at [email protected].

Interested in subscribing to SIMA's magazine?