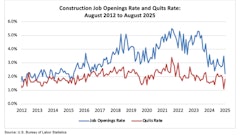

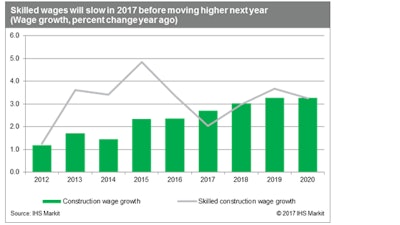

Wages for skilled US workers are coming in weaker than expected for 2017. IHS Markit now expects 2.0% annualized growth compared with our previous estimate of 3.5% growth. This lull in wage growth will be temporary and skilled wages will accelerate through 2020.

US wage growth for skilled workers slowed slightly in 2017 after four consecutive years of strong wage increases. Indeed, skilled construction workers have seen their wages rise more than 16% over the past four years, more than double the industry average. A moderation in construction activity over 2017 has taken some of the heat off, but fundamentals remain tight and we expect skilled workers to continue to experience above-average wage growth, with wages averaging above 3% growth through 2020. IHS Markit does not expect a US infrastructure package, but reconstruction efforts following hurricanes Harvey and Irma will help boost wages in the Gulf Coast and Southeast over the next three years.

What to watch

Gulf Coast: Skilled workers will see wage growth pick up as reconstruction efforts after Hurricane Harvey exacerbate already tight labor markets. Annual wage growth for skilled workers will average 3.6% between 2017 and 2020.

- Local labor market conditions: Hurricane Harvey will exacerbate shortages for construction workers. While we expect the initial impact to be on lower-skilled occupations like carpenters, drywall, and flooring contractors, skilled occupations like residential pipefitters and electricians will experience a surge in demand. Shortages will be worst in the Houston area, although the surrounding area may also be affected as strong demand pulls on local markets.

- Construction spending outlook: Construction spending will temporarily fall as reconstruction focuses on debris clearing. Expect spending to accelerate over the fourth quarter and into 2018 and beyond. Current estimates place the damage done by Harvey in the $60–100 billion range, with estimates of damaged homes ranging from 80,000 to 200,000. Limited availability of workers may constrain reconstruction efforts.

- Construction employment growth: Construction employment growth in the region will jump in the fourth quarter and surge over 2018. While the most recent outlook for employment has not yet taken into account the effects of reconstruction, it is likely that construction employment in Texas will jump by double digits next year.

- Skilled wage outlook: Skilled wage growth will average 3.6% between 2017 and 2020. Welders will experience the strongest average wage growth of 3.9% as existing shortages are exacerbated by demand from infrastructure and industrial reconstruction as well as improving upstream oil and gas activity. Electricians will experience 3.6% wage growth over the same period, followed by pipefitters (3.5%) and boilermaker (3.3%).

Pacific Northwest: Strong residential and nonresidential spending is supporting wage growth in the region. Skilled construction wages will grow an average of 3.2% annually between 2017 and 2020.

- Local labor market conditions: Labor markets have tightened in the Pacific Northwest, with unemployment in the region averaging 4.6% in 2017. Idaho and Oregon both have unemployment rates below 4.0%, while unemployment in Washington remains slightly elevated at 4.7%.

- Construction spending outlook: Strong investment in commercial, multifamily, and manufacturing construction has helped tighten labor markets and push wages higher. Construction activity will continue to expand through 2018 and then begin to slow due to a pullback of investment in residential spending. Infrastructure will remain a weak positive, growing an average of 1% over the next five years.

- Construction employment growth: Construction employment in the region has been robust, growing an average of nearly 7% per year over the past five years. Employment in the industry remains below pre-recession levels, with many of these workers having either retired or found jobs in other industries. Recruiting workers will be a challenge for the region, particularly in Oregon where more than 30% of the state is over the age of 55.

- Skilled wage outlook: Skilled wage growth will average 3.5% between 2017 and 2020. Welders will experience the strongest wage growth at 3.6% over this period, followed by electricians (3.2%), boilermakers (3.0%), and pipefitters (2.9%).

West North Central: Skilled wage growth will average 3.2% annually between 2017 and 2020. Tight labor markets will support wage growth over the next two years despite slowing construction spending.

- Local labor market conditions: The West North Central has some of the tightest labor markets due to low population density and aging demographics. The unemployment rate in this region will average 3.4% in 2017 and will fall to 3.2% in 2018.

- Construction spending outlook: Construction activity has been bolstered by the nonresidential sector, which accounts for 75% of construction spending and has supported labor demand for skilled trades. Construction spending in this sector will be flat through 2018 before declining in 2019 and beyond.

- Construction employment growth: Construction employment growth averaged 4.0% between 2012 and 2016, but weaker spending will result in weaker labor demand going forward, partially offsetting labor market pressure on wages.

- Skilled wage outlook: Skilled wages will average 3.2% growth between 2017 and 2020. Welders will experience the strongest wage growth at 3.8%, followed by boilermakers (3.3%), electricians (3.0%), and pipefitters (2.6%).

West Coast: Skilled wage growth on the West Coast will average 3.1% annually between 2017 and 2020. Strong residential and infrastructure spending are helping to tighten markets.

- Local labor market conditions: Labor market conditions on the West Coast have lagged behind the rest of the country but are showing signs of tightening. The unemployment rate in the region has fallen to 4.3%, in line with the national average.

- Construction spending outlook: Construction spending growth will continue to outpace the rest of the United States through 2018. Residential, nonresidential, and infrastructure spending are all contributing to the construction rebound in the region. An increase in the gasoline tax in California will help fund infrastructure projects in the state going forward, keeping markets for heavy and civil engineers tight.

- Construction employment outlook: The construction industry is experiencing the fastest employment growth in this region, outpacing the rest of the United States. Construction employment will grow an average of 4% over the next five years, bolstered by improving activity.

- Skilled wage outlook: Skilled wage gains will average 3.1% between 2017 and 2020. Electricians will experience the strongest wage growth of 3.3% followed by welders (3.2%), boilermakers (2.9%), and pipefitters (2.9%). Unskilled workers will also face strong wage pressure due to rising minimum wages in the region. California is currently targeting a minimum wage of $15/hour by 2022.

Mountain: Skilled wage growth in the Mountain region will average 3.0% annually between 2017 and 2020. Tight labor markets will continue to support wage growth despite flattening construction activity.

- Local labor market conditions: Labor markets in the Mountain region are the tightest in the United States with unemployment averaging a low of 3.2%. A lull in natural resource activity has weakened demand for skilled workers in the mining industry. Slowing residential spending is also taking some of the pressure off of wages, though markets will remain relatively tight over the next two years.

- Construction spending outlook: Postrecovery construction spending will peak in 2017 and begin to move lower over the next 10 years. A pullback in nonresidential spending will lead the retreat. Commercial spending is expected to slow alongside industrial spending. The residential market will offer little support and will maintain current levels of spending.

- Construction employment outlook: Improving activity in oil and gas will help boost employment growth in 2019 and 2020, more than offsetting declines in commercial and industrial construction sectors. Beyond 2020 construction employment growth will slow to the 2% range, helping take pressure off of wages.

- Skilled wage outlook: Skilled wages will average 3.0% growth between 2017 and 2020. Electricians will experience the strongest wage growth at 3.3%, followed by boilermakers (3.0%), pipefitters (2.9%), and welders (2.8%).

Midwest: Skilled wage growth in the Midwest will average 3.0% annually between 2017 and 2020. Demographics rather than demand will keep construction markets tight.

- Local labor market conditions: Labor market tightness varies across the Midwest—Indiana, Minnesota, and Wisconsin have the tightest labor markets with unemployment below 4%, while employment rates in Ohio and Illinois are closer to 5%. Michigan is tracking the national average. Looking forward, an aging population and a declining prime working age population will tighten labor markets.

- Construction spending outlook: A declining prime working age population will weigh on the residential sector. Post-recession residential spending peaked in 2016 and will gradually move lower over the next decade. The nonresidential and infrastructure sectors will also show lackluster growth; improving local finances will provide a temporary boost to infrastructure spending through 2018.

- Construction employment outlook: Construction employment growth in the region will be lackluster, growing an average of 2% per year over the next five years. Weak demand and a tightening labor force will keep costs high but demand low, weighing on payroll growth.

- Skilled wage outlook: Skilled wages will average 3.0% growth between 2017 and 2020. Boilermakers will experience the strongest growth at 3.6%, followed by electricians (2.9%), pipefitters (2.8%), and welders (2.6%).

Middle Atlantic: Skilled wage growth in the Middle Atlantic will average 2.9% growth annually between 2017 and 2020. Wage growth stalled in 2017 as weakness in the nonresidential and infrastructure sectors offset strong growth in residential construction. Looking forward, infrastructure spending will support stronger wage growth in 2018 and 2019.

- Local labor market conditions: Labor markets in the Middle Atlantic vary by state. While Virginia has one of the tightest labor markets with unemployment at 3.8%, West Virginia and Pennsylvania have unemployment rates closer to 5.0%.

- Construction spending outlook: The rebound in construction activity in the region has been less robust than in the rest of the country—but the Middle Atlantic also did not see as much of a dive as other regions. Construction spending is currently 15% below pre-recession levels with growth expected to be relatively flat through 2020.

- Construction employment outlook: Construction employment will accelerate slightly in 2018 and 2019 before slowing to sub-2% annual growth. An uptick in infrastructure spending in 2018 and 2019 will help fuel job creation while other sectors remain relatively flat.

- Skilled wage outlook: Skilled wages will average 2.9% growth between 2017 and 2020. Boilermakers will experience the strongest average growth at 3.2%, followed by welders (3.0%), electricians (2.7%), and pipefitters (2.7%).

Southeast: Skilled wage growth in the Southeast will average 2.8% growth annually between 2017 and 2020. Reconstruction around the Gulf Coast will support wages in 2018 and 2019 after sluggish growth in 2017.

- Local labor market conditions: The unemployment rate in the Southeast is slightly higher than the US average. Labor markets are tightest in South Carolina, Tennessee, and Florida where unemployment rates are either close to or below the national average. Conditions are less tight in Alabama, Mississippi, Kentucky, and Georgia where unemployment rates are closer to 5%.

- Construction spending outlook: Residential construction spending will receive a slight boost from reconstruction and repairs following Hurricane Irma. Overall the construction outlook for the region is relatively subdued.

- Construction employment outlook: Construction employment will grow in the 3-4% range over the next four years, bolstered by reconstruction. Nevertheless, overall employment levels will remain below pre-recession peaks until 2026.

- Skilled wage outlook: Skilled wages will average 2.8% growth between 2017 and 2020. Electricians will experience the strongest average growth at 3.2%, followed by pipefitters (2.9%), boilermakers (2.7%), and welders (2.3%). Welder wage growth was robust in 2014 and 2015, but subdued in the last two years. However, expect wage growth to return in 2018.

New England: Skilled wages in New England will average 2.6% annual growth between 2017 and 2020.

- Local labor market conditions: Labor markets in New England are tight across the board. New Hampshire, Maine, and Vermont have the tightest labor markets with unemployment in the 3% range. Unemployment in Massachusetts, Rhode Island, and Connecticut are closer to the national average. Labor markets in New England are aging quickly; 15% of New Hampshire's population will reach retirement age over the next 10 years.

- Construction spending outlook: The construction spending outlook in New England is flat through 2019 and will decline from 2020 onward. All major construction sectors will be subdued, although medical and education building will continue to see growth.

- Construction employment outlook: Construction employment in New England will outpace construction spending growth. Companies in the region will continue to hire to relieve an understaffed workforce. Employment growth will flatten beyond 2020.

- Skilled wage outlook: Skilled wages will average 2.6% growth between 2017 and 2020. Boilermakers will experience the strongest annual wage growth at 2.9% followed by electricians (2.7%), pipefitters (2.5%), and welders (2.2%).

New York/New Jersey: Skilled wage growth in NY/NJ will average 2.6% annual wage growth between 2017 and 2020. Weak demand will keep wage growth below the national average.

- Local labor market conditions: Labor markets in NY/NJ are slightly tighter than average. The unemployment rate in New Jersey will average 4.2% in 2017, down significantly from 5.0% in 2016.

- Construction spending outlook: The construction market is experiencing a downturn due to a heavy correction in residential spending and declining infrastructure activity. Total construction spending will fall an average of 3.4% per year between 2017 and 2020, the worst regional performer.

- Construction employment outlook: Employment growth in the construction industry will drop from an average growth rate above 4% between 2013 and 2016 to an average growth rate of 1%.

- Skilled wage outlook: Skilled wages will average 2.6% growth between 2017 and 2020. Electricians will experience the strongest wage growth, at 3.3%, due to local shortages. Boilermakers will experience 2.6% annual growth over the same period followed by pipefitters (2.5%) and welders (2.3%).

![Fcp Racatac Chair 10893876[1]](https://img.forconstructionpros.com/mindful/acbm/workspaces/default/uploads/2025/10/fcp-racatac-chair-108938761.10l0At5WXv.png?auto=format%2Ccompress&bg=fff&fill-color=fff&fit=fill&h=100&q=70&w=100)

![Fcp Racatac Chair 10893876[1]](https://img.forconstructionpros.com/mindful/acbm/workspaces/default/uploads/2025/10/fcp-racatac-chair-108938761.10l0At5WXv.png?ar=16%3A9&auto=format%2Ccompress&bg=fff&fill-color=fff&fit=fill&h=135&q=70&w=240)