On September 1, 2011, the American Road & Transportation Builders Association (ARTBA) briefed the media on the Highway/Transit Bill status and how the Stimulus Act's transportation investments have effected the highway and bridge industry. Here is a summary of the briefing:

Highway/Transit Bill Status

Both the Senate and the House have discussed different Highway/Transit bill options. The Senate is considering a two-year, $109 billion bill, according to Dave Bauer, senior vice president of government relations at ARTBA. This bill would maintain the current level of investment which would require the Senate to find the dollars to support this level of investment over that two year period.

The House is considering a six-year, $230 billion bill, Bauer says. The House is focusing on a multi-year bill consistent with what incoming highway trust fund revenues can support. Bauer says in the first year of the bill this would result in a 34% to 35% reduction from current levels of investment. Investment would grow the other years but not reach what it has been.

While there has been a lot of focus on what is different between the two bills, Bauer says we should not overlook the similarities. Both bills have similar structures including program consolidation, excluding earmarks and emphasizing state flexibility. They both also propose policy reform areas such as accelerating project delivery and establishing performance standards, Bauer says. And both bills look to leverage private resources.

Stimulus Affect

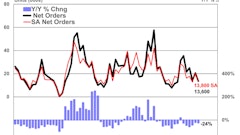

Alison Premo Black, vice president of policy and senior economist for ARTBA, summarized the effect of the stimulus on the highway and bridge market. In 2010, at the peak of the stimulus, funds supported 320,000 jobs - 108,000 on construction jobsites - Black said.

However, the stimulus was more of a "job saver" not a creator because states and local governments still pulled back on the amount of work they let out. And the stimulus focused more on "shovel ready" short-term projects. Black points out that the stimulus support was still crucial to the market over the last two years. However, the highway and bridge market only grew by $1.3 billion between 2008 and 2010, a relatively small chunk of the stimulus pie.

According to Black, the 2011 market is on track for a drop of over 12% as far as the amount of work going on. However, not all states have been cutting their programs.

Black presented to model outlooks of overall spending levels through 2013. If federal aid remains static, she says they could be a modest economic recovery for 2012 and 2013. If the federal program is funded by levels of investment it can currently support, Black predicts work will continue to decrease as money is spent out. In another scenario, Black says if investment levels are adjusted for inflation there is a possibility for a slight market gain. She still sees the focus on short-term projects remaining dominant in the market.

Black and Bauer both reminded the webinar audience that at this time it is hard to predict what will happen with the highway/transit bill and the market in the near future.