Total construction spending totaled $884 billion in June, down 0.6 percent from May but up 3.3 percent over June 2012's level. June is typically a growth month for construction, but residential building paused in its recovery, while private nonresidential and public construction also declined.

"New single-family and multifamily construction both had rare slowdowns in June, while private nonresidential construction remained stuck in neutral as it has all year and the long slump in public construction worsened," said Ken Simonson, AGC's chief economist. "For the rest of 2013, private construction appears likely to grow again but public spending is showing no signs of a recovery."

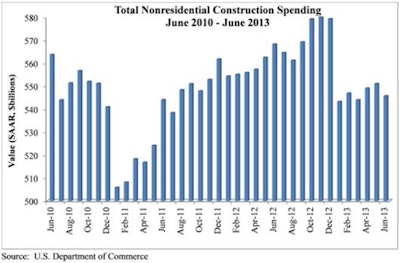

Despite the dip in June, the month's spending reached the second-highest level since August 2009.

Private residential spending was flat for the month and 18 percent higher than in June 2012. New single-family construction slid 0.8 percent in June but was 28 percent above the year-ago mark. New multifamily spending fell 3.3 percent in June but shot up 41 percent year-over-year.

Private nonresidential spending slipped 0.9 percent in June but was up 1.4 percent year-over-year. Public construction spending shrank 1.1 percent for the month and 9.3 percent over 12 months. Public nonresidential construction's rate of decline has accelerated in recent months.

"The major private nonresidential segments show divergent trends," Simonson said. "Power construction, which includes oil and gas fields and pipelines as well as electricity, climbed for the fifth straight month in June, even after Census posted large upward revisions for May and April. But such major categories as manufacturing, health care and retail construction remain in the doldrums. Meanwhile, the largest public categories—highways and education construction—are now plummeting at double-digit rates."

Ten of 16 construction sectors posted spending losses for the month, including:

- Conservation and development is down 9.4 percent

- Religious down 6.8 percent

- Water supply down 5.5 percent

- Sewage and waste disposal down 5.3 percent

- Commercial, down 5.1 percent

On a year-over-year basis, construction spending has softened in 12 subsectors, including:

- Conservation and development is down 17.2 percent

- Communication down 13.8 percent

- Educational down 12.6 percent

- Highway and street down 12.4 percent

- Religious down 12.2 percent

Only six of the 16 nonresidential construction sectors posted spending increases in June:

- Power is up 3.6 percent

- Communication up 2.5 percent

- Transportation up 1.9 percent

- Health care up 1 percent

- Office up 0.8 percent

- Amusement and recreation up 0.4 percent

Four subsectors have experienced higher spending compared to one year ago:

- Lodging is up 22.7 percent

- Water supply up 6.8 percent

- Power up 5.7 percent

- Transportation up 4.3 percent

AGC officials warned that the plunge in public construction will worsen unless policy makers in Washington can produce a budget that puts more money into vitally needed highway, water and other infrastructure projects. They noted that spending on federal projects in June was at the lowest level since September 2008 and was 29 percent below its latest peak in August 2011.

"Infrastructure spending is essential for economic growth, health and safety," said Stephen E. Sandherr, the association's chief executive officer. "Congress should make adequate funding for infrastructure a top priority next month when it works on appropriations bills to fund the government for the (federal fiscal) year beginning in October."

The Associated Builders & Contractors' chief economist, Anirban Basu, warns that plunging public-construction spending levels could combine with the general economy's anemic growth to subdue private-construction spending.

"Given sequestration and constrained state and local government capital budgets, declines in publicly financed construction are not particularly surprising," says Basu.

"However, the recent bankruptcy of Detroit will likely translate into conservative budgeting during the months ahead as financiers and policymakers adopt an even more cautious stance regarding major capital outlays.

"Construction segments heavily financed by the private sector, including commercial and lodging-related construction, were down for the month, and office-related construction spending was up only slightly," Basu adds. "The implication is that the pace of economic growth, which averaged less than 2 percent on an annualized basis during the first half of 2013, has not been enough to trigger or sustain meaningful private nonresidential construction increases.

"The conventional wisdom is that the second half of the year will be better for the broader economy, which would imply better nonresidential construction performance in 2014," Basu says. "However, with interest rates now rising, there are reasons for contractors and other stakeholders to remain cautious."