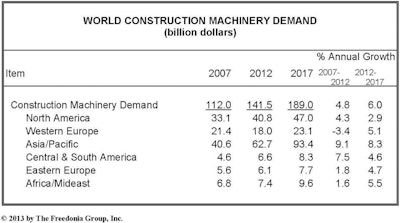

Global demand for construction machinery is expected to rise 6.0% per year to $189 billion in 2017, accelerating from the 2007-2012 pace. This expansion will be fueled primarily by growth in the Asia/Pacific region, particularly China, where the market will climb at a double-digit annual rate as construction spending, especially on infrastructure projects, continues to increase.

Although construction equipment sales in Western Europe were weak in 2012 due to a recession in many European Union countries, the market will rebound through 2017 as operators replace outdated machinery with more advanced units in an improving environment for construction spending. In contrast, strong sales in North America in 2012, particularly in the United States, will result in slower average demand gains through 2017. Many operators in the region have recently replaced older machines in expectation of faster economic growth and increased construction spending, which will lead to a lull in replacement sales for the next few years.

These and other trends are presented in World Construction Machinery, a new study from The Freedonia Group, Inc., a Cleveland-based industry market research firm.

Excavators and loaders will record the fastest sales growth through 2017, as both construction spending and investment in mining projects climb. While suppliers of dozers and off-highway trucks will also benefit somewhat from an increase in mining investment, demand for these products will expand at a pace below the overall market average because of their generally large size and price, which make it more financially difficult for operators, especially in developing areas, to purchase these machines.

Construction machinery market advances in Central and South America will slow through 2017 after posting a strong expansion from 2007 to 2012, which was supported by significant investments in large mining projects in several countries in the region. After suffering in 2012 due to economic recessions in several nations, sales growth in Eastern Europe will accelerate through 2017 as construction spending returns to healthier levels amid an improving economic landscape. Both Central and South America and Eastern Europe will experience moderate distortions in construction equipment demand going forward as Brazil and Russia, the largest markets in their respective regions, are each slated to host an installment of both the Olympics and the FIFA World Cup.

After experiencing oversupply issues over the 2007-2012 period in some of the region’s wealthier nations, the market in the Africa/Mideast region will advance at a faster pace through 2017.

World Construction Machinery (published 07/2013, 451 pages) is available for purchase from The Freedonia Group, Inc. For more information, visit www.freedoniagroup.com.