Make it through the next 12 to 18 months and the U.S. economy is positioned to have one of the most favorable outlooks of the world economies.

That’s the message Eli Lustgarten, senior research analyst for Longbow Research, delivered to the Association of Equipment Distributors (AED)/Infor Executive Forum Sept. 12-13 in Rosemont, IL.

Lustgarten was grounded in New York City as result of weather-related airport shutdowns but was deftly guided through his presentation via a live phone hookup by Kim Phelan, Construction Equipment Distribution executive editor.

“The next three to five years construction is going to be the place to be as long as the government doesn’t get in the way,” Lustgarten said. ”If we can let the free market operate the opportunities in construction are huge.”

He said total construction will be up between 5% and 10% through this year with total construction spending from 2013 through 2018 “up 6% to 10% or more.” He cited new economic drivers being natural gas and shale-based oil, the widening of the Panama Canal, and an increase in the population of elderly and children.

“Industrial activity peaked in the first half of 2012 because of sluggish global growth and global politics,” he said. “The construction equipment sector overproduced in 2012 and when you overproduce you have to go through inventory liquidation. So the second half of 2012 and early 2013 was characterized by extreme liquidation -- globally not just in the U.S.,” he said. “That’s somewhat come to an end.”

He said equipment manufacturers and distributors can expect more of the same “muddling through” for the remainder of this year and much of 2014. “Things are getting better but nothing too strong. Those companies expecting a strong fourth quarter will have to rethink that,” he said. “But the United States is still the best house in a lousy neighborhood.”

Construction Equipment

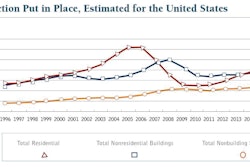

Lustgarten said that the market for construction equipment has been unusual because spending on construction equipment has outpaced construction spending itself.

“While construction expenditures have seen only modest recovery, spending on new construction machinery accelerated in 2010 to 2012 and was far stronger than originally anticipated,” he said.

He said two reasons for that are hefty tax incentives that encouraged buying (100% tax bonus in 2011 resulting in a 38% gain, 50% tax credit in 2012 and 2013) and the IRS Section 179 write off of up to $500,000 in investment in new or used equipment (set to expire this year).

He said anticipated equipment price increases -- from a combination of more costly raw materials and interim and final Tier 4 regulations -- also had an impact on purchasers. He said the price of steel, copper and aluminum, for example, will increase equipment pricing costs 3% to 5% and that Tier 4 regulations will increase costs up to 12%. And while the price increases will likely be phased in over several years the expectation of higher prices has encouraged buying now.

Overall he said he expects double-digit sales growth for light equipment in 2014 but heavy equipment sales are expected to drop between 5% and 10%.

Housing

Lustgarten said that while a return to 2 million starts annually is unlikely, “The outlook for the housing market is reasonably decent provided interest rates don’t get out of whack.” He said the new norm will be in the area of 1.3 to 1.6 million starts annually.

Overall he expects residential construction will be up 10% to 15% (vs. 17% in 2012) with multi-family taking the lead and lasting at least through 2014. He said home prices are increasing (though many buyers still are having trouble getting loans) and construction of single-family houses and remodeling will be up only slightly.

Nonresidential Construction

Lustgarten termed the nonresidential construction market “a tale of two markets” where the overall market continues to improve. “But it’s the private side that does well at the expense of the public side,” he said. “There’s just no money on the public side to allow that market to grow.”

He said he expects private nonresidential construction to grow between 10% and 15% (vs. 16% in 2012). Public nonresidential construction is expected to decline 2% to 5% (compared to a drop of 3% in 2012).

Infrastructure

Lustgarten said that there are two important aspects to this market, both with significant upsides that could be restrained by funding. One aspect is the transportation side, funded largely by the highway bill which was passed in 2009 but which since then has been extended at a bare-bones level only through short-term continuing resolutions in Congress.

“While the needs are tremendous it’s a flat market because of the lack of funding in the sector,” he said. “There are a lot of negative vibes to it.”

Lipinski to Pursue $60 Million in Annual Highway Funding

Another aspect of infrastructure is the energy side. He said that while mining will take a huge hit, largely as a result of the current dissatisfaction with coal-powered plants, the development of oil and gas reserves in the U.S. can drive significant growth in years ahead.

“The U.S can become a net energy exporter but needs the infrastructure to build out,” he said. “There’s an enormous construction upturn coming if we get our policies right in 2014 and a lot more in 2015 and 2016. There’s a real golden goose out there if we can get our policies behind it.”

Power Generation

Largely because of the politics of coal and the expiration of the Production Tax Credit (which was extended in January through this year) for construction of wind and solar power facilities, power generation “is not a market that will be doing much in 2013 and 2014.”

Rental Trends

Lustgarten said that half of equipment sales in 2013 went to rental houses, the result being that the rental industry is running ahead of expectations. Lustgarten said he expected equipment rental penetration to reach 50% in 2014 “but it got there early, in 2013.”

He said the age of rental fleets is still somewhat high at more than 50 months for five key pieces of equipment (articulating booms, scissor lifts, telescopic boom, high-reach forklifts, and loader backhoes) and more than 45 months for two other pieces (dozers, and wheel loaders) for an average age of 45.9 months for the top 10 categories. Utilization numbers, however, are still very high at 65.8%.

But he said indications are that rental companies are reassessing what are currently relatively flat spending plans for 2014.