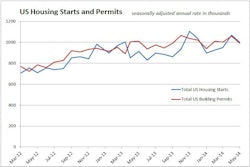

A 6.0% rise in single-family housing starts boosted March overall housing starts figures 2.8% above February performance to a seasonally adjusted annual rate of 946,000 units, marking what some will call an end to the winter 2014's chilling affect on construction. But March starts, according to figures from the U.S. Census Bureau, remains 5.9% below the March 2013 rate of 1,005,000.

Single-family starts in March hit an annual rate of 635,000; 1.9% above the rate reported in March last year. The March rate for multifamily starts fell 6.1% to 292,000 units.

Residential building permits were issued in March at a seasonally adjusted annual rate of 990,000 units, 2.4% below the revised February rate of just over 1,000,000. But the March 2014 permits pace is 11.2% above that of March 2013. Single-family permits were 0.5% above February.

“Today’s report is in line with our forecast of a gradual strengthening in the housing sector in 2014,” said Chief Economist David Crowe, with the National Association of Home Builders. “However, several uncertainties including tight credit conditions for home buyers and erratic job growth are making builders cautious about getting ahead of demand.”

Regionally in March, combined single- and multifamily housing production rose strongly in the Northeast and Midwest with gains of 30.7% and 65.5%, respectively, but fell 9.1% and 4.5% in the South and West.

Residential building permits issued in the Northeast and Midwest posted gains of 33.3% and 26%, respectively, while the West was unchanged and the South posted a 17.1% decline.

Builder confidence in the market for newly built, single-family homes rose one point to 47 in April from a downwardly revised March reading of 46 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI).

“Builder confidence has been in a holding pattern the past three months,” said NAHB Chairman Kevin Kelly, a home builder and developer from Wilmington, Del. “Looking ahead, as the spring home buying season gets into full swing and demand increases, builders are expecting sales prospects to improve in the months ahead.”

The HMI index gauging current sales conditions in April held steady at 51 while the component measuring traffic of prospective buyers was also unchanged at 32. The component measuring expectations for future sales rose four points to 57.

The HMI three-month moving average was down in all four regions. The West fell nine points to 51 and the Midwest posted a four-point decline to 49 while the Northeast and South each dropped two points to 33 and 47, respectively.

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores from each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

Note: The NAHB/Wells Fargo Housing Market Index is strictly the product of NAHB Economics, and is not seen or influenced by any outside party prior to being released to the public. HMI tables can be found at nahb.org/hmi. More information on housing statistics is also available at housingeconomics.com.