Construction economists are cautious, but they expect industry softening that started in the last quarter of 2013 and continuing through the first quarter of this year to be a result of the unusually harsh winter weather, and not weakening of the underlying economy. Total construction spending is expected to grow more than 6% in 2014, lead by housing and nonresidential buildings.

The Reed Construction Data webinar, 2014 Breakthrough Year for Construction, gathered Kermit Baker, chief economist with the American Institute of Architects; Ken Simonson, chief economist with the Associated General Contractors of America; and Bernard Markstein, U.S. chief economist with Reed Construction Data, last week to update their forecasts.

The underlying general economy is sound. Baker pointed out the stabilization of leading economic indicators and their upward trend (see line graph).

Markstein noted that gross domestic product in 29 states has exceeded pre-recession peaks.

“Employment should be growing faster,” Markstein lamented. “But Washington is finally delivering appropriations, and extended the debt ceiling until next year,” he added. “All of that is really encouraging economic growth.”

Housing is expected to be the construction’s star in 2014.

“2014 is getting off to a mixed start from a construction perspective,” Baker said. “After a big year in 2012 and into 2013, housing numbers have been relatively disappointing. But house prices are finally moving in the right direction, and mortgage interest rates remain near historical lows, so that bodes well for the starts with the worst of the winter weather behind us.”

The American Institute of Architects compiles the outlooks of eight economists watching the construction industry into a consensus forecast. Baker says their outlooks, revised over the past 60 days, produce a consensus for 2014 anticipating a 23% rise in housing starts to 1.14 million starts. The consensus is for another 24% leap in 2015 to 1.43 million starts.

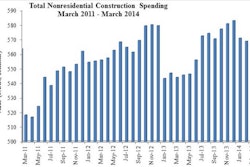

Baker pointed out that spending on nonresidential building construction has been strong in the first quarter despite the harsh weather. February nonresidential construction was 6.4% above the same month in 2013 on strength of the commercial/industrial subsector.

Two-thirds of contractors responding to the AGC Outlook Survey expect the construction market to turn up this year. Simonson said it’s the first time that many contractors were expecting a positive turn since the recession began.

Simonson forecasts total construction spending growth to more than double the 5% growth we saw in 2013. In fact, he expects construction spending to grow in the 6% to 10% range every year for the next three years.

Simonson estimates 4% to 8% growth in 2014 nonresidential construction, lead by 10% or more jumps in the power, manufacturing and lodging construction subsectors.

While he forecasts up to 5% drops in highway and street and education spending, he anticipates a 2% to 5% increase in transportation construction, and up to 5% increases in commercial and office construction.

Simonson warns that single-family housing construction could cool to a plateau, but expects multifamily construction to be a top prospect for 2014.

He singles out development of shale energy in the U.S. and expansion of ports and attendant transportation and warehousing infrastructure to accommodate larger ships coming out of the expanded Panama Canal to be key drivers of 2014 construction growth.

Simonson’s other top prospects for 2014 include:

- Manufacturing, especially petrochemical and oil/gas supply

- Oil and gas fields

- Pipelines

- Warehouses

- Lodging (hotels and resorts)

- Rail

- Data centers

Watch the archive of Reed Construction Data's webinar 2014 Breakthrough Year for Construction