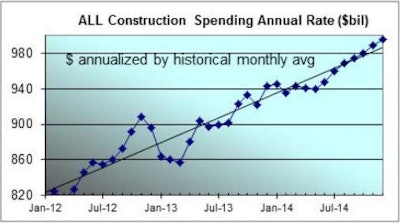

Gilbane Building Co., a $3 billion general building contractor based in Providence, RI, issued its Spring 2014 Construction Economics Report forecasts 6.6% growth in total construction spending in 2014. The report warns that workforce growth is needed to meet increasing demand for project production.

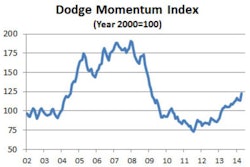

Gilbane expects continued growth in total construction spending after May. Residential and nonresidential buildings lead the expansion, while nonbuilding infrastructure holds back growth.

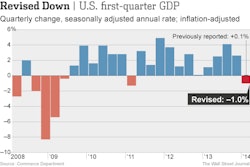

The report calls the winter slowdown temporary, influenced by a slight dip in nonresidential buildings, a brief flattening in residential, but more so by a steep decline in nonbuilding infrastructure spending.

Construction volume is 23% below peak inflation-adjusted spending, which was almost constant from 2000 through 2006. At average peak growth rates of 8% per year, and factoring out inflation to get real volume growth, it would take eight more years to regain previous peak volume levels.

Gilbane expects margins to grow in 2014, but limited labor will strain project productivity.

While the number of construction jobs grew less than anticipated in 2013, jobs grew by 156,000 last year with hours worked increasing by 3% -- the equivalent of an additional 150,000 jobs. Year to date, the industry has gained 88,000 jobs in 2014 with job growth exceeding 25,000 per month over the last three months.

"I am pleased to see that job growth has improved industry-wide, however, the construction workforce is still near a 15-year low, about 20% below the 2007 peak," said Ed Zarenski, a Gilbane estimating executive with more than 40 years in the construction business. "As the workload increases in the next few years, the industry will need a large pool of skilled workers to expand in tandem so not to have a detrimental effect on cost, productivity and the ability to readily increase construction volume."

The construction workforce and hours worked is still 22% below the 2006 peak. At average peak growth rates, it will take a minimum of five more years to return to previous peak levels.

Other report highlights:

- Whole building costs to rise and remain above material/labor inflation as work volume continues to increase.

- 65% of builders surveyed expect the cost of labor in 2014 to be a significant challenge.

- Construction spending for nonresidential buildings was flat in 2013. However, construction inflation for nonresidential buildings was about 3% to 4%. Therefore, real volume for nonresidential buildings actually declined by about 3% to 4% in 2013.

- As spending continues to increase, contractors gain more ability to pass along costs and increase margins. Supported by overall positive 2014 growth, margins and overall escalation will climb more rapidly than we've seen in six years.

Download the free report, Gilbane’s Spring 2014 Construction Economics Outlook