Roughly since the end of the recession in 2009, the nation’s leading construction CFOs have greeted each New Year with optimism, only to express disappointment after a few months. This time is different. During the second quarter of 2014, CFOs expressed as much optimism as they did during the year’s early stages, an indication that the pace of construction industry recovery is roughly meeting expectations.

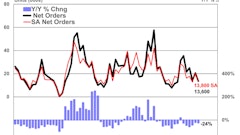

True, the overall second quarter Confindex reading declined 0.8 percent during the quarter from 130 to 129. But the overall reading remains above year-end 2013 levels and is up by nearly a percentage point from one year prior. The Business Conditions Index, which reflects the current level of construction activity, rose during the second quarter to 149, up from 147 one quarter prior and from 144 (3.5 percent) a year ago. This represented the largest year-over-year increase observed in any of the sub-indicators.

Similarly, the current confidence index, which reflects near-term prospects, rose from 122 to 124 during the quarter, which was the largest quarterly increase in any of the sub-indices. The current confidence index is up 2.5 percent from a year ago. Demand for construction continues to expand in most subsectors, with the proportion of CFOs indicating that they were either “very” or “highly” concerned about demand for construction falling from 25 percent to 19 percent during the quarter.

But construction CFO confidence remains constrained. While CFOs appear satisfied with the current state of affairs and remain relatively unconcerned with the near-term, the longer-term outlook is not as benign. The year-ahead outlook index declined 2.9 percent during the quarter, falling from 140 to 136. This represented the largest quarterly decline of any of the sub-indicators. The year-ahead outlook index is also down slightly on a year-over-year basis. There are many conceivable explanations, but one may be the scheduled expiration of the current legislation authorizing federal support for certain forms of infrastructure investment at the end of the federal fiscal year (October 1st).

Perhaps somewhat surprisingly, the financial conditions index also slipped. Despite anecdotal evidence suggesting that banks and other financial players

are ready to deploy funding more aggressively, the financial conditions index declined 2.6 percent during the quarter, falling from 116 to 113. The index is also down 2.6 percent on a year earlier basis, which represents the largest year-over-year decline in any of the sub-indices.

There are many conceivable explanations, but one may be that banks are withholding a certain level of financing for fear that a growing number of construction firms are set to falter as they deploy cash in advance of expanding contract volume, often without building in sufficient levels of profit margin and contingency. In fact, during each of the three quarters, Confindex survey response rates have been slipping incrementally, consistent with both the notion that firms are becoming busier and that others may no longer exist to complete surveys. Some survey respondents indicated that lending standards are once more becoming disciplined, with considerable focus on value of collateral and indemnification. Others indicated significant concern regarding prospective interest rate increases.

As in prior quarterly surveys, CFOs also remain deeply concerned by a lack of public funding for infrastructure. One participant indicated that federal, state and local budget challenges will likely have “a significant impact on heavy/highway and non-building construction projects.” Another respondent hopes that “Congress will finally pass some infrastructure legislation.” Others expressed frustration about the actual execution of publicly-funded projects, indicating that regulatory agencies are scrutinizing construction delivery more intensely and penalizing contractors more aggressively.

Still, the average contractor is becoming busier and profit margins are creeping higher. A full 94 percent of respondents believe that their company’s margins will be slightly better (52 percent) or about the same (42 percent) a year from now. Only 5 percent of respondents expect margins to deteriorate over the next twelve months with none of them anticipating significant deterioration.

One of the factors contributing to expectations of profitability are benign views regarding construction materials prices. Among survey respondents, 40 percent expect prices to be relatively unchanged over the next twelve months and 51 percent expect them to be only slightly worse from the perspective of buyers. If anything, CFOs have been positively surprised by the stability of materials prices in recent quarters and for now these prices are not a source of deep-seated consternation.

The same cannot be said about issues related to skills/labor supply. One respondent indicated that “competition for quality skilled workers has increased significantly as the market has begun to improve.” Another indicated that it is “harder than ever to find skilled workers in the construction trades.” Yet another indicated that “we have turned down projects because we can’t find qualified job foremen.”

The typical CFO can expect these issues to become more serious going forward. Steady construction industry recovery is anticipated with the likely exception of key public construction segments. The nation continues to add construction jobs and the construction industry unemployment rate has generally been in decline.