Based on the Q1 2015 update of Timetric’s Construction Risk Index (CRI)*, risk has edged up marginally across the 50 countries covered in the index, with the unweighted average score rising from 41.02 in Q4 2014 to 41.08. This was driven by a slight increase in risk in advanced economies that offset a decline in the average level of risk across the emerging markets. However, risk in advanced economies is still much lower than in emerging markets, with the average score for advanced economies standing at 33.37 in Q1 2015, compared to 43.38 in emerging markets

Only three countries in the CRI, Sweden, Singapore and Switzerland, have the top rating of A1, with the 10 following receiving a rating of A2. The only changes in rankings for A1 and A2-rated countries in the Q1 2015 update was that of Hong Kong, which moved above Canada into 6th place. Russia has continued to slide down the rankings. In the Q1 2015 update, Russia’s score dropped to 60.09, putting it in 45th place. In contrast, in Q1 2014 it was ranked in 40th place with a score of 52.31.

A total of 20 countries recorded an improvement in their risk profiles in Q1 2015 compared with Q4 2014. Poland is among the best performers, rising two places to 21st, supported by a healthier construction market in terms of growth, and also general improvements in credit-worthiness and governance. Portugal and Romania have also recorded solid improvements, but both remain C1-rated.

Although global crude oil prices have pick up since early January, they are still at a much lower level than in recent years. This has undermined the viability of many energy projects, and therefore has contributed to a general worsening in market and economic risk in oil-dependent economies. However, the United Arab Emirates has posted an improvement in its overall risk profile, with its fiscal buffers supporting non-oil growth as the authorities push ahead with efforts to diversify the economy.

A total of 29 countries have suffered a deterioration in their risk profiles. “There are moderately positive signs that the construction industry in countries in the Eurozone has now passed rock bottom. But Greece’s woes persist, with the election victory for left-wing opposition Syriza in Greece's January 2015 national elections creating much uncertainty, not only in the country itself but also in the wider region,” says Sina Zavertha, Economist at Timetric's Construction Intelligence Center.

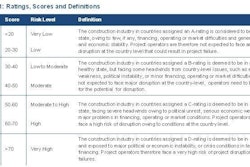

The CRI, which is updated on a quarterly basis, provides an analysis of current conditions and a forward-looking assessment of general and specific risks that could prevent projects from being executed, result in major disruptions to projects, or ultimately lead to project failures. The CRI is based on five dimensions of risk, each with varying weights: market risk, operating risk, economic risk, financial risk, political risk.