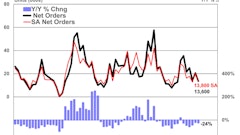

New construction starts in December advanced 4% to a seasonally adjusted annual rate of $591.6 billion, according to Dodge Data & Analytics. The December gain follows a 5% decline in November and brings total construction activity back close to the amount that was reported in October. December showed moderate increases for each of the three main construction sectors — nonresidential building, residential building, and nonbuilding construction (public works and electric utilities). For 2015 as a whole, total construction starts climbed 8% to $645.5 billion. This continues the pattern of moderate expansion for total construction starts registered during the previous three years — 2012, up 12%; 2013, up 11%; and 2014, up 9%.

The December statistics produced a reading of 125 for the Dodge Index (2000=100), compared to a revised 120 for November. For all of 2015, the Dodge Index averaged 137.

"The construction start statistics reveal continued expansion for construction activity during 2015, although the path over the course of the year was not smooth," stated Robert A. Murray, chief economist for Dodge Data & Analytics. "A strong first half of 2015 was followed by a 20% loss of momentum in the third quarter and then a slight 1% rebound in the fourth quarter, as the expansion began to show that it was getting back on track. Several factors contributed to the early 2015 strength — more growth for the commercial and institutional segments of nonresidential building, gradual improvement for single family housing alongside the continued rise by multifamily housing, and a surge of electric utility and gas plant projects that featured the start of several massive liquefied natural gas (LNG) terminals in the Gulf Coast region."

"The third quarter of 2015 witnessed a steep 30% drop for nonresidential building, as the manufacturing building category and in particular energy-related projects fell sharply," Murray continued. "In addition, the commercial and institutional building segments of nonresidential building settled back, as earlier gains may have overshot their underlying growth trend while uncertainty in the economic and political environment dampened investment in general. Residential building slipped 3% in the third quarter, due to flattening activity for single family housing, while nonbuilding construction plunged 32% as the result of a sharp reduction by the electric utility and gas plant category. On the plus side, the fourth quarter of 2015 showed the commercial and institutional segments of nonresidential building beginning to pick up the pace once again, and supportive market fundamentals (occupancies and rents) should help renewed growth for these segments going into 2016. The public works portion of nonbuilding construction also began to pick up the pace towards the end of 2015, and should be aided by the December passage of fiscal 2016 federal appropriations as well as the new $305 billion five-year federal transportation act (the Fixing America's Surface Transportation Act)."

Nonresidential building

Nonresidential building in December grew 3% to $178.5 billion (annual rate). The commercial building group provided most of the December lift to nonresidential building, rising 9% from the previous month. Office construction increased 6% and included the December start of a $210 million office tower in Oklahoma City, Okla., a $100 million office building in East Hartford, Conn., and a $44 million corporate headquarters for Subaru in Camden, N.J.

Store construction advanced 17% in December, reflecting the start of three outlet centers located in Clarksburg, Md., ($41 million), Baltimore ($35 million), and the Houston area ($35 million). The garage and service station category in December jumped 50%, boosted by the start of a $331 million consolidated car rental facility in Kahului, Hawaii. Warehouse construction in December was unchanged from its November amount, while hotel construction fell 17%.

The manufacturing plant category in December dropped 16%, maintaining the weak performance that emerged during the second half of 2015, although December did include the start of several automotive-related projects such as a $75 million automobile assembly plant in the St. Louis area.

The institutional side of the nonresidential building market held steady in December. Amusement-related work soared 87%, lifted by three noteworthy projects — the $478 million renovation and expansion of the Miami BeachConvention Center in Miami Beach, Fla., the $130 million renovation of the Nassau Coliseum in Uniondale, N.Y., and the $100 million expansion of the Kennedy Center for the Performing Arts in Washington D.C.

Transportation terminal work climbed 48% in December, and gains were also reported for religious buildings, up 13%; and healthcare facilities, up 11%. The healthcare facilities category in December was boosted by three large projects, located in Minneapolis ($147 million), Davenport, Iowa, ($139 million), and Longmont, Colo., ($108 million).

However, educational facilities (the largest nonresidential building category by dollar volume) retreated 19% in December following its improved pace during the previous two months. Cushioning the December decline for educational facilities was groundbreaking for a $100 million biomedical research center at Northwestern University in Chicago. The public buildings category also weakened in December, sliding 11%.

For 2015 as a whole, nonresidential building fell 8% to $204.2 billion. The decline followed a 24% increase in 2014, and the 2015 annual amount was still 14% above the level reported for 2013. Much of the decline for nonresidential building in 2015 reflected a 39% reduction for the manufacturing plant category following its 87% surge in 2014, as weaker energy prices in 2015 led to a pullback for large petrochemical plants. If the manufacturing plant category is excluded, nonresidential building in 2015 would be down a modest 2% after a 17% hike in 2014.

The institutional building group in 2015 settled back 4% after advancing 13% in 2014. Decreased activity was reported for healthcare facilities, down 10%, as well as such categories as public buildings, down 3%; amusement-related work, down 6%; and transportation terminals, down 11%. The educational facilities category managed to rise 1% in 2015 on top of its 15% gain in 2014.

The top five states for new educational facility starts in 2015, ranked by dollar volume, were:

- Texas

- New York

- California

- Massachusetts

- Ohio

The religious buildings category was able to register an 8% gain in 2015, although its level of activity remains quite low by recent historical standards.

The commercial building group in 2015 held steady with the dollar amount registered in 2014, when activity climbed 22%. Hotel construction showed the largest annual gain of the commercial categories in 2015, rising 15%. Large hotel projects that reached groundbreaking in 2015 included a $411 million ocean resort expansion in Lahaina, Hawaii, and the $350 million McCormick Place Marriott Marquis Hotel in Chicago.

Store construction grew 3% in 2015, led by the $600 million retail portion of the $2.5 billion 30 Hudson Yards building in New York. The garage and service station category slipped 1% in 2015, and warehouse construction retreated 3%.

The office category in 2015 pulled back 5%, although it's important to note that the decline followed a 37% increase in 2014 that was led by such projects as the $2.3 billion office portion of the $2.5 billion Apple corporate headquarters in Cupertino, Calif. Large office projects that reached groundbreaking during 2015 included the $1.9 billion office portion of the $2.5 billion 30 Hudson Yards building in New York and the $1.2 billion One Manhattan West office building, also in New York.

The top five metropolitan areas ranked by the dollar amount of new office starts in 2015 were:

- New York

- Dallas-Ft. Worth, Texas

- Washington D.C.

- Chicago

- Boston

Residential building

Residential building in December increased 6% to $278.1 billion (annual rate). Multifamily housing finished the year on a strong note, rebounding 22% after slipping 5% in November. December featured groundbreaking for 10 multifamily projects valued at $100 million or more, led by two projects in New York valued at $575 millionand $229 million respectively, a $169 million mixed-use tower in Jersey City, N.J., and a $167 million residential tower in Miami. Single family housing in December was unchanged from its pace in November, essentially staying with the flat pattern that emerged during the second half of 2015.

The 2015 amount for residential building was $265.4 billion, up 14% and stronger than the 10% gain that was reported for 2014. Single family housing grew 13% in dollar terms, showing some improvement after the 3% rise in the previous year.

The regional pattern for single family housing in 2015 revealed gains in all five major regions, to varying degrees:

- West, up 23%

- South Atlantic, up 17%

- South Central, up 7%

- Midwest, up 6%

- Northeast, up 2%

Multifamily housing in 2015 increased 18%, not quite as fast as the 32% hike reported in 2014, but marking the sixth straight year of double-digit growth. By major region, multifamily housing showed this performance in 2015:

- Northeast, up 35%

- Midwest, up 17%

- South Central, up 11%

- South Atlantic, up 8%

- West, up 6%

The top 10 metropolitan areas in terms of the 2015 dollar amount of multifamily starts were:

- New York

- Miami

- Washington D.C.

- Los Angeles

- Boston

- Chicago

- Seattle

- Dallas-Ft. Worth

- Houston

- San Francisco

Nonbuilding construction

Nonbuilding construction in December rose 3% to $135.0 billion (annual rate). The gain was due to a 108% rebound for the electric utility and gas plant category after a weak November, although the level of activity remained well below what was reported during the first half of 2015. December projects that contributed to the electric utility and gas plant increase were a $1 billion gas-fired power plant in Pennsylvania, a $380 milliongas-fired power plant in South Carolina, and a $300 million wind farm in North Dakota.

The public works categories as a group slipped back 8% in December following the 18% jump reported in November. Weaker activity was registered by highway and bridge construction, down 7%; and miscellaneous public works, down 29%. The miscellaneous public works category in December did include the start of the $915 million Saddlehorn petroleum pipeline in the states of Oklahoma, Kansas and Colorado, but activity for the category was still down relative to a strong November that included the start of the $1.6 billion Westside Subway Extension project in Los Angeles.

Each of the environmental public works categories in December posted increases — river/harbor development, up 26%; water supply construction, up 19%; and sewer construction, up 9%.

For the full year 2015, nonbuilding construction climbed 23% to $176 billion, a sharp increase after the 8% reduction in 2014. The substantial nonbuilding gain for 2015 was due entirely to the electric power and gas plant category soaring 141%.

The first half of 2015 included four massive LNG-related projects on the Gulf Coast — the $9 billion export terminal in Corpus Christi, Texas, the $8.4 billion Sempra export terminal in Hackberry, La., the $6 billion export terminal in Freeport, Texas, and a $1 billion receiving terminal in Ingleside, Texas. Overall, the gas plant segment in 2015 was more than four times the amount reported during 2014, while the electric power-related segments advanced 69%.

In contrast, public works construction in 2015 showed no change from the previous year, as the result of a mixed performance by project type. Highway and bridge construction in 2015 climbed 10% following a 13% decline in the previous year, helped by such starts as the $2.3 billion Interstate 4 Ultimate Project in central Florida.

The environmental public works categories registered moderate declines in 2015, with sewer and water supply construction each down 4% and river/harbor development down 9%. The miscellaneous public works category fell 16% in 2015, relative to its elevated amount in 2014 that included the start of several large mass transit projects.

The 8% gain for total construction starts at the national level in 2015 was the result of greater activity in all five major regions. Leading the way was the Northeast, up 17%; followed by the South Central, up 16%; the South Atlantic, up 4%; the Midwest, up 3%; and the West, up 2%.