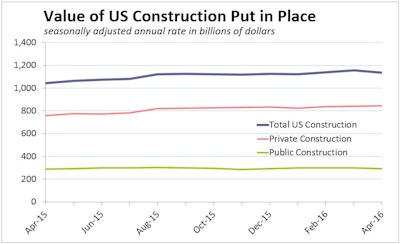

April 2016 U.S. construction spending fell 1.8% to a seasonally adjusted annual rate of $1,133.9 billion. Weakness was widespread among construction’s many sectors. Private outlays fell 1.5% in April, and public spending tumbled 2.8%. Drops registered in residential and nonresidential spending, too. Economists’ consensus forecasts had expected a 0.6% increase for the month.

During the first four months of 2016, construction spending amounted to $334.8 billion, 8.7% more than the same period in 2015.

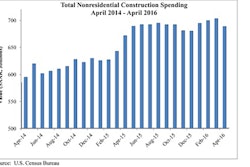

Spending on nonresidential construction dropped 2.1% in April, accelerated by a 6.5% plunge in spending on highway and street construction. Most of the biggest sectors in nonresidential construction fell significantly:

- Commercial construction spending fell 3.7% to $72.0 billion, but remains 6.8% above April of 2015

- Educational construction spending was down 2.4% to $88.4 billion, still 5.4% greater than April a year ago

- Manufacturing construction dropped 1.4% to $76.3 billion, 9.8% below April, 2015

Office construction spending was a standout, growing 1.6% to $65.2 billion; now a whopping 20.3% higher than April 2015. Spending on power construction was essentially flat, with a 0.3% rise to $90.2 billion.

Residential construction spending was down 1.5% to $445.7 billion. That’s 7.7% better than April of 2015.

Significant upward revisions to March spending estimates played a role in April’s news. Total construction spending for March was adjusted up 1.5%, with a 1.6% upward revision to private construction spending and a 1.4% change in public spending.

Wells Fargo’s Economics Group says the February and March revisions for private construction outlays paint a better picture for residential and structure investment to lift the final estimate of first-quarter U.S. gross domestic product. Mining’s continued malaise, though, should keep structure investment in negative territory for Q1.

“Looking past the volatile monthly reading, the overall trend looks a bit better with total construction spending up 4.5% from a year earlier,” according to Wells Fargo’s analysis of the Department of Commerce’s April construction spending report. “Private residential rose almost 8% on a year-ago basis, with solid gains in single- and multifamily spending. Another positive sign is that today’s report is in contrast to housing starts, which showed an increase in single- and multifamily starts and permits in April.”

![[VIDEO] US Home Sales Jump to Highest Level Since 2010](https://img.forconstructionpros.com/files/base/acbm/fcp/image/2016/06/default.57573510917c6.png?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)