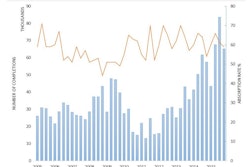

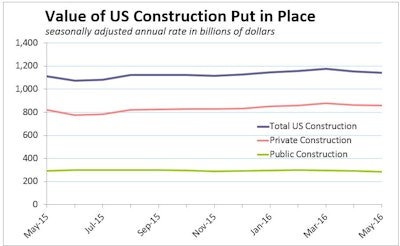

The total nominal value of construction spending put in place in the U.S. fell 0.8% in May to a seasonally adjusted annual rate of $1,143.3 billion from a downwardly-revised estimate of $1,152.4 billion in April. The May report included annual revisions dating back to January 2014.

Back-to-back negative construction spending readings in April and May suggest the second quarter will be weak. Moreover, declines are broadly based with much of the weakness concentrated in public spending.

The two largest public components are the highway and street and education segments, which both tumbled during the month. Notably, federal highway and street dropped 14.2% in May, but is up 53.5% on a year-ago basis.

The residential construction spending picture is beginning to look a little cloudy. Private outlays fell 0.3% in May, with residential unchanged. However, private single-family outlays fell for the third straight month, while multifamily and home improvement advanced in May. Looking past the volatile monthly reading, the overall trend looks a bit better with total private residential up 4.7% on a year-ago basis.

Wells Fargo Economics Group’s analysis of the Commerce Department’s monthly construction-spending numbers says, “Weakness in private single-family is a bit disconcerting, especially given recent declines in single-family housing permits. Although it’s too early tell if the recent U.S. bond rally resulting from the Brexit vote will keep long-term U.S. Treasury yields low, if sustained, we could see another refinancing wave, which will keep homeowners in place.”

Home improvements are up 2.3% relative to a year earlier. Multifamily continues to be a bright spot and is up 23.9% year over year.

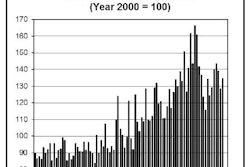

Private nonresidential construction spending slipped 0.7%, with manufacturing, power, office, commercial, education, and religious falling during the month. Commercial construction, which includes retail, office, lodging and warehouse, showed a strong recovery early in the cycle on the back of lodging and office, but the overall pace is moderating. Consistent with the slower pace of auto sales, automotive construction spending tumbled during the month and is down 15.4% year over year.

Multiretail, which includes general merchandise and malls, were also weak, registering a 28.6% and 39.7% dip, respectively. The U.S. Retail Real Estate Supply Conditions report showed that department stores accounted for more than 40% of all announcements in the latest report.

Manufacturing also slipped during the month, with chemical manufacturing now down 10.4% relative to the year earlier.

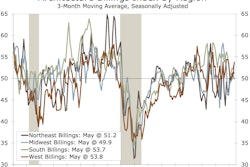

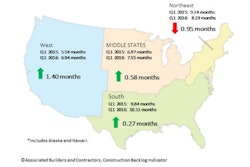

Stepping back and taking a more long-term view of construction spending, the forward-looking architecture billings index increased in May, marking its fourth consecutive reading in expansion territory. Construction planning, as measured by the Dodge Momentum Index, also strengthened in May. “With billings and planning leading the construction spending by about twelve months,” according to the Wells Fargo analysis, “We suspect this cycle has a bit more room to grow.”