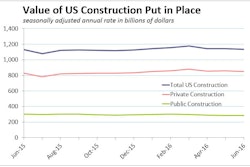

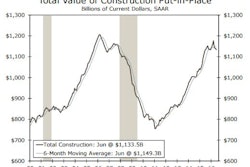

After a strong 2015, there is a growing sense that the construction industry expansion will be more tempered over the next 18 months. However, continued strong demand for hotels, office space, and amusement and recreation spaces will ensure continued growth in the overall construction spending market over this time period.

The national economy seems to be on a slower growth path so far in 2016, in part due to the growing list of national and international vulnerabilities that continue to appear. This slower growth in the broader economy is beginning to put downward pressure on the construction industry. After a solid performance last year, where most commercial and industrial construction sectors grew by 20% or more, 2016 was viewed as a year where activity was expected to moderate.

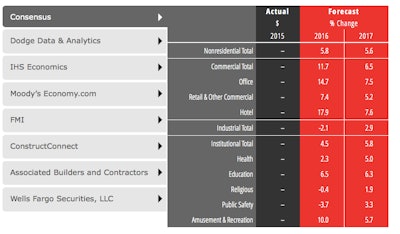

The American Institute of Architects’ (AIA) semi-annual Consensus Construction Forecast, a survey of the nation’s leading construction forecasters, is projecting that spending will increase just less than 6% for 2016, with next year’s projection being an additional 5.6% gain. Commercial construction sectors are projected to be the strongest performers this year, with the institutional categories moving back a bit from their pace of last year. Next year, the commercial sectors are expected to see slower yet still healthy levels of growth, while most institutional sectors will see a somewhat accelerated pace of activity.

| Market Segment Consensus Growth Forecasts | 2016 | 2017 |

| Overall nonresidential building | 5.8% | 5.6% |

| Commercial/industrial | 11.7% | 6.5% |

| Hotels | 17.9% | 7.6% |

| Office space | 14.7% | 7.5% |

| Retail | 7.4% | 5.2% |

| Industrial facilities | -2.1% | 2.9% |

| Institutional | 6.7% | 6.7% |

| Amusement/recreation | 10% | 5.7% |

| Education | 6.5% | 6.3% |

| Healthcare facilities | 2.3% | 5% |

| Religious | -0.4% | 1.9% |

| Public safety | -3.7% | 3.3% |

“Healthy job growth, strong consumer confidence and low interest rates are several positive factors in the economy, which will allow some of the pent-up demand from the last downturn to go forward,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “But at the same time, the slowing in the overall economy could extend to the construction industry a bit — with the biggest drop off expected in the industrial facility sector over the next year and a half.”

According to Baker, the issues that could derail continued expansion in the construction sector include:

- Weak U.S. manufacturing output

- Struggling economies in key international markets

- The ripple effect from the Brexit decision

- Typical uncertainty leading up to a U.S. presidential election that results in reluctant investors

Positive construction outlook

In spite of a growing list of threats to the U.S. economy, and therefore the construction sector, the outlook remains reasonably favorable overall. For example, the AIA’s Architecture Billings Index (ABI) continues to send off positive signals. It has remained in the growth range since mid-2012, and in spite of recent volatility, the ABI still documents increases in design activity at U.S. architecture firms. There are signs that progress in design activity may be slowing: the average ABI score of 51.8 for the first half of 2015 dipped to 51.3 for the second half of last year, and continued to ease to closer to 51 for the first half of this year. Still, the new design contracts index introduced by the American Institute of Architects, which measures new project activity coming into architecture firms, remains above the billings index. This suggests that architecture firms are increasing their backlog of project activity.

Despite Slight Drop Architecture Billings Index Continues to Trend Higher

There is evidence that gains in construction activity will continue to slow in the coming quarters. A consensus forecast of real estate trends conducted by the Urban Land Institute suggests that we are in the latter stages of this current real estate cycle. Their forecast panelists see vacancy rates increasing and rent increases slowing for the multifamily housing and hotel market through 2017 and 2018. The office and retail sectors are projected to see more stable vacancies with slower rent gains, so they too seem to be in the latter stages of this current cycle.

Commercial property values are a vulnerability to future growth in this sector. Commercial property values nationally are currently about 10% above their prerecession high, according to data from CoreLogic. International economic concerns — particularly with emerging weakness in Europe following the UK vote — may drive more capital to U.S. real estate markets, coaxing prices even higher in the coming months.

The AIA Consensus Construction Forecast Panel sees healthy but slower growth in the nonresidential building sector. After an estimated 17% growth in 2015, the consensus for this panel of experts is for 5.8% growth in overall building construction activity this year, declining very modestly to 5.6% in 2017. The commercial sectors are expected to be the strongest performers, with an 11.7% gain this year and 6.5% next, paced by continued strong performance in the office and retail sectors. Industrial construction, which saw growth last year in excess of 40%, is projected to see essentially flat levels of construction this year and next.

Healthy single-digit growth is expected from the institutional sector in 2016 and 2017. An optimistic outlook remains for education facilities, with gains in excess of 6 percent projected for both this year and next. The outlook for the health care sector has dimmed a bit, with forecast growth falling to just over 2% this year before ramping up to 5% in 2017.

![[VIDEO] Could Q2 Spending Slide Signal Turning Point for Construction?](https://img.forconstructionpros.com/files/base/acbm/fcp/image/2016/08/default.57b228e2a27c9.png?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)