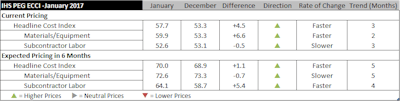

Construction costs rose again in January on strength in labor and materials costs, according to IHS Markit and the Procurement Executives Group (PEG). The headline IHS PEG Engineering and Construction Cost Index registered 57.7 in January, the highest headline reading since September 2014 and up from 53.3 in December.

The current materials/equipment price index came in at 59.9 in January. Of the 12 categories tracked in the materials sub-index, 10 showed rising prices. The two categories that recorded falling prices were ocean freight: Asia to U.S. and Europe to U.S.

Of the remaining 10 categories, the index figure for all — with the exception of copper-based wire and cable — rose compared to December. The copper index, which had increased significantly in December, gave back a little in January. However, it was still above 60, indicating increasing prices for copper-based wire and cable. All steel-related series showed strong price increases. Carbon steel pipe experienced the highest escalation compared to last month.

“Steel pipe prices are spiking in the first quarter of 2017 after weakening during 2015 and most of 2016,” said Amanda Eglinton, senior economist at IHS Pricing and Purchasing. “Prices will rise further in the second quarter, before retreating during the second half of the year. Higher steel input costs are providing the impetus for the near-term rise in steel pipe prices. Demand is starting to pick up and inventory levels are slowly receding; this will start to slowly shift leverage away from buyers over the near term, but the market will remain much more favorable than it was prior to 2015.”

The current subcontractor labor index came in at 52.6 this month. While slightly lower than December’s reading of 53.1, the January reading still presents positive momentum. In the Midwestern United States, labor costs remained the same compared to December. In the Northeast, South and West, labor costs rose. Even areas affected by the downturn in energy markets are feeling the effects of a tightening labor market. In Canada, labor costs remained the same in both Eastern and Western regions.

The six-month headline expectations index moved up from 68.9 in December to 70.0 in January, recording another month of increasing prices. The materials/equipment index stayed positive, at 72.6, slightly lower than the 73.3 recorded in December. Despite the slight giveback, this figure affirms widespread expectations of higher future prices. Every component showed rising prices, with steel-related indexes leading the way. Sub-contractor labor price expectations were 64.1 in January, higher than the 58.7 recorded in December. In both the United States and Canada, labor costs are expected to rise in every region.

In the survey comments, respondents have noted no shortages in supply of materials. Proposal activity has registered an uptick in the recent months, and participants are expressing cautious optimism for 2017.