Sealcoating-only sales for the 2020 Sealcoating 50 totaled $161,001,568, compared to last year’s $137 million, which was a significant increase over the more than $112 million total of the 2017 list (50 companies).

Just for historical purposes (and not for direct comparison), the sealcoating-only sales totals for the last few years when the list included 75 companies was $171 million in 2018, $201 million in 2016, and $249 million in 2015. We have consistently noted that the high-volume years of 2015 and 2016 likely are the result of pent-up demand and that sealcoating-only totals are settling into a more “normal” level since then. This year’s total, which is amplified by the addition of several larger companies to the Sealcoating 50, support that contention.

Sealcoating-only sales trailed all other industry segments (as they have each year of the survey), with paving-only sales surpassing $832 million, striping-only sales reaching $204 million, pavement repair-only sales at $217 million, followed by sealcoating-only sales at $161 million.

Total Sales for the Sealcoating 50

Total sales for all the work the 2020 Sealcoating 50 did was $1,271,173,438 ̶ up almost $300 million from the more than $977 million reported last year and the $885 million total Sealcoating 50 sales reported in 2017.

Sealcoating-only sales represent 13% of total Sealcoating 50 sales, down from 14% last year but equal to the 13% of 2017. The remaining sales represent a broad mix of pavement maintenance-related work, including:

- 38 companies perform paving work

- 45 companies perform striping work

- 42 companies perform pavement repair work

None of the 50 companies on the list performs only sealcoating (one generates 87% of sales from sealcoating) and only four of the companies generate 75% or more of sales from sealcoating.

Highest Profit Margins Continue Growth

Despite the fact the sealcoating-only sales volume brings up the rear of the four industry segments, that doesn’t mean sealcoating has to be less profitable than the other segments. The good news is the highest margins continue to grow, while the smallest margins also show slight improvement.

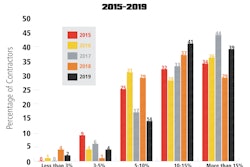

- None of the contractors on the list reported margins of less than 3%

- 6% report margins between 3-5%

- 22% report margins of 5-10%

- 26% report margins of 10-15%

- 46% report margins of greater than 15%.

Interestingly, the middle-margin ranges of 5-10% and 10-15% absorbed the greatest changes, with the 10-15% range declining 15% and the 5-10% range improving by 8%. As the chart indicates, this is a marked reversal of last year. We noted last year that 80% of the Sealcoating 50 reported margins of 10% or more (consistent with the 77% in 2017), but that has declined to 72% this year.

Where the Sealcoating 50 Work

Consistent with other years and with the sealcoating service, contractors on the Sealcoating 50 emphasize off-road work, with all the Sealcoating 50 indicating they generate sales from parking lot work; 10% report they generate 100% of sales from parking lots (6% last year). Another 26% report 90% or more of sales from parking lots, and 62% report sales from driveway work; 72% report they work on streets; 12% report they work on highways.

The Sealcoating 50s’ Customers

- 50 contractors work for commercial/industrial customers

- 47 contractors work for multi-family residential customers

- 38 contractors work for municipal clients

- 23 contractors work for single-family homeowners

Replacing the Sealcoating 50s’ Equipment

Only three companies reported it would cost less than $500,000 to replace their equipment. Another 11 reported it would cost $500,000-$1 million to replace their fleet; 10 companies said it would cost $1-$2 million; and 25 companies reported it would cost more than $2 million to replace their equipment.

![Lee Boy Facility 2025 17 Use[16]](https://img.forconstructionpros.com/mindful/acbm/workspaces/default/uploads/2025/09/leeboy-facility-2025-17-use16.AbONDzEzbV.jpg?auto=format%2Ccompress&fit=crop&h=100&q=70&w=100)

![Lee Boy Facility 2025 17 Use[16]](https://img.forconstructionpros.com/mindful/acbm/workspaces/default/uploads/2025/09/leeboy-facility-2025-17-use16.AbONDzEzbV.jpg?ar=16%3A9&auto=format%2Ccompress&fit=crop&h=135&q=70&w=240)