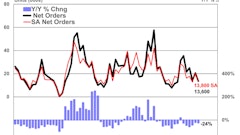

Washington, DC (June 23, 2011) — The Equipment Leasing and Finance Association's (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity for the $521 billion equipment finance sector, showed overall new business volume for May was $5.6 billion, up 30% from volume of $4.3 billion in the same period in 2010. Compared against April volume, May volume increased by 10%. Year to date, new business volume is up 27% over last year.

Credit quality continues to improve. Receivables over 30 days decreased 12% to 2.9% in May from 3.3% in April, and declined by 28% compared to the same period in 2010. Charge-offs remained unchanged at 0.8% in May from the previous month, and decreased by 51% from the same period in 2010.

Credit standards remained unchanged in May from the previous month at 76%. Sixty-eight percent of participating organizations reported submitting more transactions for approval during the month, an increase from 45% in April.

Finally, total headcount for equipment finance companies in May decreased 2% and was down 1% year-over-year. Supplemental data shows that the construction and trucking sectors continued to lead the underperforming sectors.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for June is 52.6, down from the May index of 63.2, indicating industry concerns over the sputtering economic recovery and uncertainties regarding lease accounting changes. For more detailed information on the MCI-EFI visit www.LeaseFoundation.org

ELFA President and CEO William G. Sutton, CAE, said: "Directionally, there is good news both in the amount of new business generated during the period and the rebound in credit quality. However, some industry sectors continue to lag, and an atmosphere of uncertainty prevails."

"New business volume improvements continue but in an uneven manner across different industries," said Harry Kaplun, president, Frost Leasing, in San Antonio. "This lack of a uniform trend suggests some weakness in the overall recovery. If the recovery can be more universal, the current availability of capital and improving portfolio performance have the equipment finance industry well positioned to serve the future needs of U.S. industry."

About the ELFA's MLFI-25

The MLFI-25 is the only index that reflects capex, or the volume of commercial equipment financed in the U.S. The MLFI-25 is released globally at 9 a.m. Eastern time from Washington, D.C., each month, on the day before the U.S. Department of Commerce releases the durable goods report. The MLFI-25 is a financial indicator that complements the durable goods report and other economic indexes, including the Institute for Supply Management Index, which reports economic activity in the manufacturing sector. Together with the MLFI-25 these reports provide a complete view of the status of productive assets in the U.S. economy: equipment produced, acquired and financed.

The MLFI-25 is a time series that reflects two years of business activity for the 25 companies currently participating in the survey. The latest MLFI-25, including methodology and participants is available below and also at http://www.elfaonline.org/ind/research/MLFI/

MLFI-25 Methodology

The ELFA produces the MLFI-25 survey to help member organizations achieve competitive advantage by providing them with leading-edge research and benchmarking information to support strategic business decision making.

The MLFI-25 is a barometer of the trends in U.S. capital equipment investment. Five components are included in the survey: new business volume (originations), aging of receivables, charge-offs, credit approval ratios, (approved vs. submitted) and headcount for the equipment finance business.

The MLFI-25 measures monthly commercial equipment lease and loan activity as reported by participating ELFA member equipment finance companies representing a cross section of the equipment finance sector, including small ticket, middle-market, large ticket, bank, captive and independent leasing and finance companies. Based on hard survey data, the responses mirror the economic activity of the broader equipment finance sector and current business conditions nationally.

ELFA MLFI-25 Participants

ADP Credit Corporation

Bank of America

Bank of the West

BB&T

Canon Financial Services

Caterpillar Financial Services Corporation

CIT

De Lage Landen Financial Services

Dell Financial Services

EverBank Commercial Finance

Fifth Third Bank

First American Equipment Finance

GreatAmerica

Hitachi Credit America

HP Financial Services

John Deere Financial

Key Equipment Finance

M&I Equipment Finance

Marlin Leasing Corporation

Merchants Capital

PNC Equipment Finance

RBS Asset Finance

Siemens Financial Services

Susquehanna Commercial Finance

US Bancorp

Verizon Capital Corp

Volvo Financial Services

Wells Fargo Equipment Finance

About the ELFA

The Equipment Leasing and Finance Association (ELFA) is the trade association that represents companies in the $521 billion equipment finance sector, which includes financial services companies and manufacturers engaged in financing capital goods. ELFA members are the driving force behind the growth in the commercial equipment finance market and contribute to capital formation in the U.S. and abroad. Its over 600 members include independent and captive leasing and finance companies, banks, financial services corporations, broker/packagers and investment banks, as well as manufacturers and service providers. In 2011, ELFA is celebrating 50 years of equipping business for success. For more information, please visit www.elfaonline.org.