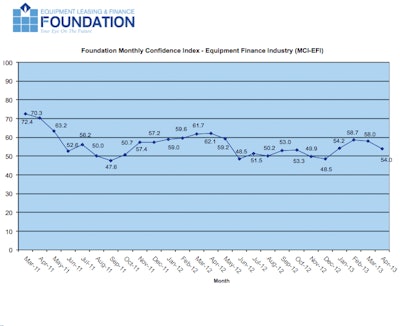

The Equipment Leasing & Finance Foundation (the Foundation) releases the April 2013 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI). Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $725 billion equipment finance sector. Overall, confidence in the equipment finance market is 54.0, an easing from the March index of 58.0, reflecting industry participants’ continuing concerns over the economy and the impact of federal policies on capital expenditures.

Confidence in Equipment Finance Market Levels Off in March

When asked about the outlook for the future, MCI survey respondent Ron Arrington, President, CIT Global Vendor Finance said, “The effects of sequestration, tax increases and healthcare costs are causing companies to continue to hold back on investment in capex. That said, the equipment financing market is growing, albeit modestly, largely driven by enterprise consumption focusing on equipment life cycle management and productivity gains to reduce operating expense. If the second half of this year brings greater certainty on political and economic issues, companies are poised to increase their capex spending and this should bode well for the equipment financing industry.”

April 2013 survey results

When asked to assess their business conditions over the next four months:

- 6.3% said they believe business conditions will improve, down from 21.9% in March

- 84.4% of respondents believe business conditions will remain the same, up from 71.9% in March

- 9.4% believe business conditions will worsen, up from 6.3% the previous month

- 12.5% believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, a decrease from 21.9% in March

- 75% believe demand will “remain the same”, up from 68.8% the previous month

- 12.5% believe demand will decline, up from 9.4% in March

- 18.8% expect more access to capital to fund equipment acquisitions over the next four months, down from 28.1% in March

- 81.3% of survey respondents indicate they expect the “same” access to capital to fund business, an increase from 68.8% the previous month

- No one expects “less” access to capital, down from 3.1% of respondents in March

- 25% expect to hire more employees over the next four months, unchanged from March

- 65.6% expect no change in headcount, down from 71.9% last month

- 9.4% expect fewer employees, up from 3.1% of respondents who expected fewer employees in March

- 87.5% of the leadership evaluates the current U.S. economy as “fair,” up from 84.4% last month

- 12.5% rate it as “poor,” unchanged from March

When asked to assess conditions over the next six months:

- 15.6% believe that U.S. economic conditions will get “better” over the next six months, unchanged from March

- 68.8% of survey respondents indicate they believe the U.S. economy will “stay the same”, down from 71.9% in March

- 15.6% believe economic conditions in the U.S. will worsen, an increase from 12.5% who believed so last month

- 31.3% believe their company will increase spending on business development activities during the next six months, unchanged from March

- 68.8% believe there will be “no change” in business development spending, unchanged from last month

- No one believes there will be a decrease in spending, also unchanged from March