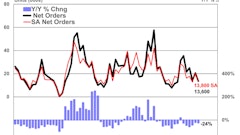

After a disappointing March, the nation’s nonresidential construction industry bounced back moderately in April. According to the June 3 release by the U.S. Census Bureau, nonresidential construction spending increased 0.7 percent in April, with outlays increasing to a seasonally adjusted annualized rate of $552.45 billion. However, nonresidential construction spending is down 2.1 percent from one year ago.

Total Construction Spending Registers Small Gain in April 2013

Privately financed projects primarily drove spending gains in April, with private nonresidential construction spending rising 2.2 percent for the month and 0.6 percent on a year-over-year basis. Public nonresidential construction spending dipped 1.1 percent for the month and is down 5.2 percent compared to April 2012.

Eight of the 16 nonresidential construction sectors posted increases in spending for the month, including:

- Power, up 7.8 percent

- Sewage and waste disposal, up 7.7 percent

- Public safety, up 5.6 percent

Spending in other growth sectors was up less than 1 percent. Five sectors have registered increases in spending on a year-over-year basis including:

- Lodging, up 16.6 percent

- Transportation, up 11.4 percent

- Manufacturing, up 2.1 percent

- Commercial, up 1.9 percent

- Office, up 1.6 percent

In contrast, eight nonresidential construction sectors experienced spending declines for the month, with the largest decreases in:

- Religious, down 11.3 percent

- Conservation and development, down 5.6 percent

- Communications, down 4.6 percent

Sectors recording the largest losses from one year ago include:

- Conservation and development, down 11.5 percent

- Educational, down 10.7 percent

- Amusement and recreation, down 10.5 percent

Residential construction spending slipped 0.2 percent for the month but is up 18.3 percent from the same time last year. Total construction spending - which includes both nonresidential and residential spending - was up 0.4 percent for the month and is up 4.3 percent from April 2012.

“The dominant theme associated with today’s report on the nation’s nonresidential construction industry continues to be slow and steady,” said Associated Builders and Contractors Chief Economist Anirban Basu. “While weather and other factors can impact monthly performance, the industry continues to be poised for slow spending growth.

“Nonresidential construction tends to lag the performance of the overall economy,” added Basu. “The broader economy continues to expand at a roughly 2 percent pace and is closing in on completing four years of economic recovery. The implication is that nonresidential construction spending will also continue to recover but only gradually.

“In the larger context, at least four aspects of the broader economy that are expanding more briskly than construction,” Basu stated. “These include energy production, housing, consumer spending on automobiles and financial markets.

“The performance of these economic segments helps explain the increase in spending observed over the past year in categories such as power, commercial, lodging and office,” said Basu. “With consumer spending continuing to rise and the nation continuing to add jobs each month, the expectation is that these and many other private segments will continue to recover over the course of 2013.

“Meanwhile, weak state and local government budgets continue to plague the recovery,” Basu remarked. “Though some state budgets have improved materially in recent years, many states continue to wrestle with long-term deficits in their pension and healthcare funds, which will continue to suppress public construction investment in the near future.”

View the March spending report.