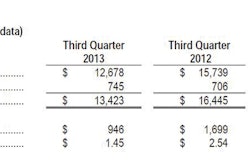

Terex Corp. reported net sales of $1,810.6 million in the quarter ended September 30, 2013, which was 0.6 percent less than the same quarter in 2012. But gross profit grew 2.2 percent to $387.1 million.

Income from continuing operations of $89.3 million, or $0.77 per share, nearly tripled that of the third quarter of 2012.

Terex Third-Quarter 2013 Financial Results

“Our third quarter operating results were as we expected but with a better tax rate,” said Ron DeFeo, Terex chairman and CEO. “The current environment is mixed overall, and remains challenging to predict. We are seeing strength in early-cycle product categories where demand is mostly replacement driven. We continue to have strong performance from our Aerial Work Platforms business and solid execution by our Materials Processing business."

He said the company's cranes and construction segments remain challenged.

DeFeo describes the global economy as "lacking a clear direction," with North America remaining most stable, Europe delivering slight improvements in the company's Genie AWP segment, and the Middle East providing growth. Weakness in Europe and Australia have offset gains in other regions, though.

“Our operating margins have remained consistent," said DeFeo. "However, we expected 2013 to be a year of significant sales growth, and this has not occurred. Our businesses that have a significant portion of products dependent on non-residential construction have not recovered as quickly as we had expected. Businesses that are less dependent on non-residential construction, such as our Port Solutions and AWP businesses, are seeing improving business conditions. This, along with our interaction with customers globally, is what provides a level of support that a broad-based recovery is more a matter of when it will happen, not if it will happen.”

Outlook

“We now expect earnings per share to be between $2.05 and $2.25 per share (excluding restructuring and other unusual items), an increase from our previous guidance of $1.90 to $2.10 per share," said DeFeo. "The improvement in guidance is driven by an anticipated lower full year adjusted effective tax rate of approximately 33% which adds approximately $0.15 of earnings per share. With respect to our underlying business, earnings expectations remain unchanged although on slightly lower net sales of $7.3 billion to $7.5 billion.”