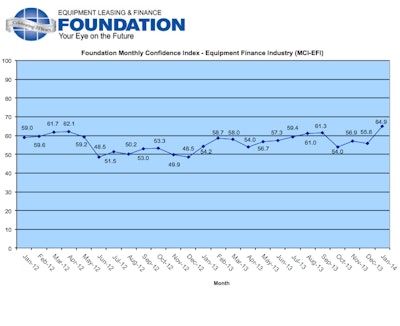

The Equipment Leasing & Finance Foundation (the Foundation) releases the January 2014 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $827 billion equipment finance sector. Overall, confidence in the equipment finance market is 64.9, the highest confidence level in two years, and an increase from the December index of 55.8. An improved general outlook for economic activity among industry leadership contributed to the increase.

When asked about the outlook for the future, MCI survey respondent David Schaefer, CEO, Mintaka Financial, LLC, said, “We’re optimistic about 2014 as we come off of a very strong Q4. The recent federal budget deal is positive since it takes some uncertainty out of the market. Employment gains were also positive and this should bring more equipment demand and, therefore, financing opportunities. Margins are still being compressed as capital is abundant but demand remains fairly neutral.”

January 2014 survey results:

When asked to assess their business conditions over the next four months:

- 33% of executives responding believe business conditions will improve, up from 12% in December

- 61% believe business conditions will remain the same, down from 78.8% in December

- 5.6% believe business conditions will worsen, down from 9% who believed so the previous month

- 36% believe demand for leases and loans to fund capital expenditures (capex) will increase, up from 15.2% in December

- 61% believe demand will “remain the same”, down from 78.8% the previous month

- 2.8% believe demand will decline, down from 9% who believed so in December

- 25% expect more access to capital to fund equipment acquisitions, relatively unchanged from December

- 75% expect the “same” access to capital to fund business, unchanged from the previous month

- No one expects “less” access to capital, also unchanged from the previous month

- 33% expect to hire more employees, an increase from 27.3% in December

- 58.3% expect no change in headcount, down from 60.6% last month

- 8.3% expect fewer employees, down from 12% who expected fewer employees in December

- 2.8% of the leadership evaluates the current U.S. economy as “excellent,” down from 6% last month

- 94.4% evaluates the current U.S. economy as “fair,” up from 85% last month

- 2.8% rate it as “poor,” down from 9% in December

When asked to assess economic conditions over the next six months:

- 41.7% believe that U.S. economic conditions will get “better”, an increase from 24.2% who believed so in December

- 55.6% believe the U.S. economy will “stay the same”, a decrease from 66.7% in December

- 2.6% believe economic conditions in the U.S. will worsen over the next six months, a decrease from 9% last month

- 55.6% believe their company will increase spending on business development activities, an increase from 30.3% in December

- 39% believe there will be “no change” in business development spending, a decrease from 66.7% last month

- 5.6% believe there will be a decrease in spending, an increase from 3% who believed so last month