Based on the latest construction spending data, construction is still trying to find its balance coming out of the difficult winter. New residential construction continues to lead the way; while nonresidential construction finally showed some life and heavy engineering stumbled.

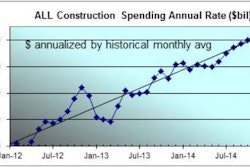

The U.S. Census Bureau reported that total construction spending inched up 0.2 percent in April to $953.5 billion at a seasonally adjusted annual rate (SAAR). Year-to-date not seasonally adjusted (NSA) spending was 8.9 percent higher than the same period a year ago.

Nonresidential building construction spending ended its five-month slide, jumping 1.4 percent to $303.4 billion (SAAR) in April after falling 0.8 percent in March. Year-to-date NSA spending was 3.7 percent higher than last year.

Heavy engineering (non-building) construction spending declined 0.8 percent to $267.2 billion (SAAR) in April after rising 1.1 percent in March. Year-to-date NSA spending was up 3.4 percent from a year ago.

Total residential construction spending, which includes improvements, was unchanged in April at $382.9 billion (SAAR) following an increase of 1.3 percent in March. Showing its continued strength, new residential construction spending, which excludes improvements, rose 1.4 percent to $234 billion in April, marking 31 monthly increases in a row. Year-to-date NSA total residential construction spending was 18.1 percent higher than last year, and new residential construction was 17.7 percent higher.

Private construction spending was essentially unchanged at a seasonally adjusted (SA) rate in April after advancing 0.7 percent in March. Year-to-date NSA spending was 13 percent higher than the same period in 2013.

Public construction spending rose for the second month in a row, up 0.8 percent in April after increasing 0.3 percent in March. Year-to-date NSA public spending was down 1.3 percent from last year.

The forecast

The Reed forecast assumes the economy strengthens modestly, growing at a somewhat faster pace this year and next. As a result, investment in plant and equipment will increase to the benefit of nonresidential building construction.

Heavy engineering (non-building) construction activity is forecast to increase this year and next. Expect increased federal funding for infrastructure projects to be forthcoming this year and beyond, although the amount will be well short of what is needed to repair and upgrade the country's aging infrastructure. Public-private partnerships at the state and local level will provide additional funds for needed infrastructure projects, but still leave us well short of where we should be.

Residential construction will continue to show the greatest improvement, though starting from a low level. Multifamily construction activity has largely returned to normal, although there is still room for some growth. Single-family construction is held back from faster growth by difficulty in obtaining mortgages, scarcity of lots for building, rising building materials prices, skilled labor shortages, and consumer fear.

Total construction spending is forecast to increase 9.3 percent in 2014 and 11.2 percent in 2015, with nonresidential and heavy engineering construction strengthening and residential construction continuing to lead the way.

The economy

The nation's economy suffered a setback in the first quarter as a result of the unusually severe winter weather. The most recent estimate of first quarter real (inflation-adjusted) gross domestic product (GDP) growth shows a plunge of 2.9 percent (SAAR). Efforts to recover lost business and get various projects back on track will help produce a sharp second quarter rebound. Most analysts expect second quarter real GDP growth around 3.5 percent. The real test will be in the second half of the year when these weather effects are no longer a major factor.

Overall, the economy does appear to have underlying strength. SA nonfarm payroll employment has increased by more than 200,000 for four consecutive months. With the May employment report, the number of jobs finally exceeded the pre-recession peak in January 2008. Construction employment has not done as well. As of May, the number of SA jobs was 1.7 million below its April 2006 peak. However, the number of jobs was 572,000 higher than its January 2011 low.

During the housing recession, many workers left the construction industry. Even with the rebound in construction employment, many have not returned — either retiring or finding jobs outside of construction. Despite an overall improvement, the unemployment rate for construction workers remains relatively high — 8.6 percent in May. Yet many employers report a shortage of skilled construction workers. Many of those workers are currently employed in the oil and gas industry — particularly heavy equipment operators.

Despite the first quarter tumble, the economy appears to be on more solid footing. We do expect somewhat stronger growth, but the United States economy is not fully recovered. Although nonfarm payroll employment has exceeded its previous peak, in the intervening six years the working age population has grown.

Even though the April and May unemployment rate of 6.3 percent is the lowest it has been since September 2008, it does not signal a healthy labor market. There are many discouraged workers who would (and maybe soon will) re-enter the job market if they thought there was a reasonable chance of securing a decent job. There are still too many long-term unemployed workers who could contribute much to our economy if given the chance.

Although businesses are beginning to invest more in new plant and equipment, they are still very cautious given the uncertainty over federal fiscal policy. Legislation providing appropriations for the current federal government fiscal year, which ends on September 30, was only signed into law in January, three months into the present fiscal year. The outlook for passage of appropriations for the 2014-15 fiscal year is for last minute action. Even that is not guaranteed.

Similarly, there is also concern over the debt ceiling. The debt ceiling was suspended until March of next year. The ceiling needs to be raised, suspended, or eliminated (the best alternative, but extremely unlikely). The sooner action on one of these alternatives is taken, the better as it would remove a major source of uncertainty for the economy. Again, however, early action seems unlikely.

Meanwhile, some potential risks will probably be avoided, but cannot be ignored. The risks include:

- A sustained spike in interest rates due to the Federal Reserve unwinding its asset purchase program too rapidly

- Sharp reduction in government spending in the short run

- Sovereign debt default by one or more European governments

- One or more European governments abandon the euro

- A sudden, significant increase in oil prices (much more than the recent rise in prices due to concern over developments in Iraq) for a prolonged period