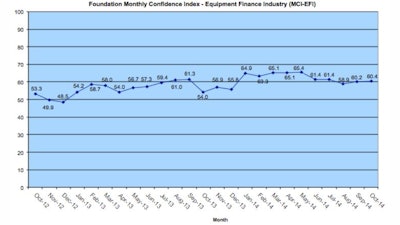

The Equipment Leasing & Finance Foundation's (the Foundation) October 2014 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) was at 60.4, slightly better than the September index of 60.2, with survey participants indicating increasing or consistent demand tempered by U.S. economic concer. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $827 billion equipment finance sector.

When asked about the outlook for the future, MCI-EFI survey respondent David Schaefer, CEO, Mintaka Financial, LLC, said, “Application volume has been solid this past quarter. We expect exceptional year-over-year fourth quarter growth to be greater than 50 percent. It's hard to find much negative at this point so we are focused on being disciplined both in terms of credit and pricing.”

When asked to assess their business conditions over the next four months:

- 23% believe business conditions will improve , down from 36.4% in September; 74% believe business conditions will remain the same, up from 60.6% in September; 3% believe business conditions will worsen, unchanged from the previous month

- 25.7% believe demand for leases and loans to fund capital expenditures (capex) will increase, down from 30.3% in September; 71.4% believe demand will “remain the same”, up from 66.7% the previous month; 3% believe demand will decline, unchanged from September

- 11.4% expect more access to capital to fund equipment acquisitions, down from 15.2% in September; 88.6% expect the “same” access to capital to fund business, up from 84.8% in September; None expect “less” access to capital, unchanged from the previous month

- 40% expect to hire more employees, an increase from 30.3% in September; 48.6% expect no change in headcount, down from 60.6% last month; 11.4% expect fewer employees, up from 9% in September

- 3% of the leadership evaluates the current U.S. economy as “excellent,” down from 6% last month; 94.3% of the leadership evaluates the current U.S. economy as “fair,” up from 87.9% in September; 3% rate it as “poor,” down from 6% the previous month

When asked to assess conditions over the next six months:

- 28.6% believe that U.S. economic conditions will get “better” over the next six months, a slight increase from 27.3% who believed so in September; 68.6% believe the U.S. economy will “stay the same”, up from 66.7% in September; 3% believe economic conditions in the U.S. will worsen, down from 6% who believed so last month

- 34.3% believe their company will increase spending on business development activities, an increase from 15.2% in September; 63% believe there will be “no change” in business development spending, a decrease from 84.8% last month; 3% believe there will be a decrease in spending, up from none who believed so in September